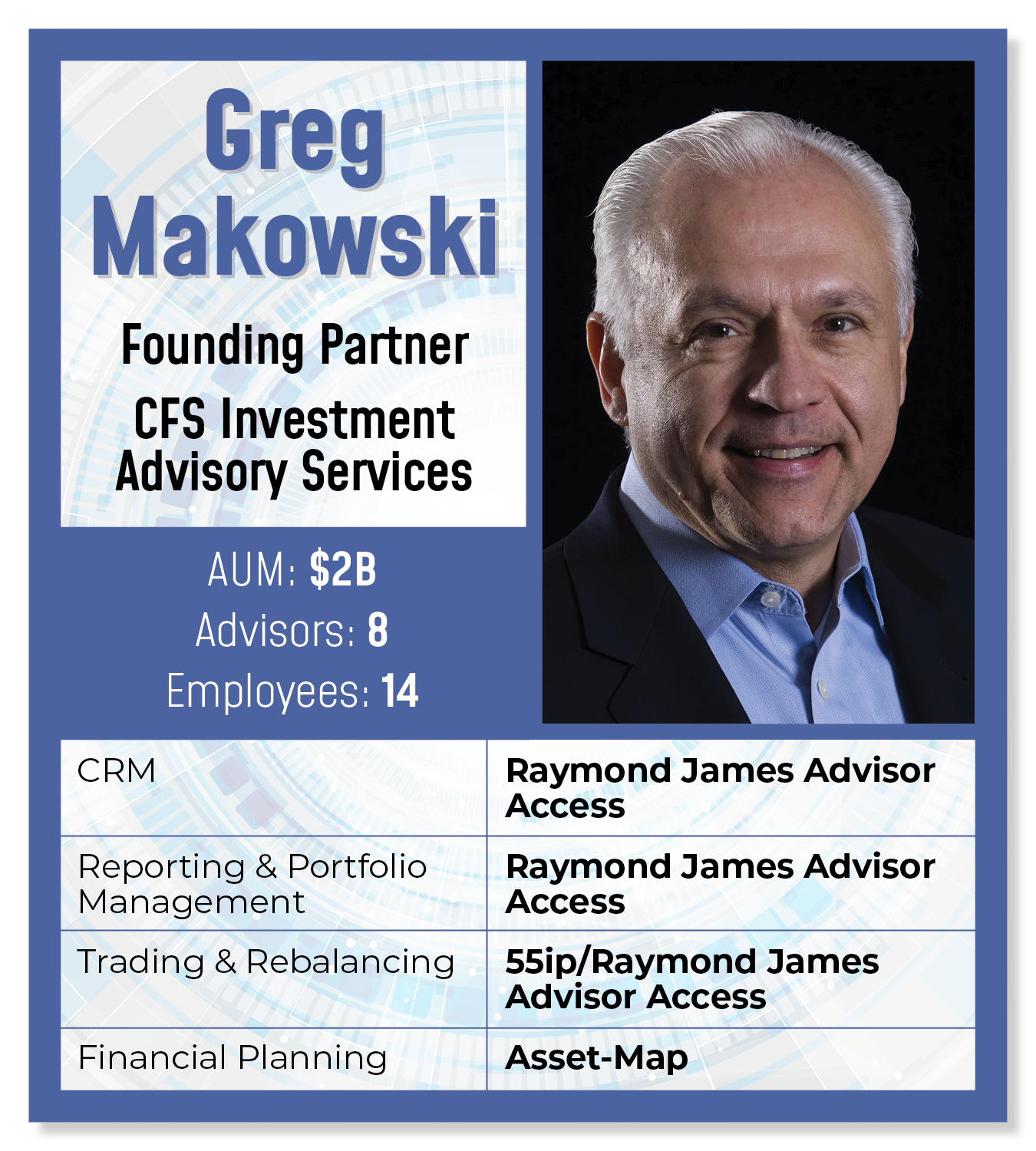

CRM/Rebalancing/Reporting: Raymond James Advisor Access

The tech stack is dependent on your custodian. We were using TD Ameritrade and a small custodian called Trust Company of America, now Axos Advisor Services. At the time, we were using Redtail CRM. We decided half a dozen years ago, we were tired of all that plug-and-play, where programs don’t talk to each other well. When you do plug-and-play, there’s always the siren of a better product. You get seduced into thinking, “This has to be better.” The enemy of good is perfect. You’re constantly tearing apart your business trying to implement better software.

Also, if you take on a new piece of technology and present it to the client, if the client likes it, you’ve got to continue to use it. We’ve made some errors rolling something out to clients. Suddenly it’s not working, but then clients start asking about it. Then they start questioning our analytical skills of picking out and analyzing software. It casts a dim light on our ability to discern what we should be using or not. We’re careful in integrating any outside technology. We use it ourselves for a while.

We’re RIA-only. We’re not brokers at all. We gave up our Series 7s quite a while ago. Raymond James is a known company, but most people don’t know they’re in the RIA custody business. What drew us to custody there was their vertically integrated tech stack. There’s never a break in data services. It’s all perfect. That makes our life easy. Now we’re not chasing all the obligatory tech that you must use.

We’re RIA-only. We’re not brokers at all. We gave up our Series 7s quite a while ago. Raymond James is a known company, but most people don’t know they’re in the RIA custody business. What drew us to custody there was their vertically integrated tech stack. There’s never a break in data services. It’s all perfect. That makes our life easy. Now we’re not chasing all the obligatory tech that you must use.

The negative of the Raymond James tech stack is their APIs are not robust yet. They’re working on that. They know that. They’ve brought in some new executives whom we’ve met because we’re a large RIA for them.

Financial Mapping: Asset-Map

Because the core tech is integrated, now what we focus on is adding bells and whistles. The reason we use Asset-Map is that most people think in pictures. We diagram concepts to clients. Asset-Map gives them a clear picture of where all their assets are custodied and stored. We use that as an add-on to the tech stack because it makes everything understandable for the client. Several of our clients print off their Asset-Map and either put it on a bulletin board in their house so their family knows what’s going on, or they have it in a file for their spouse in the event something happens to them.

Model Portfolios/Trading: 55ip

We’ve built in extraordinarily inexpensive asset management for our clients. It’s not a game-changer anymore. Everybody’s got model portfolios. But can you deliver them easily and inexpensively to the client? And without breaking the bank at your firm by building up an entire back office? Our firm has incredible scale because of how we utilize technology. We have an internal trader that does one-off trading for our clients, but for the model trading, we use 55ip. They’re not as error-prone as internal traders because it’s a big company. That works incredibly well.

Direct Indexing: Aperio

Direct Indexing: Aperio

We’ve been through the direct indexing game for 15 or 20 years. We used to use Folio Financial. They were doing fractional shares a decade ago or longer. We’ve gotten away from all of that. Now, with larger clients that want direct indexing, we use Aperio because they are cost-effective and have great technology. We negotiated incredibly good pricing. They can do all sorts of direct indexing for our clients. Some of our clients also want to do values-based investing or exclude certain industries, sectors or individual equities that they don’t like.

AI Statement Transcription: Advisor Core by YourStake

We’re demo-ing Advisor Core by YourStake, which is going to streamline our practice. I’m looking at a new case right now with a million statements. To manually enter the data would be difficult. With Advisor Core by YourStake, you scan the statements into it. The AI system reads it and turns it into an Excel spreadsheet. It does all the allocation analysis for you. It’s all quick and scalable with near-perfect replication.

Cybersecurity and Backup: Webroot/Microsoft Defender/Datto

We use Webroot but will be migrating to Microsoft Defender next year for our cybersecurity. We still have our files on our hard drive and we back that up throughout the day onto Datto. If we get hacked or shut down, we can operate off Datto for about a year. Additionally, we can go back in time to retrieve anything lost.

Document Management: N/A

We don’t use a document management system. We store all our files on our file server by client so it’s very easy to use. And, if we lose a file we go onto Datto and retrieve it.

As told to reporter Rob Burgess and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what's in your wealthstack? Contact Rob Burgess at [email protected].