Bank of America executives said that trading volume on Merrill Edge, the self-directed online trading platform run by Merrill Lynch Global Wealth Management, spiked 180% in the second quarter.

Over 330,000 new clients have signed up for the platform this year, and a third of them are age 35 or younger. The online platform has 3,000,000 clients in total.

Merrill Edge debuted in 2010 with $65 billion in brokerage assets made up of those clients at Bank of America and Merrill Lynch with assets of less than $250,000. Merrill Edge has no minimum asset level requirement for new clients. In 2016, Merrill Guided Investing was added; for a $5,000 minimum and a 0.45% annual fee, investors were given access to 15 portfolios managed by Merrill Lynch professionals and composed of diversified ETFs and socially responsible portfolios.

Then in June of last year, the wealth manager introduced Merrill Guided Investing with an Advisor. For a 0.85% annual fee and an investment minimum of $20,000, investors were offered access to a Merrill Financial Solutions Advisor, of which there are now 3,000, for one-on-one advice and periodic reviews. Merrill FSAs are salaried employees, not to be confused with Wealth Management Financial Advisors, which number close to 15,000 nationally. When it comes to connecting with FSAs via Merrill Guided Investing, according to a company spokesperson, clients can call to make an appointment as often as they like and "are aligned to an FSA based on their initial preference on how they wanted to work with us, either in a financial center or over the phone."

According to Aron Levine, Bank of America’s president for preferred and consumer banking & investments, the three programs now have about $250 billion in brokerage assets. This is up $39 billion from June of last year.

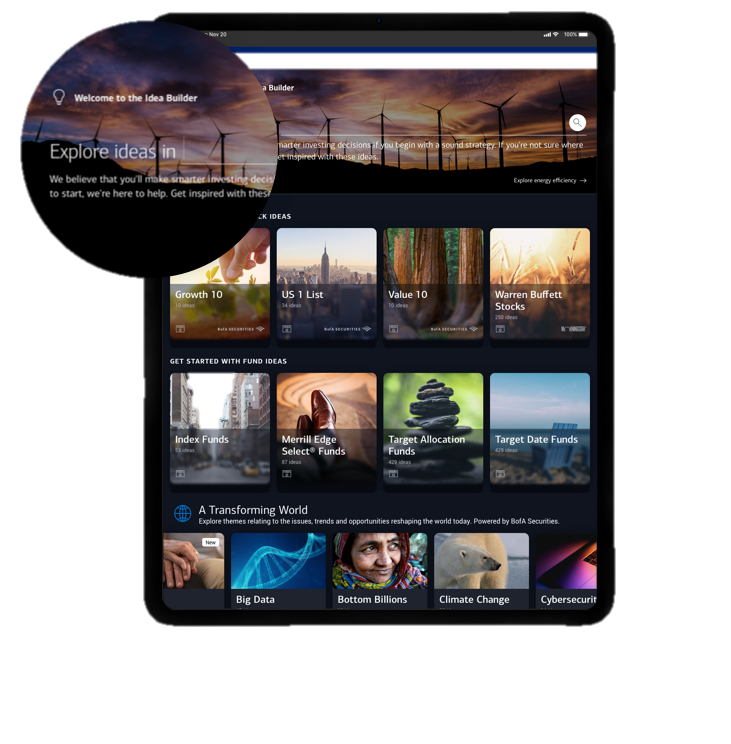

Meanwhile, a little over a week ago Bank of America also released a new interface for Edge called Idea Builder. According to spokesman Andy Aldridge, it was developed internally and with “key industry partners across BofA Global Research, MSCI and Morningstar.”

Cory Triolo, head of digital client experience at Merrill Edge, said Idea Builder, which features 130 investing themes—ranging from E-Sports to a grouping called Warren Buffett Stocks (the latter includes 230 companies)—had, in about a week, generated 25% higher order throughput among Edge clients.

In addition, he said, the average Edge client, including more experienced investors, who tend to know what they're looking for already, spends three to four times as much time doing research via Idea Builder than she or he did previously.