Years ago, retirement plan experts built their businesses targeting plans using dabblers and blind squirrels, underscoring the dangers while highlighting the benefits of using a specialist. That same philosophy is driving changes for CPA plan auditors along with revised requirements and PEPs, which limit auditing costs for their members.

And though fewer DC plans use inexperienced CPAs to audit their plan, according to a 2023 DOL report, “70 percent of the audits fully complied with professional auditing standards or had only minor deficiencies under professional standards.” The result, according to the DOL is, “30 percent of the audits (3 out of 10) contained major deficiencies … [which] puts $927 billion and 11.7 million plan participants and beneficiaries at risk.”

That compares to 39%, $653 billion and 22.5 million participants in their 2015 study. Not surprisingly, the DOL found a correlation between, “the number of employee benefit plan audits a CPA performed and the quality of the audit work.”

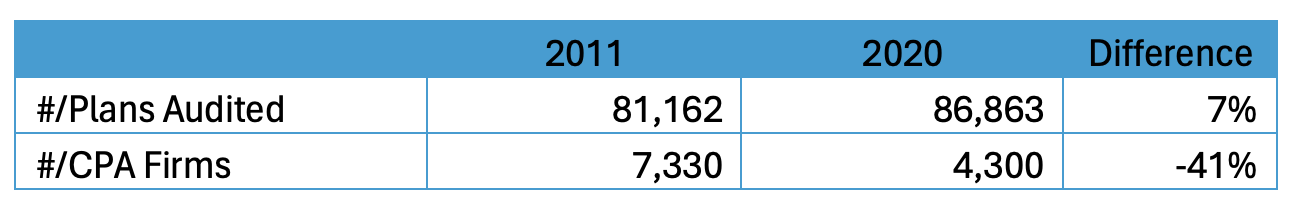

The 2023 DOL report indicated a 7% increase in the number of plans audited from 2011-2020 and a 41% decrease in the number of CPA firms conducting the audit:

Changes in the DOL’s definition of “larger” plans requiring an audit last year are expected to eliminate audit requirements for approximately 20,000 plans. The big change is the 100-participant count now includes only those with a balance rather than eligible to participate. Additionally, if they were a “small plan” filer in the previous year, the plan can remain a small plan filer until the plan participant count reaches 121. All of which makes force outs now at $7,000 or less that much more important.

The number of plans could drop precipitously due to new criteria of “large” plans and PEPs.

PEPs providers lure plans promising to greatly reduce or even eliminate the audit cost as the pooled plan must only file one audit. But according to Karen Sanchez, Partner at Sikich, “The cost reduction depends on the make-up of the PEP and how many need to be sampled.”

Sanchez noted that the dangers of using an inexperienced ERISA auditor include protracted interaction with the DOL during an investigation as well as the inability of the inexperienced auditor to detect issues early. Though she does not build systems that integrate payroll and record keeping, a key component of a successful ideal plan, she can review the processes and make suggestions just as she does for running a plan overall.

Russ Kanner, Senior Manager at Smith + Howard, notes that the top issues he finds with plans include:

- Definition of compensation

- Timely remittance of deferrals

- Timely filing of the plan audit with the 5500 Form

Brad Bartells, Partner at MUN CPAs, said many plans do not follow plan documents especially related to the definition of compensation. It’s like having an IPS but not following the rules. Loan distributions can be another issue, according to Todd Hallowell, founder of 401(k) Assurance, as well as asking for things not needed that could be red flags for the DOL.

All of which might cause RPAs to wonder, “Why should I care?”

Plans are looking to their advisor to be their quarterback overseeing the entire plan and all the vendors. If something goes wrong with the audit, plans will not be happy to hear their advisor claim, “It’s not my problem.” It may not be their fault, but it is their problem.

It's also amusing to me when advisors use litigation as a scare tactic for smaller and mid-size plans. The chances of plans under $100 million or even $250 million to be sued is low and the copycat lawsuits without merit are getting tossed more quickly. But DOL audits and investigations are much more likely which is a form of litigation for smaller plans. Advisors that proactively suggest to the 11.7 million plans using a “blind squirrel” auditor that a change is required will be valued even if there is a risk of offending the client’s CPA performing the audit. Just as they did when many of them were hired.

The American Institute of Certified Public Accountants’ (AICPA) Employee Benefit Plan Audit Quality Center lists almost 2,000 qualified CPAs on its website.

So while not sexy, helping with audits and recommending qualified CPAs is an RPA to not just distinguish themselves but also help the plan avoid costly errors and identify problems before they metastasize. And helping clients avoid audits due to the new DOL definition of “large” plans as well as joining a PEP would further elevate the plan advisor.

Fred Barstein is founder and CEO of TRAU, TPSU and 401kTV.