Your 401(k) plan clients must comply with numerous regulations each year. A checklist like the 2021 Annual Plan Compliance Review provided by Mobile, Alabama-based Employee Fiduciary, LLC can help the sponsor and you avoid unintentional compliance missteps. Eric Droblyen, the firm’s president and CEO, recently shared some additional compliance-guidance advice for advisors.

WealthManagement.com: What are some of the must-do first quarter 2021 deadline tasks that advisors should monitor with their plans?

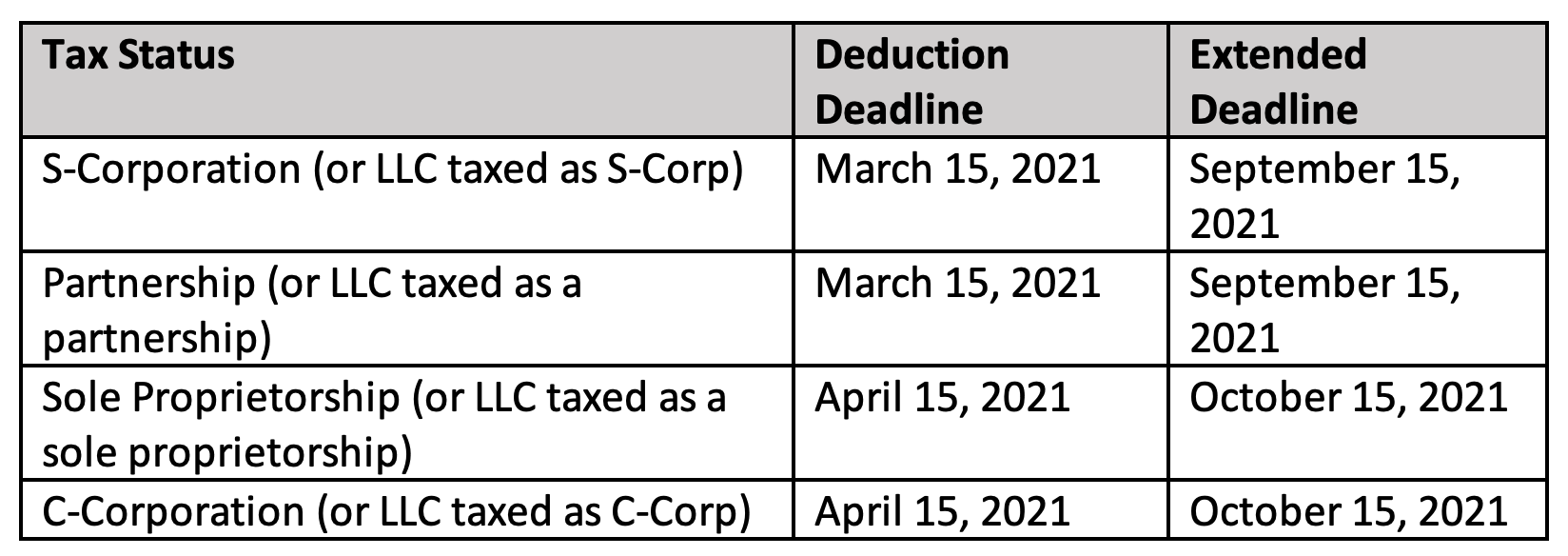

Eric Droblyen: For most calendar-based 401(k) plans, Q1 2021 will be all about 2020 non-discrimination testing. That’s due to the March 15 deadline for distributing corrective refunds resulting from a failed 2020 ADP/ACP (actual deferral percentage/actual contribution percentage) test without penalty and the deduction deadline for funding a year-end 2020 contribution:

While a third-party administrator (TPA) will complete 2020 non-discrimination testing, they will need certain information – generally an employee census and company ownership—from the sponsor to do their job. Often, this information is requested in a year-end questionnaire. TPAs usually impose a deadline for sponsors to return their questionnaire if they want their testing completed by a Q1 deadline. January 31 is most common.

WM: The 2021 Annual Plan Compliance Review lists four major categories: non-discrimination testing, Form 5500 reporting, participant disclosure and plan document maintenance. Do you encounter any mistakes from plan advisors, sponsors, recordkeepers or TPAs in each category that are more common than others?

ED: When it comes to 401(k) administration, the saying “garbage in, garbage out” couldn’t be more true. When a sponsor provides inaccurate information to their TPA, you can pretty much guarantee the situation will lead to non-discrimination testing and Form 5500 reporting mistakes. When these mistakes result in bad test results or a deficient Form 5500 filing, the consequences can be severe—up to plan disqualification or fiduciary liability. TPA questions can seem tedious or invasive, but plan sponsors must do their best to respond to them accurately. Otherwise, they risk avoidable non-discrimination testing and Form 5500 reporting mistakes. Good advisors ensure their clients are clear on that.

WM: Have any regulatory rulings issued in 2020 changed the checklist from past years? If so, how and what do advisors need to know?

Advisors should always be on the lookout for new 401(k) legislation and regulation that could affect their clients. Some items to consider for 2021:

- Many 401(k) plans must be formally amended to reflect the IRS’ final hardship distribution rules—which generally took effect in 2020—no later than Dec. 31, 2021. Advisors should confirm their clients do not miss this deadline.

- The SECURE Act liberalized the requirements for safe harbor 401(k) plans with a nonelective contribution. The law eliminated their participant notice requirement and gives sponsors the ability to retroactively amend their traditional 401(k) plan into a safe harbor plan by making a qualifying 4% nonelective contribution. If a client fails their 2020 ADP/ACP test, advisors may want to suggest retroactively amending the plan into a safe harbor plan to avoid contribution refunds in 2021.

- Most 401(k) plans today are written on IRS “preapproved” plan documents. These documents must be completely rewritten (or “restated”) every six years to reflect recent legislative and regulatory changes. The last six-year restatement cycle was called the “PPA” (after the Pension Protection Act of 2006) cycle. On Aug. 1, 2020, the Cycle 3 (or “post-PPA”) cycle opened. From Aug. 1, 2020 to July 31, 2022, all 401(k) plans must be restated onto a post-PPA document. Most TPAs will start restating plans in 2021. Advisors can use their client’s mandatory restatement as an opportunity to consider plan design changes.

WM: How might plan advisors, who often focus more on plan investments than administration, help sponsors ensure that all the involved parties are doing what they need to do for compliance throughout the year?

ED: Find a TPA they trust. 401(k) administration requirements are extensive. However, when a competent 401(k) recordkeeper and TPA are hired, they will do the heavy lifting, leaving the plan sponsor and their advisor to simply ensure the requirements are met. That monitoring can be done using a checklist.