Participants in 401(k) plans may not be investing enough to even meet the average savings amount they expect to require throughout their retirement, according to a new survey from Schwab Retirement Plan Services. The survey also found that most 401(k) plan participants view themselves as ‘savers’ as opposed to ‘investors.’

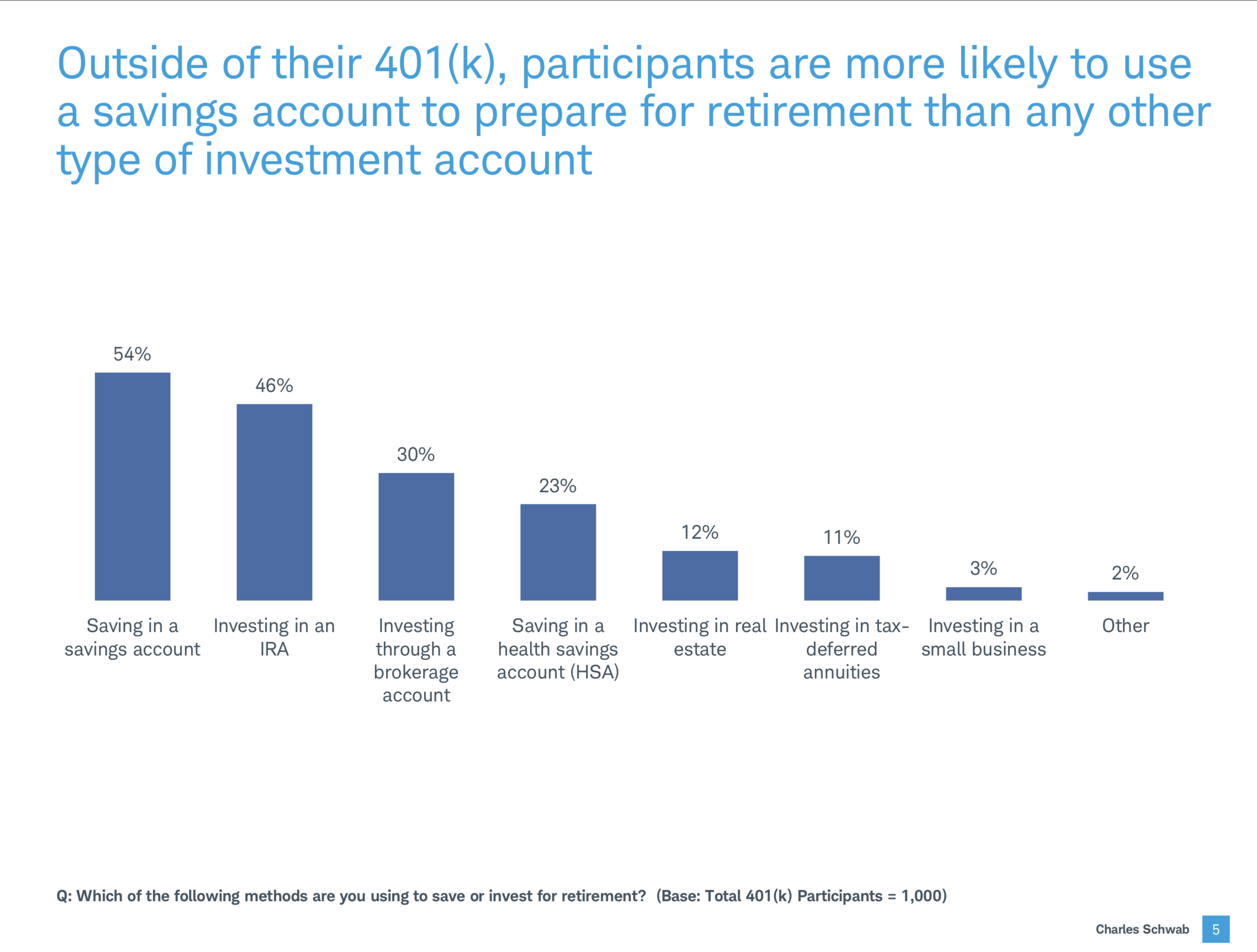

The survey tallied responses from 1,000 people currently contributing to 401(k) plans, ranging from 25 to 70 years old; of the respondents, 65% indicated that enrolling in a 401(k) plan was their first experience with investing. When saving for retirement, 401(k)s is often the primary or only investment strategy used, according to the survey. Besides 401(k) enrollment, 54% of respondents indicated they were most likely to use a savings account to prepare for retirement as opposed to another investment account. This could result in missed opportunities, according to Schwab Retirement Plan Services CEO Catherine Golladay.

“Any effort to set aside money for the future is worthwhile. That said, money intended for retirement has far more growth potential if it’s invested through an IRA or Health Savings Account, for example, than if it’s placed in a regular savings account,” she said. “Having access to more investment education could help participants get more out of their investments, both inside and beyond their 401(k) accounts.”

On average, participants believed they would need $1.7 million saved for retirement, and 58% indicated their 401(k) was the only or largest source for retirement savings. Despite this, 49% had not made any changes to the percentage of their salary they were saving in their plan during the past two years, and 4% actually decreased their contribution amount.

Employees decidedly saw 401(k) plans as essential in determining whether they would accept a job opportunity; 87% of respondents considered it a must-have benefit, second only to health insurance. Participants also said they’d feel more confident about their financial decisions with professional assistance, but only 52% felt their specific situation required such advice.

Some participants reported they had sought other avenues of support, with 52% saying they’d used an online retirement calculator. This tended to encourage further interest and action, with 71% saying they wanted to learn more and 61% actually changing actions based on the results (48% said they’d boosted contributions to their 401(k), while 28% reported they’d changed spending habits).

“The next step would be talking with a financial professional, a service many people can access through their 401(k),” Golladay said. “We believe everyone can benefit from professional financial advice, and by offering it at work, employers can help move their employees from saving to investing to true financial ownership.”