Some senators expressed concerns Tuesday over how index funds vote their shares of public companies, questioning whether they simply use individual investors’ money to advance environmental, social, governance and other political issues.

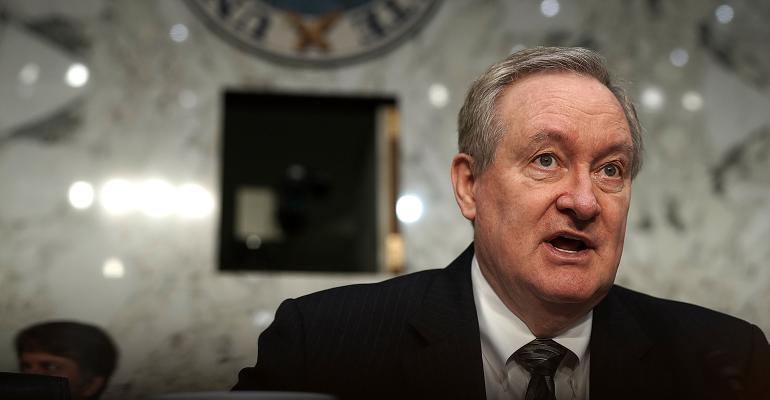

“Last year, Chairman Clayton expressed concerns that the ‘voices of long-term retail investors may be underrepresented or selectively represented in corporate governance,’” said U.S. Sen. Mike Crapo (R-Idaho), chairman of the Senate Committee on Banking, Housing, and Urban Affairs, at a hearing Tuesday morning. “It is important to understand how institutional investors are voting the shares of the money they manage to make sure that retail investors’ interests are being reflected in these voting decisions.”

Index funds hold about 17 percent of all U.S. shares, and they represent the largest shareholder in 40 percent of all U.S. companies, according to former U.S. Sen. Phil Gramm, speaking as a witness at the hearing. Their proliferation has increased the danger by political activists, he added, and the fact that these funds are voting somebody else’s shares presents a potential conflict of interest.

“The big, big problem is that we’re headed like a freight train toward a situation where corporate America, the engine of much of our economic process and mass production, is going to be controlled by index funds that don’t own shares directly in those companies but are voting somebody else’s shares,” Gramm argued.

“How they vote—and the publicity it gets—is bound to affect their marketing," Gramm said. "So you’ve got a conflict of interest building between the interest of the shareholder and the index fund. And the index funds are becoming more and more dominant, even at small companies.”

Gramm suggested index funds be subject to a fiduciary duty, as Vanguard founder Jack Bogle urged, so the funds vote in the interest of shareholders. He also suggested the Securities and Exchange Commission require funds to poll investors and vote their shares as specifically directed.

“We’ve got special interests that are trying to force business—banks—not to make loans to specific kinds of businesses,” Gramm added. “I don’t understand why people don’t see how dangerous that is because you can start with no loans to consumer lenders or no loans to gun dealers, and pretty soon, you’ve got a policy where you’re cutting off sectors of society to get access to private services. This is a very dangerous business. Congress ought to be making those decisions.”

When one senator asked whether he was concerned that political considerations—rather than profitability—rule the day, John Streur, president and CEO of Calvert Research and Management, said that worry was not well-founded. In fact, index funds vote predominantly with the management of the company, he said.

Streur said investing with an ESG lens is now mainstream, and that firms with high scores on financially material ESG issues perform well.