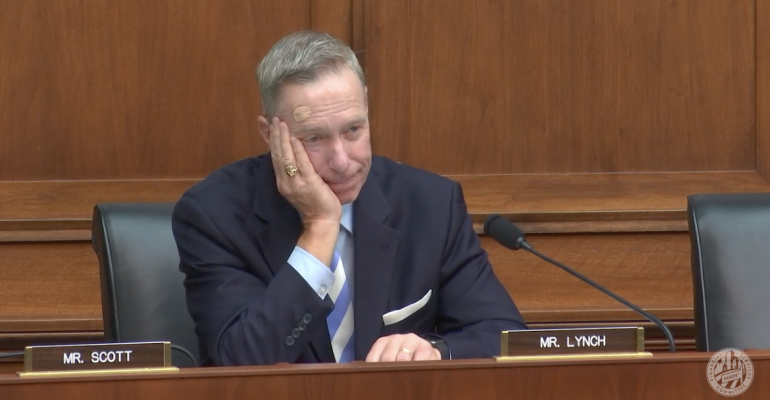

Representative Stephen Lynch (D-Mass.) pushed back against the Securities and Exchange Commission for its Regulation Best Interest rule proposal during a House Financial Services Committee hearing on Wednesday. Lynch said it was a weak standard, leaving a gap between what was proposed and what was mandated in Section 913 of Dodd-Frank.

“We put language in [Dodd-Frank] that said, ‘The standard shall be no less stringent than the fiduciary standard under the Adviser’s Act’; clearly it’s not,” Lynch said, speaking to Dalia Blass, director of the SEC’s division of investment management. “There’s still statutory language that insists that the standard be no less stringent. We fail to meet that obligation that’s set forward in the Dodd-Frank Act. Do you concede that that’s a gap now?”

Blass responded by explaining the proposal took principles from the investment advisor’s fiduciary standard—the duty of care and the duty of loyalty—as well as the impartial conduct standards from the Department of Labor’s fiduciary rule, which died in court.

“The core principles are the same,” she said. “[The proposal] tailored these principles to the broker/dealer relationship model to preserve that model. That was important to continue to provide choice to investors in the markets with respect to commission accounts.”

In April, a five-member SEC panel voted to propose its Regulation Best Interest, mandating a disclosure document summarizing investment advisors’ and brokers’ relationships with clients and offering an official interpretation of the standard of conduct for investment advisors. Blass said the SEC has received over 6,000 comment letters.

Lynch said he agreed with Massachusetts Secretary of the Commonwealth William F. Galvin’s stance on the SEC proposal, which asserts a “weak and somewhat vague standard” that would force Massachusetts to adopt its own rules to protect investors and require brokers to provide non-conflicted advice.

“Secretary Galvin also contends that the proposal really presents a veneer of a fiduciary standard that would allow existing weakness in FINRA’s suitability standard to persist,” Lynch said.

“I think it’s also important to keep in mind, this is a proposal,” Blass responded. “We have received north of 6,000 comment letters to this proposal. We’re in the process of going through these comments to see what changes, if any, we should be recommending up to the commission.”