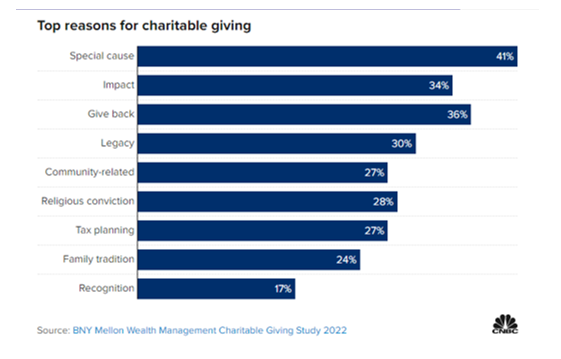

BNY Mellon Wealth Management’s inaugural Charitable Giving Study has been getting a lot of media attention lately because it found tax breaks aren’t what motivates high-net-worth (HNW) individuals to give to charity. Instead, researchers claimed the top three motivators were: (1) supporting special causes, (2) making an impact with their money, and (3) wanting to give back. Tax planning ranked third from the bottom with only one in four (27%) citing it as a strong motivator for charitable planning.

The study polled 200 individuals with at least $5 million in net worth. Again, this was a poll, so most respondents were likely to cite the altruistic answers they think pollsters would like to hear, not necessarily their true values. I say this because almost every new client we take on tells me: “We’re not that charitable.”

Another thing that’s misleading about this widely cited study is that it claims the younger generations “are more charitably inclined, and they care more about impact.” Hey, I’m a baby boomer child of the 1960s. When we were younger, we all wanted to change the world, too. Then real-world responsibilities kick in. Suppose you checked in with Millennials and Gen Zers 20 years from now when most are married, with a house, three kids, car payments and $100,000 a year in college tuition looming—per kid? That’s what they’ll be staying up at night worrying about—not charitable causes.

That being said, we’ve turned many small givers (even non-givers) into bigger givers once they understand how they and their families can benefit from favorable tax rules around giving. For instance, a family that was negotiating to sell the successful medical practice it founded recently hired us. Because of the nature of the enterprise, it was very difficult to deploy some of our more traditional pre-sale tax savings strategies. However, our client was the founder of the practice and clearly the driving force behind its success. We were able to allocate a significant portion of the sale to personal goodwill. We then used that personal goodwill to fund a special type of charitable trust that not only provided a significant charitable income tax deduction to the family but also avoided the capital gains tax on that portion of the sale. Ultimately, those funds will pass to charity, but the double tax savings allowed our client to save substantial amounts of tax today. Again, the family was motivated primarily by tax savings, but that motivation will ultimately make them big givers.

I’ve been in this business a long time. Clients are more concerned about taking care of their families than they are about giving their money away. Unless you’re uber-wealthy, it’s family first. When you explain how it’s possible to keep the money in the family for three generations before it transfers seamlessly to charity, they’re all over it.

Preparing Next Gen

Most of the wealthy families I know are terrified about leaving so much money to the kids, because they don’t feel the kids are prepared to handle it. We’re doing a lot of family governance work right now that entails educating the next generation about not only what they’ll be receiving in terms of substantial wealth but also how they’ll be receiving it and what’s expected of them once they receive it. We’re trying to get them into a position where they know how to be good stewards of their family’s wealth.

Every single client we work with in the $30 to $40 million range and up tells us the same thing: “If I give my kid a dollar, they spend $1.20.” Imagine how they feel about getting them ready to receive $20 million. Sound familiar?

This certainly hit home with a family we recently started working with. After reviewing their estate documents, we found their plan allowed for total distribution of their entire estate in intervals as each child reached certain milestone ages 25, 30 and 35. While this tiered approach is common practice, it certainly doesn’t address the fears that parents have about their children’s ability to handle substantial wealth. In the course of planning, we corrected the distribution problem, but we’ve also begun working closely with the family’s other advisors to help educate its next generation.

One we get the family’s planning done, we move quickly to the education phase. We not only want to avoid reckless spending but also reckless philanthropy– giving money away to every cause they come across without doing their due diligence on the charities or requiring any accountability. That’s another way to blow the money.

We try to put tight controls in place, but we also want the kids well prepared to receive their windfall – and before mom and dad have died. We want them to be clear about what it means to have so much money and the responsibility that goes along with it. So ultimately if they do end up giving all their money away, it’s because that’s what they really wanted to do so – not because they blew it.

Advisor’s Role

When it comes to charitable giving, there are many reasons that clients give. But reducing taxes is always No.1, and taking care of family is No.2. As the BNY Mellon study found: “Most investors (particularly younger investors) want ‘my wealth advisor to understand my values.’” As an advisor, you can make a tremendous difference in clients’ lives by educating them about the tax and estate planning advantages of smart philanthropy and by preparing the next generation(s) of their family to be responsible stewards of the family’s wealth and legacy.

Randy A. Fox, CFP, AEP is the founder of Two Hawks Consulting LLC. He is a nationally known wealth strategist, philanthropic estate planner, educator and speaker.