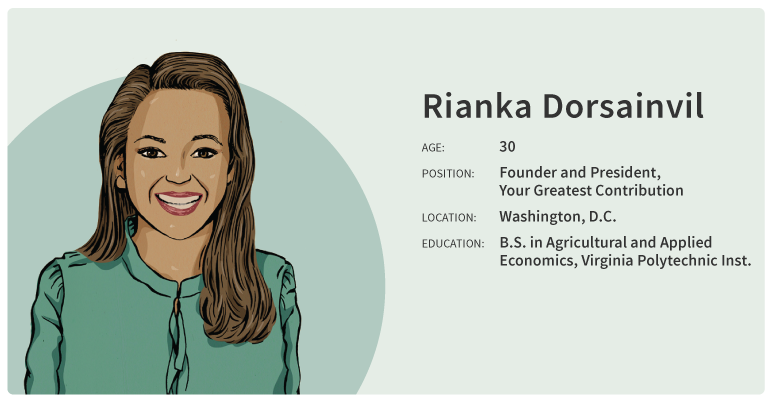

Rianka Dorsainvil

Age: 30

Position: Founder and President, Your Greatest Contribution (YGC)

Location: Washington, D.C.

Education: B.S. in Agricultural and Applied Economics, Virginia Polytechnic Institute and State University (Virginia Tech)

If the financial-advisory industry needs a spokesperson to help more young students and professionals recognize that it is a welcoming industry for people like them, Rianka Dorsainvil is about as good as it gets.

The 30-year-old founder of her own financial planning firm, Your Greatest Contribution (YGC), in Washington, D.C., fell “completely in love” with the idea of giving financial advice professionally after taking a financial planning 101 course as an undergraduate at Virginia Tech.

Before then, Dorsainvil said she never considered a career as an advisor. Many students enter post-secondary education with the intention of being a doctor, lawyer or accountant, but she didn’t know anyone intending to pursue wealth management. At job fairs on campus, wealth managers were sparse or nonexistent.

Even for younger professionals aware of the opportunities, the perception that the industry lacks diversity can be a deterrent. Dorsainvil has made it her mission to help more young professionals see beyond the overwhelmingly homogenous demographics and toward the opportunities.

“I always raise my hand because I want to be an example to those who maybe haven’t even thought about this as a career,” she said.

In addition to starting her own firm, Dorsainvil is part of the CNBC Digital Financial Advisor Council, consisting of 20 professionals who write guest columns providing insights and frontline perspectives on the industry. She’s also a Certified Financial Planner (CFP) and participated in the “I Am a CFP Pro” campaign, which encouraged others to attain the certification.

As the former president (and now a chairperson) of the Financial Planning Association’s NextGen community, she also was an important leader in educating young professionals using the organization’s platform.

She also volunteers her time helping the elderly prepare their taxes, free of charge. Dorsainvil recalled discovering her grandmother was paying an exorbitant amount to have her taxes done—money that she couldn’t afford to spend, in part because she never had a financial plan.

“There is a misconception that you need to be a millionaire to work with a financial planner, and that’s not true,” she said. That belief has helped her grow her firm, as many early clients without large accounts have become wealthier as their careers progress—and they stick with her. In fact, Dorsainvil says her practice is growing so fast, she may soon look to hire an advisor to join her. Thanks in part to her efforts, the talent pool of available candidates is growing deeper every day.