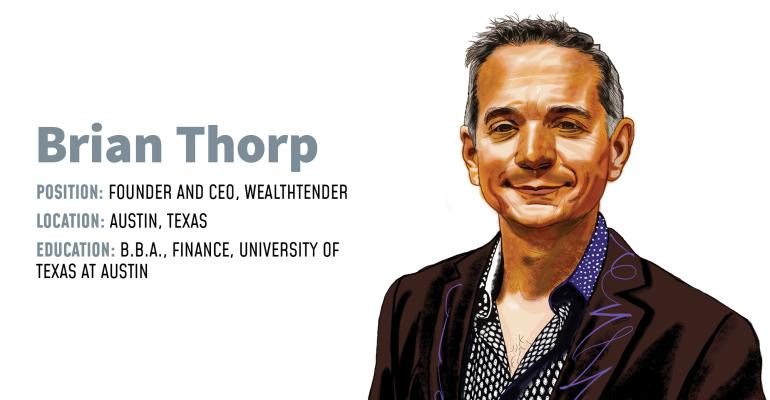

Brian Thorp, founder and CEO of Wealthtender, said the best piece of advice he ever received boiled down to, “Measure twice, cut once.”

Carefully assessing opportunities and challenges on the horizon has served Thorp well as he worked toward the success of his online matching and reviews platform for advisors.

Before founding Wealthtender in 2019, Thorp spent nearly 22 years with Invesco. Most of his tenure there was as an institutional sales manager, before becoming director of sales strategy and retail in 2013 and finally head of financial advisor platforms in 2016.

Before founding Wealthtender in 2019, Thorp spent nearly 22 years with Invesco. Most of his tenure there was as an institutional sales manager, before becoming director of sales strategy and retail in 2013 and finally head of financial advisor platforms in 2016.

After more than two decades in the corporate world, Thorp said he was bitten by the “entrepreneurial bug.” This desire coincided with what he, correctly, viewed as an emerging opening in the market.

“I have always believed that regulatory change creates opportunities for disruption,” he said.

The shift Thorp perceived came to fruition in 2021 when the SEC implemented its so-called “Ad Rule,” a set of regulatory changes that gave advisors new marketing options with the ability to solicit client reviews and recommendations—and direct prospects to them.

Thorp said to develop Wealthtender, he looked to review platforms for other professions, including doctors and lawyers, and saw the development of relevant articles paired with these reviews as key to connecting prospects with advisors. Wealthtender features an online publishing platform for articles and syndication partnerships with websites including MSN.

“It’s not necessarily re-creating the wheel but doing something in our space that had never been done before,” he said.

Wealthtender’s review process is designed to pass compliance checks, as reviews are first routed to the advisor or compliance officer to make edits and add disclosures before publishing. This step is important, as an SEC risk alert published in June reiterated that the agency would be looking for “reasonably designed” policies from firms using testimonials in their marketing. The commission also warned it would be diving more deeply into reviews searching for “ineligible persons” and whether reviewers were clients, compensated or had conflicts (the “3 C’s”).

“Even though they’ve got the green light … are they necessarily doing it the appropriate way?” Thorp asked rhetorically.

“We want to make sure we’re buttoned up so we can ensure compliance officers and advisors come through any exams or sweeps looking perfectly squeaky clean.”

Thorp’s careful strategy has, so far, proved successful. Wealthtender today features around 450 advisors, who are each paying around $49 a month. With competitors including Amplify Reviews and Indyfin, Wealthtender is far from the only find-an-advisor website supporting reviews. However, Thorp said Wealthtender’s competitive pricing is one of the factors helping to set them apart.

“Now with everybody having to follow the marketing rule, it’s gone from, ‘OK, we’ll get around to this at some point,’ to now, ‘OK, this is something we know we need to do,’” he said.

“We know we’re not going to be the only industry or profession where online reviews aren’t a meaningful contributor to the consumer discovery process to make more informed and educated decisions.”