As a child, Dr. Preston Cherry’s mother taught him about the value in thinking about financial wellness from a psychological perspective.

“The vulnerability, the compassion, how to deal with shame, how to deal with guilt and regret, being open, being honest with oneself, and all of that,” he said. “My mother introduced that into our home at very early ages.”

This has driven much of Cherry’s recent work, and he maintains that there are metrics for measuring the effects of different psychological approaches to finance.

“We’re talking about stages of change,” he said. “What’s inspiring you? What is your willingness and your readiness to change? And there are stages that influence what type of decisions and changes you’re willing and able to make to accomplish your goals. And you can measure that by your levels of perception, your levels of worry and anxiety. Are they high or low? Your levels of satisfaction. Do you feel you’ve accomplished your goals?”

In an article published by Cherry while earning his doctorate, he said the first three steps to achieving financial wellness involved admitting one’s financial truths, acknowledging the feelings those truths create and then taking action to adjust them where needed in small and achievable ways.

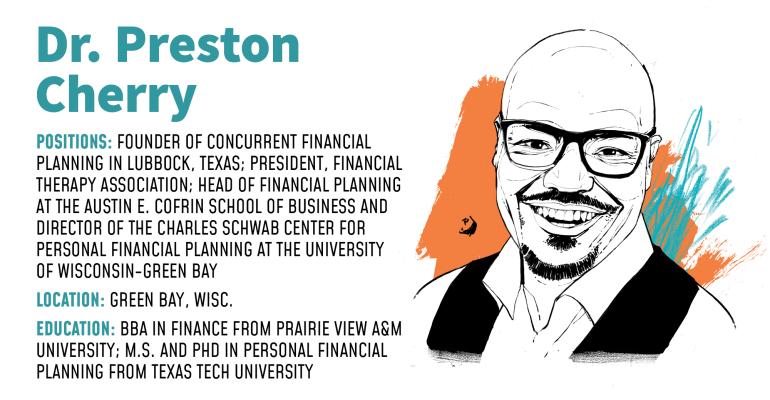

He’s now one of the industry’s leading experts in the nascent field of “financial psychology,” a concept he was introduced to while getting his doctorate in personal financial planning from Texas Tech University.

And it’s one approach to financial planning that has quickly gained a following.

Cherry got his start in banking, but quickly got turned onto financial planning through a mentor at Prairie View A&M University, where he got his bachelor’s degree. He earned a master’s degree in financial planning in 2006, then later returned to Texas Tech to earn his doctorate.

These days, he lives in Green Bay, Wisc., heading up the financial planning department at the University of Wisconsin’s business school and serving as director of the new Charles Schwab Center for Personal Financial Planning on the same campus.

Cherry said his speaking engagements and work to promote awareness of financial psychology, as well as financial literacy, are what’s really driving him.

“The terminology and the empirical research and how it’s being delivered nowadays is so important,” said Cherry, who stressed that helping clients to face hard truths and be vulnerable in their own personal journeys is a big part of helping them to achieve a healthy balance between finances and lifestyle.

“You’re going from trying to understand how we process information and those types of things that behavioral finance was focused on in the beginning to really getting into well-being,” he explained. “We’re now talking about how it may not be an irrational versus rational matter, it may really be more about perspective, cultural experiences or your background and what shaped you.”