Gabe Rissman was studying at Yale University when fellow student Patrick Reed recruited him to be part of a student campaign calling on the university’s legendary $43 billion endowment (as of June 2021) to drop fossil fuel investments.

But they weren’t just protesting with placards and bullhorns. The two were part of a student-run investment fund managing $100,000 of the endowment and gained firsthand experience in divesting and shareholder engagement. Rissman became the first student to file a shareholder resolution asking ExxonMobil to cease donations to climate deniers, which ultimately succeeded.

That prompted the duo to take a closer look at the wide gap between retail investors and this kind of values-based investing, and the role the financial advisor could play in filling it.

“Financial advisors, wealth managers are not necessarily meeting—depending on the study—80-90% demand for ESG,” Rissman said. “What we were finding ... was that it was challenging for advisors to tell the story of ESG.”

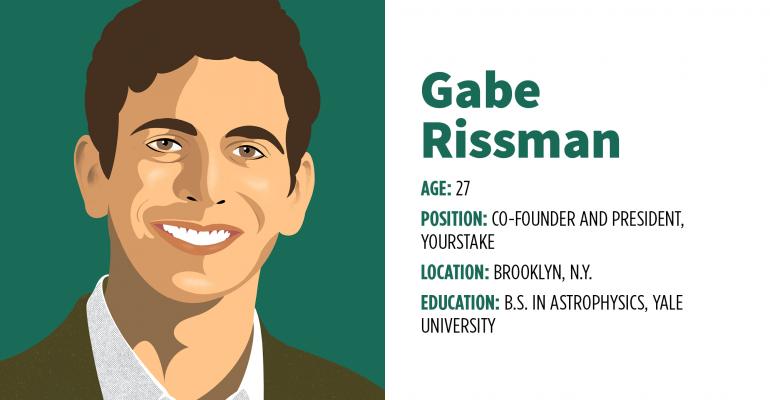

Enter YourStake, the ESG platform for advisors, launched in November 2019 by Rissman and Reed. The newest iteration of the platform includes an ESG personality-type quiz for clients, company and fund screeners and what Rissman calls “methaphor metrics,” real-world analogies that demonstrate the impact of the investor’s portfolio. The startup now serves financial advisors across nearly 150 firms representing over $250 billion in assets under management.

YourStake constructed the 14-question survey to be more of a behavioral-style questionnaire. It asks clients whether they agree or disagree with certain statements, such as “I avoid eating meat,” “Companies should pay a living wage even if it means employing fewer people,” “Society should fix problems like health care and education before devoting resources to climate change” or “I go out of my way to avoid buying products that use forced labor.”

The tool then links the results to the reporting and portfolio research metrics that would be most relevant to that investor.

The next step? Advisors diagnose their client portfolios based on their personality types. The third step is comparing the advisor’s ESG model with the client or prospect’s non-ESG portfolio and showing the difference in terms of the impact on the client’s area of concern. YourStake won’t just give an ESG score but rather shows the numbers behind the impact of a portfolio, like how many COVID hospitalizations have been prevented, the number of jobs supported, or drunk driving incidents the client’s portfolio is responsible for.

YourStake recently partnered with First Affirmative Financial Network, a Colorado Springs, Colo.–based investment advisory firm that specializes in social, responsible and impact investing, to launch a direct indexing platform. The Values-Aligned Direct Index Solution is powered by YourStake’s ESG data and allows advisors to use YourStake’s values questionnaire as a starting point to create a customized ESG portfolio. Orion Advisor Services will provide the trading and rebalancing tools.

Rissman says YourStake addresses the controversy of “greenwashing”—when a company or a fund’s sustainability claims and marketing outpace its actual sustainability practices—which is a top concern among investors. While many fund screeners show sustainability metrics or whether ESG is mentioned in the prospectus, YourStake has a toggle that looks instead at a firm’s proxy voting record and shareholder engagement.

“What we’re doing is looking at the actual resources devoted to ESG and proxy voting and shareholder engagement, to get a better sense of the firm’s actual commitment to ESG, instead of its specific language,” he said.