The most popular sites designed to help retail investors find financial advisors use search filters like location, specialty, certification types, and, in some cases, language.

But until recently you could not search specifically for a financial advisor of color.

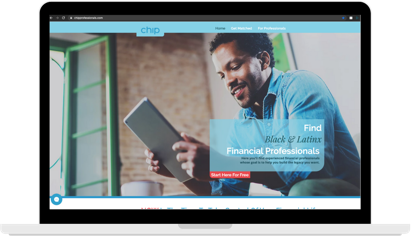

Enter Dana Wilson, an advisor registered with LPL Financial in New York, N.Y. She recently launched CHIP (Changing How Professionals Prosper), an online directory of Black and Hispanic advisors and financial professionals geared toward helping prospective clients find them.

“When you go to some companies’ sites, it’s tough. You have to really click through a couple pages to find the Black and brown individuals. It’s not as easy as it should be so I’m hoping CHIP makes it easy for people,” said Wilson. Less than 7% of the industry is made up of Black and Hispanic professionals, according to U.S. government data.

CHIP had a soft launch late last year and came out of beta mode in February. There are over 100 finance professionals on the platform; 70% are financial advisors and 60% have the Certified Financial Planner designation.

The site works similarly to other advisor-matchmaking sites like SmartAsset, Paladin Registry or Edward Jones’ Match Quiz. Consumers answer questions related to their financial situation and are then matched with advisors who best fit the clients’ needs.

Advisors interested in the platform, and those who’ve already signed on to CHIP, won’t have to pay a fee until 2021. Wilson said she then plans to charge under a subscription-based model. She does not characterize the mission as exclusively a lead generator for advisors. The goal is to “bring a more inclusive and robust experience to the financial services industry to ensure that access is at the forefront for all.”

The concept for CHIP arose out of Wilson’s 10 years in the wealth management industry. Since 2006, she worked at both a bank and a traditional brokerage firm before joining an independent practice affiliated with LPL.

“A lot of times I was the only Black woman on the floor or in that environment. In meetings, there would just be me in a sea of white men and that was just kind of the norm of wealth management and private wealth,” Wilson said.

The isolation intensified when she joined an independent firm as there were fewer chances to see other advisors in general, much less advisors of color.

Wilson connected the lack of access, visibility and representation in financial services with that of Black and Hispanic consumers of financial products and advice. Advisors with less understanding of prospects from different backgrounds may inadvertently push those individuals away from financial services, an upsetting idea for Wilson.

“We don’t have the luxury of people doing nothing with their money,” she said.

CHIP is self-funded, for the moment. Wilson stepped down from her position as a client-facing advisor to give more focus to CHIP, though she maintains an administrative role with her firm. Future iterations may add more demographic categories to the platform and allow for more targeted searches.

She said she is looking at raising investments or grants to fund the project. She’s also forming partnerships with consumer-focused fintech companies and organizations to ensure CHIP reaches those audiences as well.

While there’s a demonstrated need on the consumer side for the service, she said, it’s been harder to get the industry itself to stand behind her efforts.

“We’re on the same side,” she said. “As far as professionals are concerned, they [firms] want their professionals to grow. They want that retention. They want that opportunity to recruit more individuals to their companies. And the way that you do that is to work alongside companies like mine where you have access, and you’re being that champion and empowering your company [advisors] to be part of that platform.”