When asked to rate the amount of time various activities take on scale of one to five, 73% of advisors indicate client meetings or client service activities rate either a four or five. Other top-scoring activities include portfolio management, client acquisition and research. By contrast, activities with less of a direct influence on clients occupy significantly less of advisors’ time. For example, advisors report that employee training, human resources functions and back-office operations take up the least amount of their time.

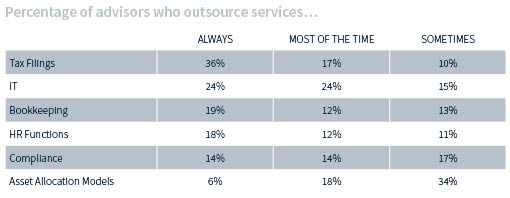

Investment advisors frequently make more time for client-facing activities by outsourcing back-office functions. More than half of all respondents indicate they outsource tax filings, IT, bookkeeping, HR functions, compliance and asset allocation models at least some of the time.

Advisors generally tend to leverage resources affiliated with their firms when it comes to outsourcing, rather than hiring third parties. In our findings, bookkeeping and tax filings represent the only exceptions. Two-thirds of respondents (66%) indicate they primarily outsource tax filings to a third party.