The United States rates below average on its regulatory and tax framework for the mutual fund industry, according to a new analysis by Morningstar. While the country scored well on mutual fund governance, it lagged other markets around the world on policy and tax incentives to invest.

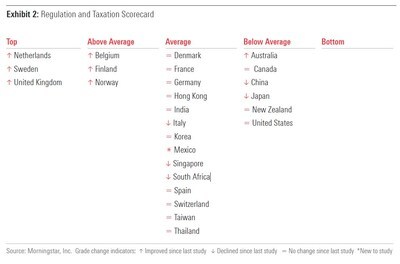

The Netherlands, Sweden and the United Kingdom got top grades in the analysis, making them the most investor-friendly countries on regulation and taxation. Australia, Canada, China, Japan and New Zealand also received below-average grades, alongside the U.S. No market received a “bottom” grade, as they all provide basic investor protections.

The results were part of Morningstar’s Global Investor Experience Study, which examines the regulatory and tax frameworks mutual fund investors face.

The U.S. system was criticized for its retirement investing framework, which is not mandated, and because investors have to pay capital gains tax when a fund realizes those gains. In addition, many employers don’t offer retirement plans.

Another reason the U.S. ranked lower is due to tax policies in the country that make passive and exchange traded products more attractive than active funds.

“The most problematic tax policies are when arcane elements of the tax rules prompt investors to choose one product over another without a rationalised policy justification,” the authors of the report said.

The U.S. also received below-average scores for the overlap and duplication among its financial regulators, which include the Securities and Exchange Commission, Financial Industry Regulatory Authority, Commodity Futures Trading Commission, Department of Labor and the states.

And despite the SEC passing its Regulation Best Interest, Morningstar says regulators still tolerate conflicts of interest created in mutual fund sales, such as soft-dollar arrangements and distribution fees.