So far, 2020 has provided an interesting opportunity to review the “passive” versus “active” debate. In generally up markets, as we have had for many years, most investors are “relative” investors, meaning they are most interested in how their portfolios perform relative to the broader stock market as a whole. To that end, many turn to passive, index-tracking investments to ensure they are “keeping up with the Joneses.” However, when markets turn south, investors' attitudes shift; suddenly, they are more interested in “absolute” returns, protecting their assets as much as possible from the market carnage. Active managers argue this is when their approach can pay off; they say they can be the proverbial lighthouses in the storm, safely guiding a ship (read, investment portfolio) to a sheltered harbor for protection. However, recent data from S&P Dow Jones Indices suggests otherwise.

U.S. equity mutual funds have been under pressure for years. In the period between January 2018 and April 2020, U.S. equity mutual funds suffered $683 million of net outflows, while U.S. focused ETFs gathered $344 million of new money, according to the Investment Company Institute (ICI). While the ICI stats include both passive and active in both categories (U.S. equity mutual funds and U.S.-focused ETFs), a more detailed look at inflows and outflows shows the shift toward ETFs has been driven in part as investors have favored low-cost strategies, especially passive ETFs tracking indexes that have performed relatively well. However, many asset managers have held out hope that investors might return to active managers when market volatility increased, and active funds demonstrated the value of their security selection. In hindsight, the environment in the first four months of 2020 seemed like an ideal time to be an active manager, much like a baseball player seeking a fastball down the middle of the plate to hit out of the ballpark, as equity markets fell into a bear market in March before partially recovering in April. Unlike indexes, active managers can buy or sell stocks at full discretion, picking up favored names that sold off or moving some money to cash based on fundamental and valuation concerns.

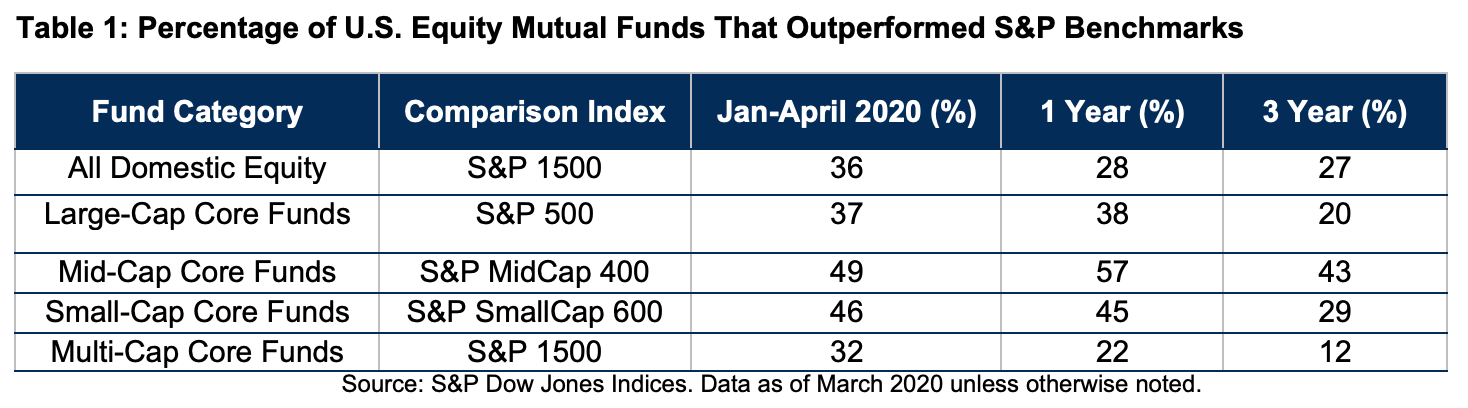

So, how did the active managers do? Just over one in three (36%) active domestic equity mutual funds outperformed the multicap S&P 1500 Index in the first four months of 2020, according to S&P Dow Jones Indices. The index provider also released data on active management versus index performance for one year and three years ended March, as well as for different capitalization categories; see Table 1.

Many investors will be disappointed with the active management underperformance highlighted in the S&P Dow Jones Indices data, we think, and the shift toward index-based ETFs is likely to continue in the second half of 2020 and beyond. The case for active management is even weaker on a five- and 10-year basis, but CFRA cautions investors from relying too much on what seems distant in the rearview mirror. That’s why CFRA’s fund ranking methodology incorporates an analysis of the holdings inside the portfolio and their likely future prospects, as well as a look at costs and risks of buying and holding any specific mutual fund.

High fees for active funds make outperforming a challenge. The average fee for actively managed equity mutual funds shrank in the past two decades but remains quite high relative to index-based alternatives. In 2019, the 0.74% expense ratio for active equity mutual funds was 67 basis points higher than the average index-based equity mutual fund, according to ICI data. Yet this was only modestly lower than the 79 basis point difference in 2000 as index funds also cut expenses over the past two decades.

CFRA ETF and fund rankings can help investors identify the best choices for their portfolios. Investors preferring a mutual fund approach to index investing should consider CFRA four-star-rated Schwab S&P 500 Index (SWPPX) and Vanguard 500 Index (VFIAX), which are rated favorably in part for their low expense ratios—0.02% and 0.04%, respectively—that are well below the 0.93% growth/income category average used in our reports.

ETF flows has been increasing in recent years, as these products provide liquidity benefits relative to index mutual funds and do not require minimum levels of investment. SPDR Portfolio S&P 500 ETF (SPLG) and Vanguard S&P 500 ETF (VOO) charge minuscule 0.03% expense ratios, while investors in iShares Core S&P 500 ETF (IVV) incur a 0.04% fee for S&P 500 Index exposure.

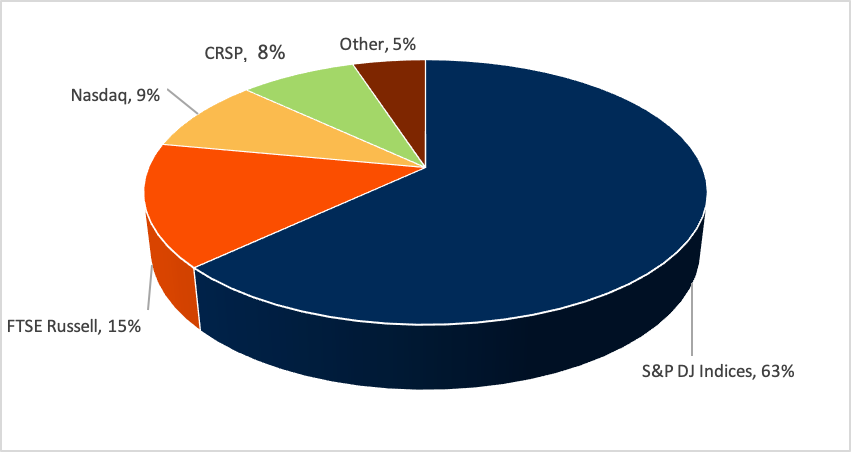

S&P Dow Jones benchmarks are widely followed by ETF investors. Though investors have a wide array of large-cap index-based ETFs to consider, the funds tracking benchmarks from S&P Dow Jones are dominant. (See Figure 1.) More than $6 of every $10 invested in large-cap index-based ETFs at the end of April 2020 track an index from SPGI, including IVV, SPLG, VOO and the slightly more expensive SPDR S&P 500 ETF (SPY), according to First Bridge Data, a CFRA company.

iShares Russell 1000 ETF (IWB), Invesco QQQ Trust (QQQ) and Vanguard Large-Cap ETF (VV) are examples of other large-cap funds that track indexes from FTSE Russell (15% market share), Nasdaq (9%) and CRSP (8%). SPGI will continue to benefit, by our analysis, as large-cap investors seek out lower-cost, better-performance alternatives.

Figure 1: Large-Cap Market Share Among Index Providers

Conclusion

While the first four months of 2020 could have been an opportunity for large-cap active managers to hit a home run and showcase their stock selection skill set, just over one in three outperformed the S&P 500 Index in the first four months. Actively managed mid- and small-cap funds demonstrated relative success compared with relevant benchmarks, but high fees relative to index-based mutual funds and ETFs continue to detract from performance. We think the recent trend to shift assets away from actively managed mutual funds to index-based alternatives is likely to persist unabated, with S&P Dow Jones Indices among the major beneficiaries given its market share.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.