The fundamental premise of impact investing is that it can deliver a double bottom line: a positive social and/or environmental change and a market-rate financial return. Yet it can be difficult to parse through a sea of information (and frequently marketing spin) to select funds that actively deliver on these twin goals.

Environmental, social, and governance frameworks are laudable and have had a positive influence for clients concerned about investing with ESG goals in mind. ESG-compliant funds, however, are not required to make a measurable impact. True impact investing, on the other hand, should intrinsically meet ESG criteria.

The reputational risk of failing to meet impact goals or ESG requirements has become an increasingly significant concern for companies. Regulations, such as the Sustainable Finance Disclosure Regulation in Europe, go some way toward ensuring transparency and accountability for public market sustainable investments, but there is no precise legal equivalent for private markets. This is a challenge for financial advisors and their clients because effectively assessing the processes implemented by funds to guarantee that their underlying holdings will meet impact goals is crucial to achieving the sought-after double bottom line.

The First Bottom Line: Having a Positive Social and/or Environmental Impact

How should financial advisors approach identifying funds that are likely to provide genuine impact for their clients? In short, they should seek out funds that:

- Demonstrate intentionality around their impact;

- Employ a robust framework for measuring effectiveness; and

- Actively track and regularly report on impact-related key performance indicators.

Intentionality: While some strategies are inherently impactful—for example, a renewable energy fund that invests in solar and wind energy—it is more important to seek out fund managers who clearly state their intention to contribute to positive social and/or environmental change. While this may seem obvious, fund managers that place this goal front and center—rather than as a marketing-led afterthought—are more likely to have thoughtfully constructed a robust approach to generating and measuring impact.

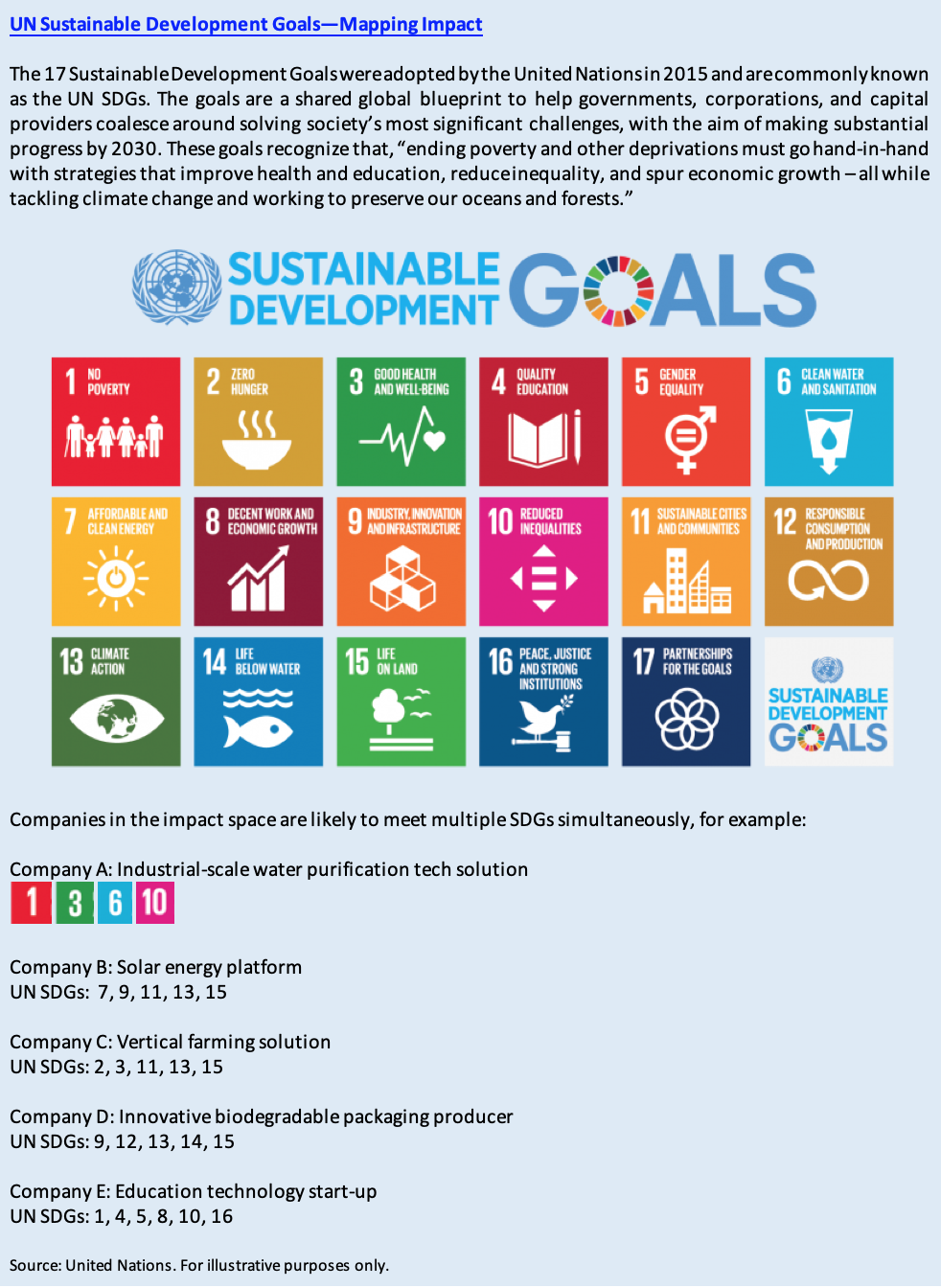

Measuring Impact: When selecting a fund, the primary goal for financial advisors whose clients are looking for impact should be ensuring that the fund applies a robust framework to its portfolio companies. For example, some firms map their portfolio companies to the United Nations Sustainable Development Goals. These SDGs are, however, relatively high-level, abstract concepts. It is therefore preferable to seek out funds that go a step further by explicitly analyzing how those SDGs (or other impact goals) are being met.

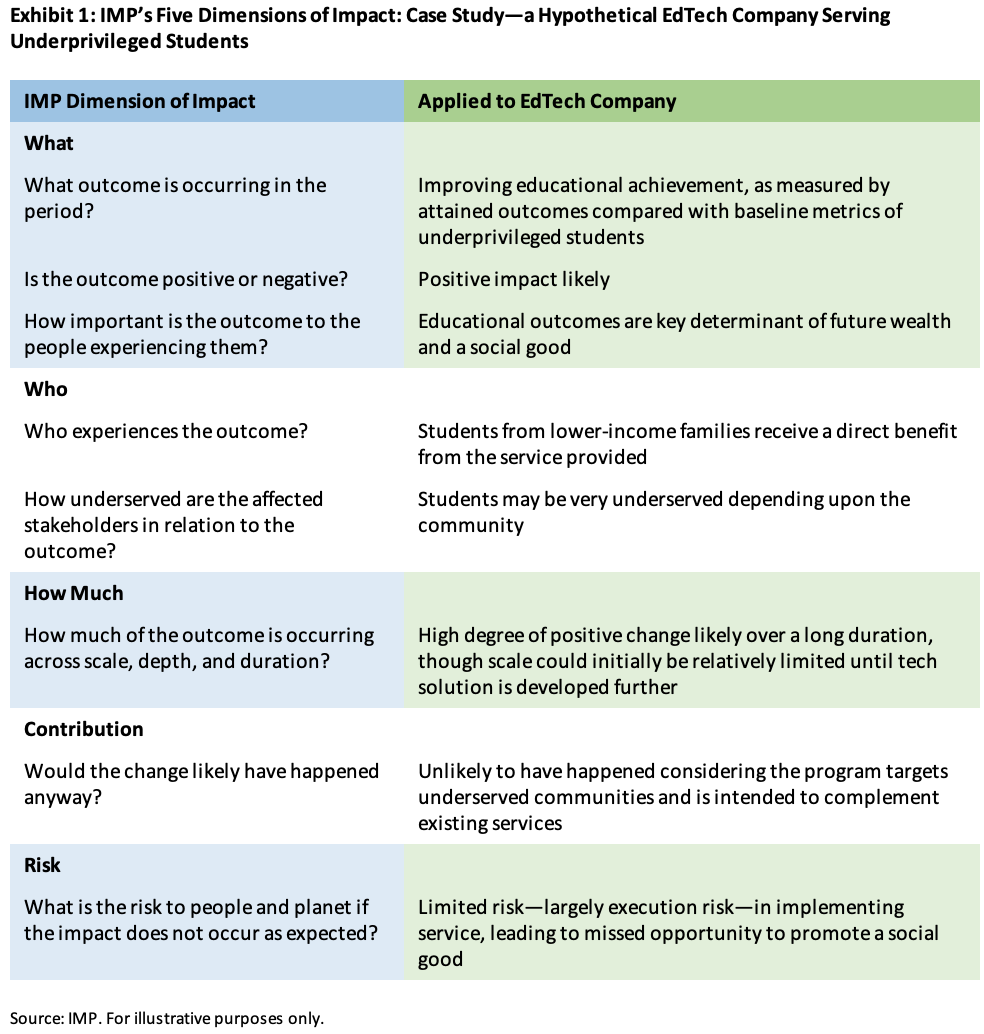

There are frameworks that help fund managers do this. One such common framework is the five dimensions of impact laid out by the Impact Management Project—namely what, who, how much, contribution and risk. As our hypothetical case study shows, this framework breaks down the expected impact of a portfolio company into practical, easy-to-digest factors that help funds understand the expected depth and breadth of an impact outcome, and parse who and what it would directly affect.

Monitoring and Reporting Impact: It is obviously vital to determine whether an investment is likely to have a positive impact, but it is not sufficient. It is equally important that a fund manager has a robust system by which to track impact throughout its ownership of a portfolio company.

One common and useful approach involves selecting one or more KPIs for each holding, alongside typical financial measurements, such as net profit margin and interest coverage. There are several sources—including the Global Impact Investing Network (GIIN) IRIS+ catalog—that offer metric sets that aim to foster consistency across investments, although in many cases impact KPIs should be tailored to the specific company and/or sector. Examples include greenhouse gas emissions avoided or reduced and number of children developmentally on track.

These results must be included in regular reports to clients, whether quarterly (alongside financial performance) or annually. In recent years, a few pioneering managers have even held themselves accountable by tying a portion of their own carried interest (profits) to reaching certain impact-oriented goals. This clearly signals a firm commitment to impact, as well as aligning managers’ interest with clients.

The Second Bottom Line: Delivering a Market-Rate Return

Impact investments may generate a strong or top-quartile return, but there is insufficient data available to ensure an apples-to-apples comparison with other investments, due, in part, to the difficulty in separating out the historical performance of impact and nonimpact investments in funds that may have featured both. Further, we are likely still several years from the emergence of a high-quality equivalent impact fund benchmark, unlike more established private market asset classes in which there are multiple major data providers that allow financial advisors to benchmark funds against their peers.

Performance analysis must, therefore, focus on absolute or market-rate returns. In other words, each advisor should use their own asset class return expectations to determine what appropriate performance would be for their client’s impact investments. For example, advisors may target a mid-teens return within their client’s equity bucket, or a high single-digit yield within their credit allocation. Advisors can then apply these benchmarks to impact investments their clients are considering. In other words, rather than necessarily seeking top-quartile outperformance, financial advisors should target the double bottom line we mentioned earlier: a positive social or environmental impact and a market-rate return as determined by their client’s investment goals. In our view, a market-rate return is more than adequate compensation, given the ability to also do good and drive positive change.

Kunal Shah is managing director, head of private equity solutions, co-head of research at iCapital.

Tatiana Esipovich is senior vice president, research and due diligence at iCapital.