Active money management is in retreat these days, as investors opt for the passive management style instead. They have gravitated to stock index funds, which have outperformed actively-managed funds in recent years.

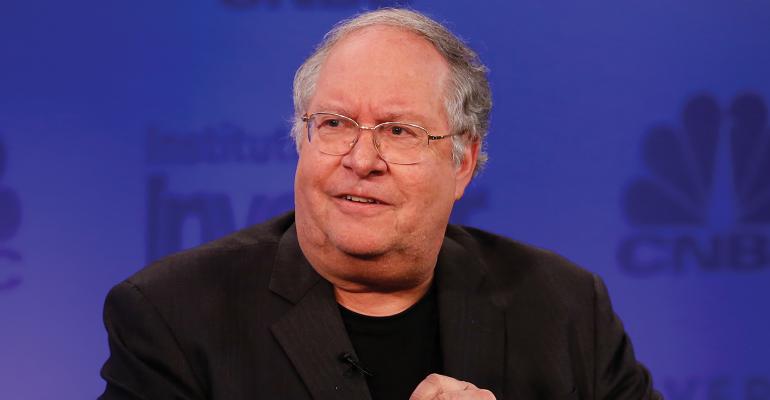

But veteran portfolio manager William Miller, chairman and chief investment officer of Miller Value Partners, hasn’t given up on active management. And he’s one who should know. Miller beat the S&P 500 index 15 years in a row as portfolio manager of Legg Mason Capital Management Value Trust (1991-2005), reportedly setting a record for diversified mutual fund managers.

A value investing stalwart, Miller, 67, now manages Miller Opportunity Trust and Miller Income Fund. He recently chatted with WealthManagement about passive versus active money management, his streak and a number of other investment topics.

WealthManagement.com: How do the benefits of active management stack up against passive?

Bill Miller: The two styles are complementary. Passive gives you low cost and historically beats most active managers most of the time, mostly because of cost. But costs aren’t zero. For major stock index funds, it’s 5 to 15 basis points. That means the funds underperform the index every year, and the longer you invest, the more those costs compound.

Active management doesn’t underperform every year. Active management provides an opportunity to beat the index. There are investors who have beaten the index over 20-to-30-year periods.

I’m not opposed to passive management. Individuals are well advised to have at least 50 percent of their portfolio in passive funds and complement that with highly active managers. Now we’re seeing money move from expensive closet indexers to low-cost passive funds, as it should.

WealthManagement.com: What makes you a believer in value investing?

BM: Warren Buffett, who has made more money than any investor in the world, is a prototype value investor. As he says, you might not get rich with value investing, but you won’t get poor. It’s a good way to have assets increase in value. Whether it’s growth or value, there are people temperamentally suited to that psychology. Growth investors get nervous if prices go down, while value investors view that as an opportunity. My psychology is as a value investor.

WealthManagement.com: Has your investment approach changed since you entered the business 35 years ago?

BM: Yes, during the early years, value investing was based on traditional accounting—low price to earnings, low price to book, above average yield. That worked well in the early years, but not in the late 1980s into the ‘90s.

People generally misinterpreted studies finding that stock prices looking statistically cheap usually had some kind of problem and weren’t mispriced unless those issues went away. Declining return on capital was the biggest problem. So we tried to buy when return on capital was low and waited until that return was normal to sell. Our investing changed from being almost entirely backward looking and accounting-based to forward looking and economic-based.

WealthManagement.com: Do you think your 15-year streak of outperforming the S&P 500 will be broken soon?

BM: I doubt it will be soon, because there is probably no one with a streak of more than seven years currently. There has never been a 12-year streak aside from mine. There are things going on now that make it more difficult. The Dodd-Frank law, which I think should be repealed, limits liquidity in the market, because banks can’t invest as much capital. ETFs are buying baskets of stocks, making correlations higher.

Most importantly, there are more layers of risk management at every large investment management firm. There’s an inability to tolerate large tracking errors, and it’s those kinds of funds that beat the market. There’s a big increase in closet indexing. All that means the ability for portfolio managers to be different from the market is less than it used to be. Finally, algorithmic trading is backward looking. Algorithms may make up two-thirds of trading, and they have nothing to do with anything but robots.

Almost every streak is broken at some point, so mine probably will be. All long streaks are a combination of luck and skill.

WealthManagement.com: How did the luck and skill combine in your streak?

BM: It’s difficult to disaggregate the luck and skill. Fortunately, I worked for a firm [Legg Mason] that was hands-off until the financial crisis. That enabled me to benefit from skill and luck in the mid- to late 1990s, when most value investing did poorly. The technology sector went from underpriced in 1995 to overpriced in 1999. Most value investors didn’t buy tech. We were one of the first. My team and I had done work on the impact of technology on the economy. That’s an example of skill.

As for luck, tech got way overdone going into 2000. We were fortunate to realize that and began to get out in December 1999. When tech crashed, we had gone away from it.

WealthManagement.com: What do you think are the most common investment mistakes made by financial advisors?

BM: One problem is how they deal with risk. There is a lot more action on perceived risks, exposing clients to risks they aren’t aware of. For example, since the financial crisis people have overweighted bonds and underweighted stocks. People react to market prices rather than understanding that’s a bad thing to do.

Most importantly, most advisors are too short-term oriented, because their clients are too short-term oriented. There’s a focus on market timing, and all of that is mostly useless. The equity market is all about time, not timing. It’s about staying at the table.

Think of the equity market like a casino, except you own it: You’re the house. You get an 8-9 percent annual return. Casinos operate on a lower margin than that and make money. Bad periods are to be expected. If anything, that’s when you want more tables.