Whether it’s the family home, undeveloped land, a rental property, or some other investment, your real estate held for more than one year may be the most highly appreciated asset you own. This means you could face significant capital gains taxes if you sell your real estate. Depending on your particular financial and charitable goals, donating real estate to a 501(c)(3) public charity, including a donor-advised fund, could allow you to leverage one of your most valuable investments to achieve maximum impact with your charitable giving.

What are the benefits of donating appreciated real estate held for more than one year? First, you potentially eliminate the capital gain tax liability you would incur if you sold the real estate yourself and donated the proceeds, which may increase the amount available for charity by up to 20 percent. If you itemize deductions on your tax return instead of taking the standard deduction, you also may claim a fair market value charitable deduction for the tax year in which the gift is made.

While appreciated non-cash assets are often the most tax-smart charitable gifts, not all charities have the capabilities to accept these gifts. Donor-advised funds, which are public charities, provide an excellent gifting option for contributions of real estate, as they typically have the resources and expertise for evaluating, receiving, processing, and liquidating this type of gift.

To gift appreciated real estate to a donor-advised fund, the process involves transfer of title to the donor-advised fund account by deed of gift. When the gift is complete, you may claim a fair market value tax deduction, if you itemize, as of the date of transfer of title. Doing so may allow you to pay no capital gains tax when the real estate is liquidated, the cash proceeds can typically be reinvested for tax-free potential growth, and you can recommend grants to your favorite charities immediately or over time at your convenience.

Case study: making a larger gift while increasing tax savings

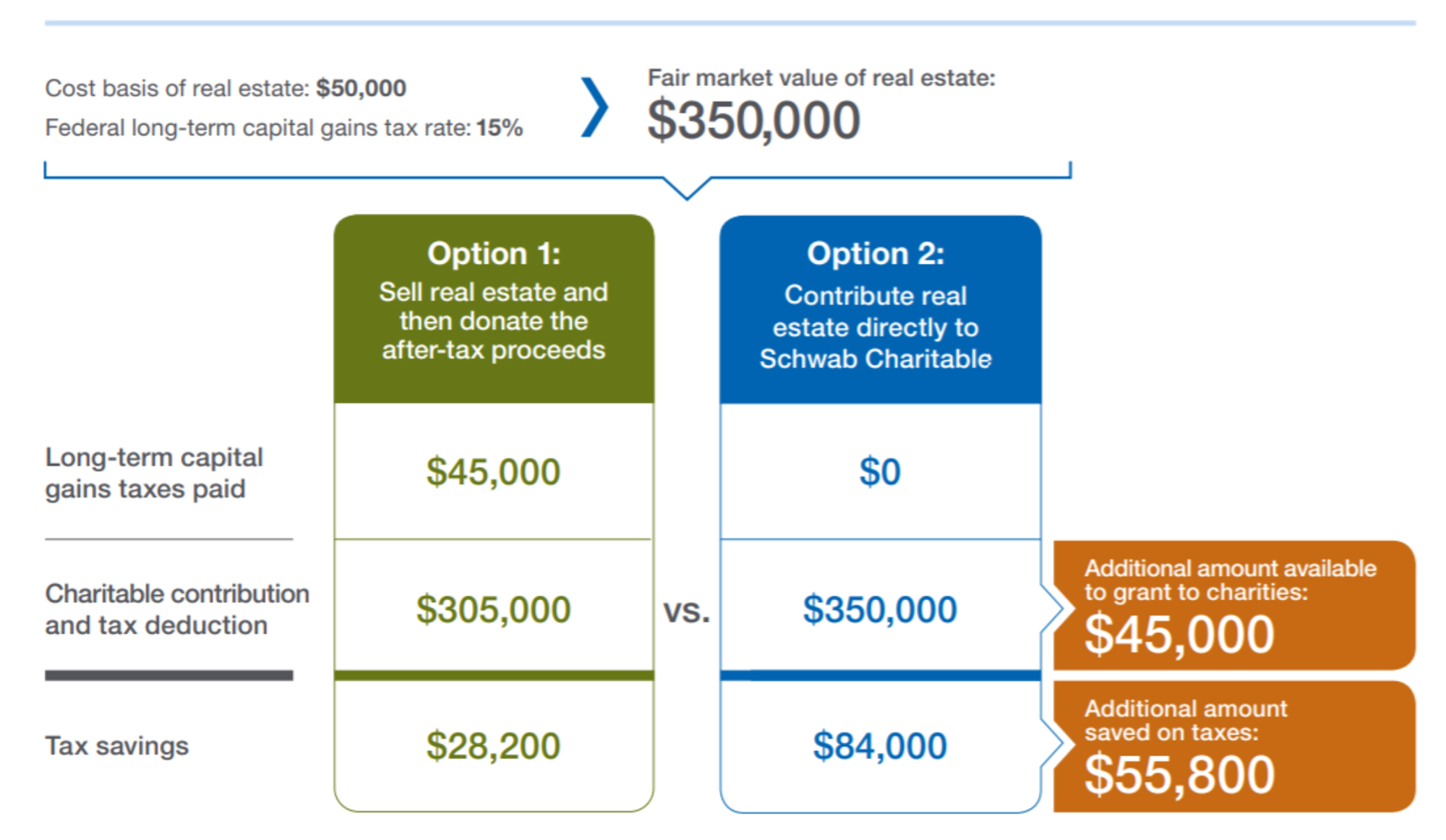

To illustrate the impact of donating appreciated real estate, consider Jim. As he approaches retirement, Jim no longer wishes to manage a single-family rental property he inherited from his parents 25 years ago. Because Jim is charitably minded, he has considered selling the rental property and using the net sale proceeds to support various charities. Selling the rental property, however, will expose Jim to capital gains taxes on 25 years of appreciation. As it stands, Jim’s adjusted cost basis in the rental is $50,000 and the property has a current estimated value of $350,000.

Assuming a 15 percent federal capital gain tax rate upon sale of his rental property, Jim would realize capital gains on $300,000 of appreciation and owe an estimated $45,000 in federal capital gains taxes ($300,000 x 15 percent = $45,000). In this scenario, as shown in Option 1, after paying the tax, Jim’s estimated net cash available for charitable giving is $305,000.

Jim’s financial advisor suggests that Jim could instead donate his rental property to a public charity, including to a donor-advised fund, as a way to potentially eliminate federal capital gains taxes ($45,000) and claim a fair market value income tax deduction ($350,000, based on a qualified appraisal), as shown in Option 2.

By donating his rental property directly to charity, as shown in Option 2, Jim potentially eliminates federal capital gains taxes and thereby has an additional $45,000 available to grant to charities. He also has an additional $55,800 in tax savings.

By donating his rental property directly to charity, as shown in Option 2, Jim potentially eliminates federal capital gains taxes and thereby has an additional $45,000 available to grant to charities. He also has an additional $55,800 in tax savings.

In addition to the potential tax benefits described above, the following considerations may apply.

1. Donate marketable real estate. You may consider contributing real estate to charity as long as the charity can sell the property in a timely manner (i.e., it is a marketable property and relatively easy to liquidate). In addition, it makes sense to donate real estate where:

- The property has been held for more than one year and has appreciated significantly.

- The property is debt free. If there is debt on the property, you may be subject to IRS “bargain sale” rules at the time of donation, which can generate capital gains tax and lower the value of your charitable deduction. In addition, the debt may be taxable to the charity when the property is sold (e.g., acquisition indebtedness).

- You are willing to transfer the property irrevocably to the donor-advised fund or other public charity, which will negotiate the sale price and control the sale, often using an experienced intermediary.

2. Avoid prearranged sales. If a sale is expected prior to your charitable contribution of real estate, then the terms of the sale should still be under negotiation. The documentation must not have proceeded to the point at which the IRS would consider it a prearranged sale. In that unfortunate instance, the IRS may deem your donation an “anticipatory assignment of income” to the charity. As such, you may be required to pay capital gains taxes when the real estate is sold by the charity.

3. Qualified appraisal requirements and annual deduction limits apply. Overall deductions for donations to donor-advised funds are generally limited to 50 percent of your adjusted gross income (AGI). The limit increases to 60 percent of AGI for cash gifts, while the limit on donating appreciated non-cash assets held more than one year is 30 percent of AGI. The IRS permits a carryover for five tax years, should your charitable deduction exceed AGI limits in a given tax year. To substantiate your charitable income tax deduction, you are required to complete IRS Form 8283 and obtain a qualified appraisal from a qualified appraiser for contributions of real estate in excess of $5,000.

While extraordinary charitable needs will persist into the future, the tax benefits of charitable giving may change under the new administration. Now is a great time to consider maximizing tax benefits and the impact of your charitable giving with a donation of real estate.

For more information about the advantages of contributing appreciated non-cash assets, you can read an overview article.

Caleb Lund serves as managing director of charitable strategies group at Schwab Charitable. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice.