If time flies when you’re having fun, then it stands to reason that the opposite is also true. Unbelievably to me, over two years have now elapsed since I penned this article predicting how insurance could integrate with wealth management.

I love the insurance industry. It’s not the puppy love I felt when I leapt headfirst into leading my first insurance business. It’s not the coming-of-age identity struggle I faced as my career progressed and I had to decide whether to focus my energy on operations or strategy. Now, I’m talking mature love. When you love something the way I love the insurance industry, you don’t just care about it in your spare time. You want to see it flourish into the best version of itself. Over and over again.

The insurance industry is in an awkward position. It is plagued by product commoditization, prolonged low interest rates, regulatory mandates ill-matched with insurance distribution, nontraditional entrants effecting tax and capital arbitrage, and generalized disruption. In advising my insurance company clients about how to innovate our way out of these circumstances, I often empathize with Bill Murray’s character in Groundhog Day. Until we begin to acknowledge, and maybe even embrace, the changes, we will be stuck in an endless loop where insurance is perceived as a commodity and where distribution is expensive (which makes products expensive!). Insurance in this world remains isolated from an increasingly integrated, fintech-driven, fee-conscious, financial advisory community.

State insurance regulation governs the conduct of agents and insurance brokers. It needs to be adapted to govern RIAs as well. Insurance advisement is a premise different from insurance sales, just as there is a big difference between the consumer experience of advice versus sales of securities. While some insurance professionals already consult on or about contracts for consumers, and legally charge a fee for doing so, this model is not mainstream for insurance distribution. Insurance regulation currently occurs at the point of sale and does not contemplate ongoing advice. It should be adapted to do so. Such an adaptation would facilitate a transformation of both insurance, which means liability management, and wealth management as disciplines.

There is no direct corollary to the ’40 Act for insurance. There is no national authority that can define the meaning of the term “insurance advis(o)er.” There is no independent national source upon which financial professionals can rely for accurate annuity conduct, oversight and advice.

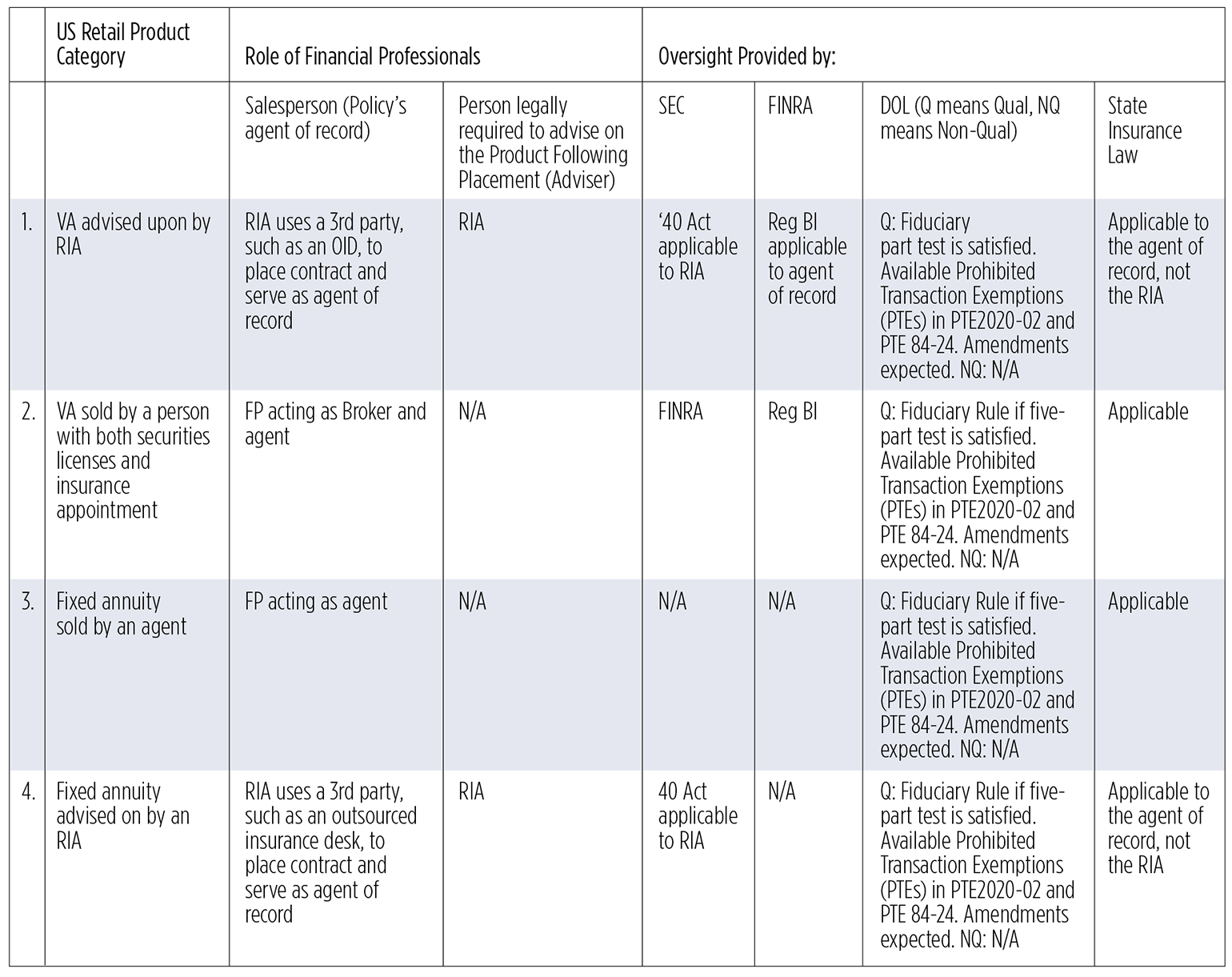

We are all receiving a high volume of rapidly changing regulatory guidance. It is not always clear how it applies to the nascent world of “insurance advice.” I empathize with the advisors who tell me that there is not one place they feel they can turn to for definitive guidance about what their responsibilities are for various forms of annuity transactions. To try and assist advisors who feel this way, I have compiled the table below. This is not legal advice, but I hope it gives a starting point for a broader discussion in the industry.

Michelle Richter’s Non-Lawyer Best Guess on Applicability of Various Laws to Different Types of Annuity Transactions. Feedback welcome, especially from financial regulatory lawyers!

I’ve never been more optimistic that the environment, now, is here for us to make our case that insurance products, in the context of holistically managed lifetime wealth (not assets!) optimization, can substantially improve both psychological and quantitative outcomes for many clients.

Our industry faces a material hurdle in convincing RIAs that there are sources to which they can turn for trustworthy information about annuities. From practical problem solving, to regulatory concerns, to tips from fellow advisors, to summaries of cutting-edge research, advisors need sources they can trust to help them focus on where their attention needs to be: in managing the wealth (not assets!) of their clients, and developing their practices using insured solutions to achieve better—better by virtue of including more certain features, not by virtue of having lower costs—outcomes for their clients and their families.

I emphasize the distinction between wealth and assets. Wealth management, which means the management of the nexus of asset management and liability management, and asset management itself, are, of course, different disciplines. More about that distinction coming soon!

Michelle Richter is the founder and principal of Fiduciary Insurance Services and executive director of the Institutional Retirement Income Council.