It’s a good time to be a registered investment advisor in the United States. The average earnings margin before owner compensation of 408 RIA firms surveyed for the 2017 Fidelity RIA Benchmarking Study was 52 percent in 2016. Rates for fee-based compensation have held steady while the market had a banner year in 2017.

Look a little closer; it appears not every client is charged the fee advertised by their RIA. Many pay less, and the gap between what firms say they charge and what they end up collecting is widening, implying that actual market rates for an advisor’s services are lower than traditionally thought, according to Fidelity’s study.

Median effective fees charged by RIAs have changed little or not at all since 2011. Clients with more than $5 million in assets are paying 75 basis points, up from 70, and those with $10 million or more are paying 58 bps, down from 60. Clients with $1 million or less are still paying 1 percent; $2 million, 90 bps; and $3 million, 80 bps.

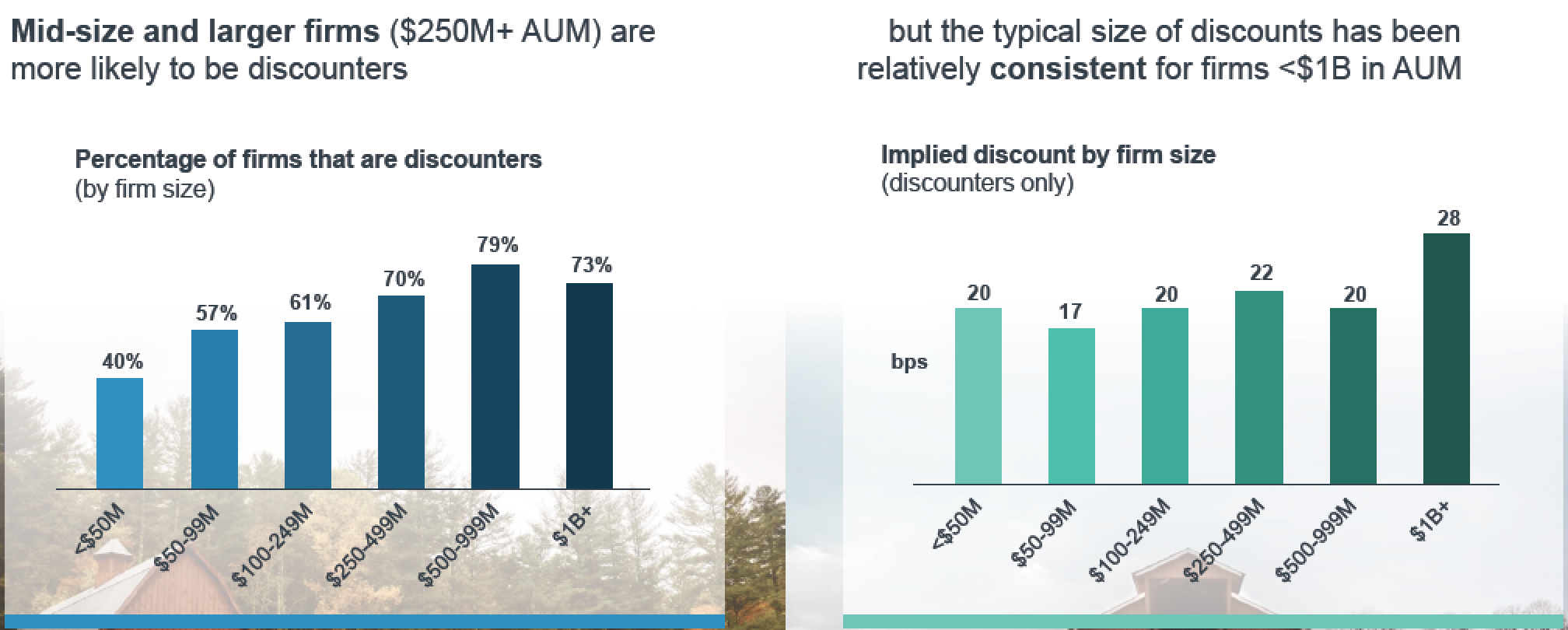

Even so, discounts to the published rate are frequent. Fidelity considers RIAs with at least a 10 bps gap between the expected and actual bps revenue a “discounter” and finds that 64 percent of all firms qualified for the label. The median gap between the expected and actual revenue yield at discounters was 21 bps—more than one-fifth of what an RIA, at least in theory, could have collected in fees.

Fidelity surveyed firms with less than $50 million in assets under management and as much as over $1 billion.

Discounting advisory fees is a longtime practice by many firms done for a variety of reasons. A lower fee is a common bartering chip to get a new client to come on board. Older clients retiring and beginning their phase of withdrawals might also be offered a lower fee, according to David Canter, the head of the RIA segment for Fidelity Clearing & Custody Solutions.

At that point in a client’s life, they reach the peak dollar amount they’re paying their advisor, which Canter said could be their biggest expense at the time, though they might actually require fewer services. It’s a win-win to offer a lower fee because the client pays less which maintains the relationship and the advisor can still collect compensation without as much work put in, plus it helps preserve connections with, say, their children.

“We’ve seen this for years, especially in the higher end of the market where advisors charge a flat annual retainer or a flat fee,” Canter said.

Mid-size and larger firms (those with more than $250 million assets under management) are more likely to offer discounts, but the discount spread is relatively consistent across all sizes of RIAs, though slightly higher at the over $1 billion firms.