Over half of advisors—54 percent—say they’ve been using “rep as portfolio manager” (Rep as PM) platforms for the past five years, managing investment portfolios across client accounts. Only about 10 percent of advisors surveyed say they don’t use these platforms in any capacity.

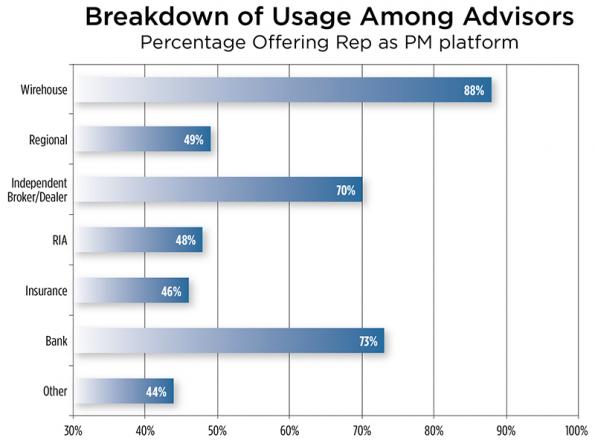

Wirehouse and national firms are the most likely to offer advisor-directed platforms, followed by the bank and independent broker/dealer channels. About half of RIA firms have this feature available, but those who do have been much quicker to commit to it in terms of both number of clients and client assets.

Discretionary Management on the Rise

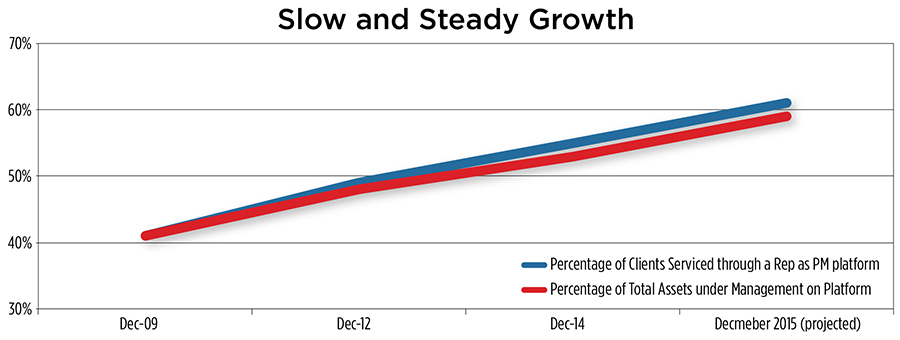

Advisors’ use of these platforms continues to grow—almost 90 percent of advisors use this type of platform in some capacity today—showing a steady increase since December 2009 in the percentage of clients and client assets serviced on these platforms.

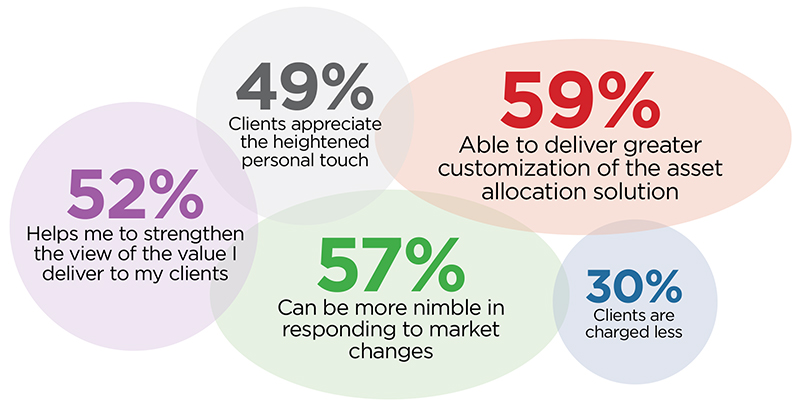

The Benefits of a Rep as PM Platform

According to advisors, the two biggest advantages to using a Rep as PM platform were the increased ability to be more nimble in their response to market changes, and increased customization in asset allocation choices.

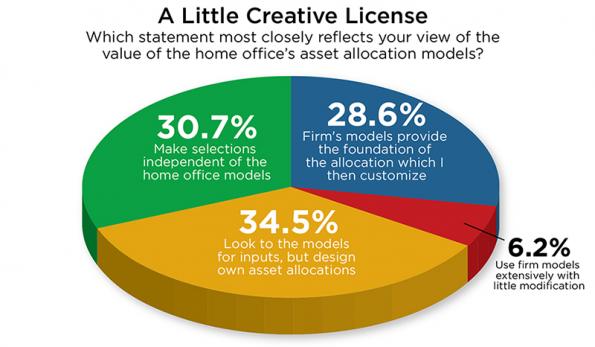

Advisors Prefer to Do It Themselves

Few advisors just use their firm’s asset allocation models, but the level of customization ranges widely depending on where the advisor sits. More than half (57 percent) of RIAs make their selections independently from the firm’s models, compared to around just 10 percent of advisors at the insurance and regional firms. Advisors at wirehouses and national firms generally prefer to customize a model that acts as a foundation for their decisions.