The future of Dodd-Frank reform and its impact on the financial services industry will be decided by the upcoming presidential election, according to speakers at SIFMA's annual meeting held Monday in New York City.

Mitt Romney has said that Dodd-Frank imposes a far greater-than-needed regulatory burden on the industry and that if he is elected he will repeal it. If that happens, expect the current rules to be replaced by some other less-burdensom set of standards, says Charlie Black, chairman of Prime Policy Group and former advisor to Romney's campaign. Romney will focus more on the lack of harmonization between regulators under the current provision, and provide the regulators with more "clarity of intent." But if he has a Democratic Senate, it will be difficult to get any big changes passed, he predicted.

The lack of harmonization is one of the industry’s biggest gripe with the rules.

“No one, however, can be happy about where the reform process stands,” said Timothy Ryan, president and CEO of SIFMA, in his opening remarks. “The problems began as a result of the political and bureaucratic constraints that produced a complex 2,000-page law, leaving the great majority of details to regulators like Gary Gensler (chairman of the U.S. Commodity Futures Trading Commission).”

As it stands now, only one-third of the rules have been finalized over two years after passage; many major rules, such as the fiduciary standard, remain unresolved. Dodd-Frank required 87 studies by regulators, which is ultimately going to lead to an estimated 398 rules laid out over a projected 29,000 pages. The reform has involved nearly 4,000 meetings of financial services regulatory agencies, including 1,282 meetings at the SEC, according to research compiled by Tiburon Strategic Advisors.

Future of Schapiro

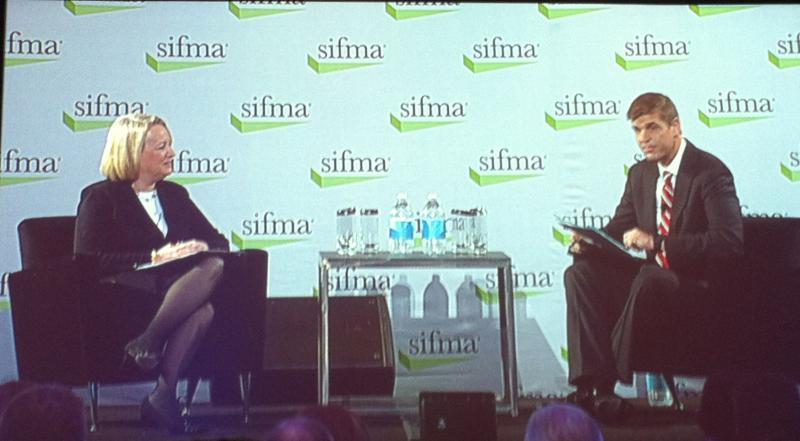

But the future of Dodd-Frank and a fiduciary standard also largely depends on whether SEC Chair Mary Schapiro stays in her current role. Schapiro, who spoke at the SIFMA meeting, has been an outspoken advocate for a uniform standard of care and has been working to get a proposal on the table. On Tuesday, she said she was more confident that a fiduciary standard would get done, and she named early next year as a target for a proposal. The agency is currently developing a concept release, or a preliminary discussion of the rule, to ask questions and get feedback on a standard’s economic impact before proposing a rule.

“It may on the outside feel like there’s not much progress, but there’s a lot going on inside the building,” she said. “The devil’s in the details. It’s not going to be the easiest rule in the world to write.”

“It may on the outside feel like there’s not much progress, but there’s a lot going on inside the building,” she said. “The devil’s in the details. It’s not going to be the easiest rule in the world to write.”

But even if a fiduciary standard is adopted, industry groups opposed to the standard, such as the Business Roundtable and the Chamber of Commerce, can challenge the rule in court, and likely will, said Duane Thompson, senior policy analyst for fiduciary consultant fi360.

“You have 60 days to challenge an administrative rule, and it’s a pretty good likelihood that a fiduciary rule will be controversial, even if there is support, at least lip service given, to a fiduciary standard,” Thompson said.

But Schapiro’s future at the SEC is uncertain. Rumors have been floating around that Schapiro will not stick around after the elections, whether Obama returns to office or not. When asked about her future at the SEC, Schapiro said Tuesday that she hadn’t thought about what she will do after her terms ends, June 2014.

If Romney is elected, she’ll likely resign and allow the administration to pick a new chairman, as others have done in the past, Thompson said. Thompson believes she’ll leave at the end of the year, even if Obama is re-elected.

“I think the lack of energetic denial that she’s not done is evidence that she will leave one way or another,” he said. “She’s had four years in there. She’s gotten beat up by Congress. I forget how many hearings she’s testified at, but they weren’t very pleasant.”

Industry Supports Fiduciary Rule

Either way, SIFMA supports a fiduciary standard and believes it should be a priority. During his comments, Ryan proposed three priorities for the remaining rules under Dodd-Frank; in addition to a fiduciary standard, other priorities were insuring that no financial institutions are “too big to fail” going forward and proceeding with core derivative reforms.

Fi360’s Thompson expects a fiduciary standard to come out sometime down the road; it’s inevitable, given the general industry and consumer groups’ support for it. But if we have a Republican SEC chairman, the agency probably won’t make it a priority.

“They are not going to have the same mandate from the administration to move forward on a fiduciary rule or to move forward aggressively on a lot of Dodd-Frank, so that’s why I think you’ll see more of a delay or less emphasis for making a fiduciary standard a priority under a Romney administration,” he said.