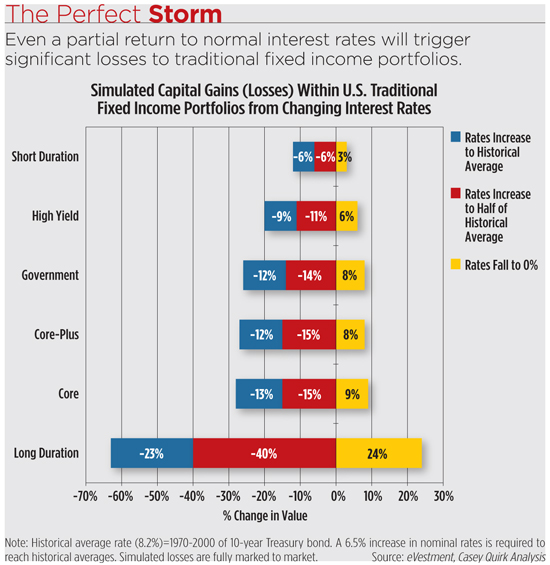

Baby boomers are expected to face major losses in their 401(k) plans and IRAs in the next few years as interest rates climb, according to a new study by Casey, Quirk & Associates, an investment management consultant. About $1.2 trillion of defined contribution plan assets are invested in fixed income, but when interest rates rise to even half their historical average, these plans will likely lose up to $180 billion, Casey Quirk reported. “Even a partial return to long-term nominal interest rates will trigger substantial losses to investors in traditional fixed income products,” the firm said. “These clients, mostly retail fund shareholders and defined contribution plan participants, are unprepared for fixed income losses.”

But investors’ overall exposure to fixed income should remain steady. Instead Casey Quirk predicts the types of fixed income instruments used and demanded will change. The study expects U.S. investors to dump $1 trillion in traditional fixed income products—core, core-plus, government and benchmark-oriented fixed income strategies—and put it into global and emerging market bonds, high-yield and loan portfolios, alternative fixed income strategies, inflation and rising-rate defense strategies, and opportunistic strategies, particularly the dynamic and multisector varieties.