Increased regulatory burdens, the ascendance of automated investment advice platforms, fee compression and the rising costs of running an advisory practice; the current environment doesn’t bode well for retail financial advisors. Yet, nearly eight in 10 independent advisors expect more opportunities than challenges in the coming decade, according to Schwab Advisor Services’ latest Independent Advisor Outlook Study. Forty-one percent of advisors say the independent model will differentiate most significantly from captive models by offering such services as tax planning, charitable planning and health care planning. “As they widen their set of services, advisors will increasingly be viewed by clients as more than financial planners. They will be the go-to advisors on a diverse range of life planning needs,” said Bernie Clark, executive vice president and head of Schwab Advisor Services. Schwab had a bit of fun with the survey as well. When asked what they would do with $100 and some spare time, 42 percent said they would eat out, 24 percent would go to a sporting match and 14 percent would go to a concert.

Custodians Partner to Expand Alternative Offerings

Trust Company of America has teamed up with Millennium Trust Company to expand the firm's alternative asset offerings. Prior to the partnership, the more than 7,500 advisors who custody with Trust Company of America could only hold alternative assets in clients’ tax-advantaged portfolios on the platform. Now, advisors can custody clients' alternative assets for taxable portfolios, meaning they will be able to custody non-traded REITs, hedge funds, private equity and debt, commodities and other investments.

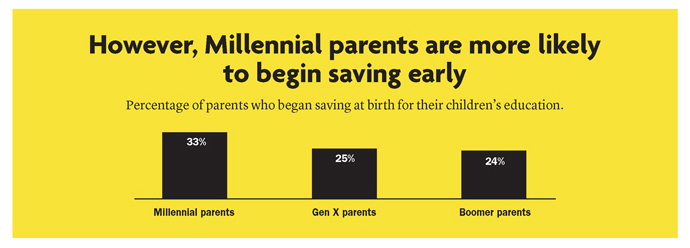

Millennials Need Advice On Saving For College

While 92 percent of Americans believe parents have a responsibility to save for their children's education, a recent KRC Research and TIAA survey shows they could use some advice on doing so. Most parents are missing out on the tax benefits of a 529 college savings plan; only 16 percent use one, while 20 percent are using a traditional savings account. On a more positive note, the poll also found that 33 percent of millennials begin putting money away for their kids when they are born. Only 25 of Gen X parents and 25 percent of baby boomer parents did the same.