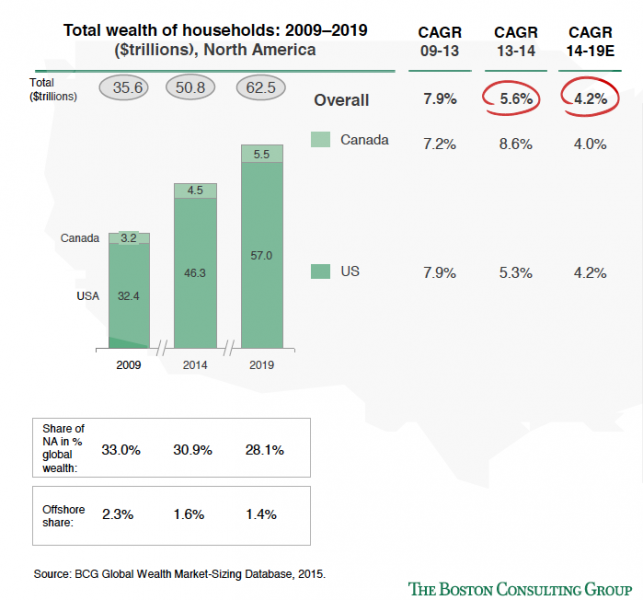

North America is still the largest and most developed wealth market in the world, with wealth growing 5.6 percent in 2014, according to the Boston Consulting Group’s 2015 Global Wealth Study. But most of that growth was due to market appreciation, while only 22 percent came from new wealth creation. BCG Senior Partner Bruce Holley expects that growth rate to decelerate in the coming years.

“A lot of players are really benefiting from the markets going up,” Holley said. “That still masks a potential weak engine of net new assets, and so focusing on that is important.”

The Global Wealth Study found that strong equity markets fueled a 12 percent boost in global private wealth in 2014, marking the third consecutive year of double-digit growth.

North America still has the most millionaires of any region in the world, and the fastest growing segment was households with more than $100 million of assets. BCG expects this segment to grow 12 percent by 2019.

But BCG said wealth managers are facing an increasingly complex world that threatens many traditional business models. In the face of tightening regulation, a complicated investing environment and technological evolution, wealth management firms face tough strategic choices if they want to maintain growth and profitability through 2020, the consulting firm says.

For one, wealth managers need to focus on organic growth and acquiring new relationships.

Advisors also need more effective branding to differentiate themselves, especially as private banks and brokerages start to offer similar products and services, Holley said.

As for technology, Holley said it isn’t just millennials that demand digital interactions with advisors. BCG found that older users are active on the desktop, and advisors need to understand their core clients and use technology to appropriately serve them.

“Digital can also be a platform,” said Holley, who mentioned the increasing presence of automated wealth management technologies. “Thinking about how you can use digital to lower your cost-to-serve to drive profitability is important.”

The Asia-Pacific market is expected to surpass North America as the wealthiest region in the world in 2016, with China expected to surpass the U.S. as the wealthiest nation in the early part of the next decade.