Statistics are often thrown around in this industry, showing that the heirs of wealthy clients fire their parents’ advisors most of the time. A 2014 Vanguard study found that as many as 95 percent of children take their assets elsewhere when they inherit. But a new study by GlobalData found that globally just 28 percent of the children of high-net-worth clients move their assets to another wealth manager when they receive their inheritance. Taken in context this seems less surprising. Much of the world's wealth management apparatus evolved along lines tied to big banks and private banking; and especially in Europe and Asia, many family relationships with banks span generations.

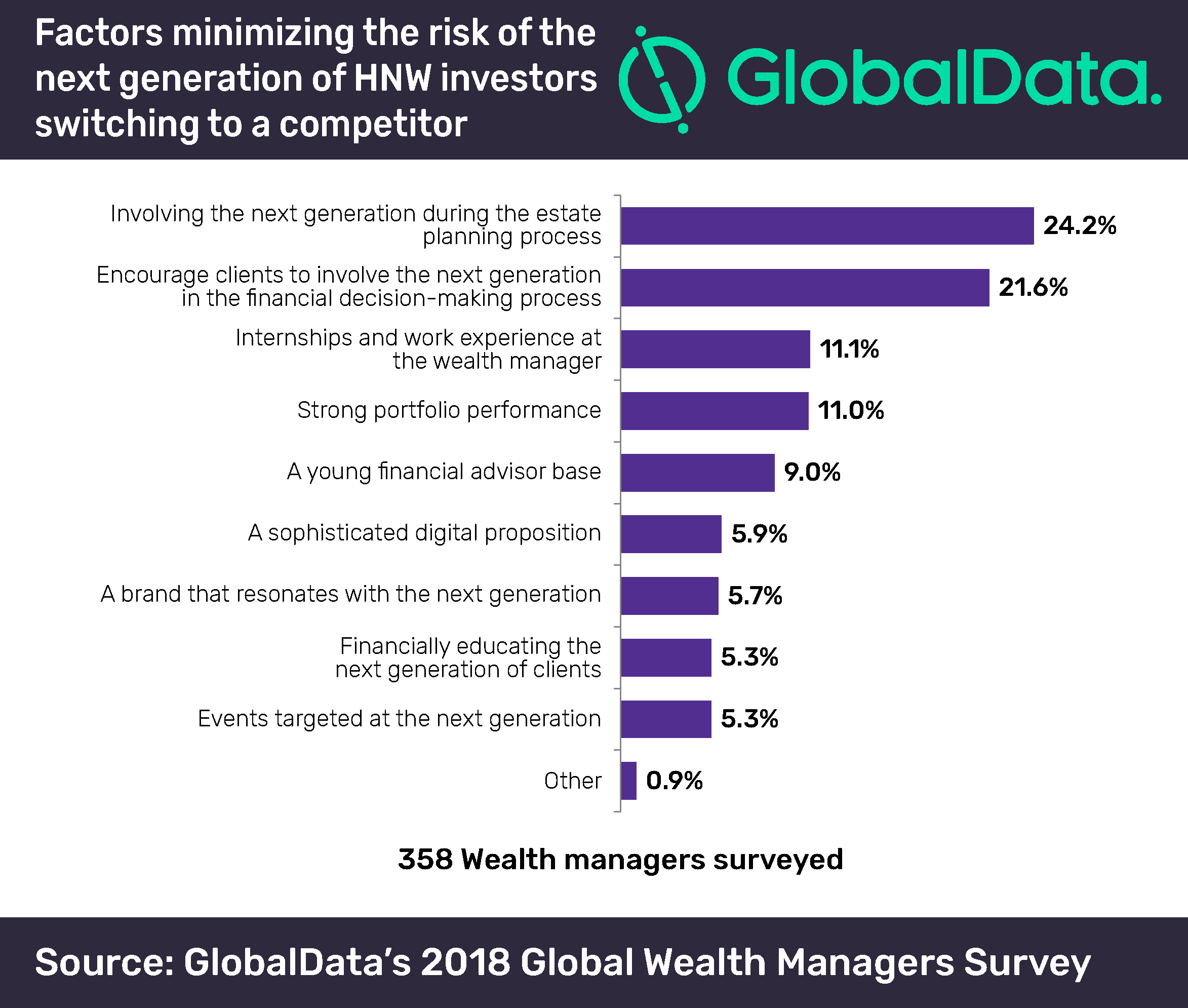

In the 2018 GlobalData survey of 358 wealth managers globally, wealth managers said engaging the next generation in the estate-planning process was most effective in retaining younger clients. Encouraging clients to involve the next generation in the financial decision-making was also an important retention tool.

“Reaching out to the next generation early on is critical, but wealth managers are not doing a good job,” said Heike van den Hoevel, senior wealth analyst for GlobalData. “Of course, discussing one’s mortality is a subject many would rather avoid. But if providers fail to ensure the continuation of the relationship with successors, this will amount to a significant chunk of their current business being lost.”