Financial-services industry players have spent the better part of the last decade raising the alarm about the coming talent shortage, urging advisors to make recruiting younger individuals a top priority. Their efforts up to now have largely been fruitless. But a new report by TD Ameritrade Institutional indicates that advisors are starting to invest in that next generation of talent—finally.

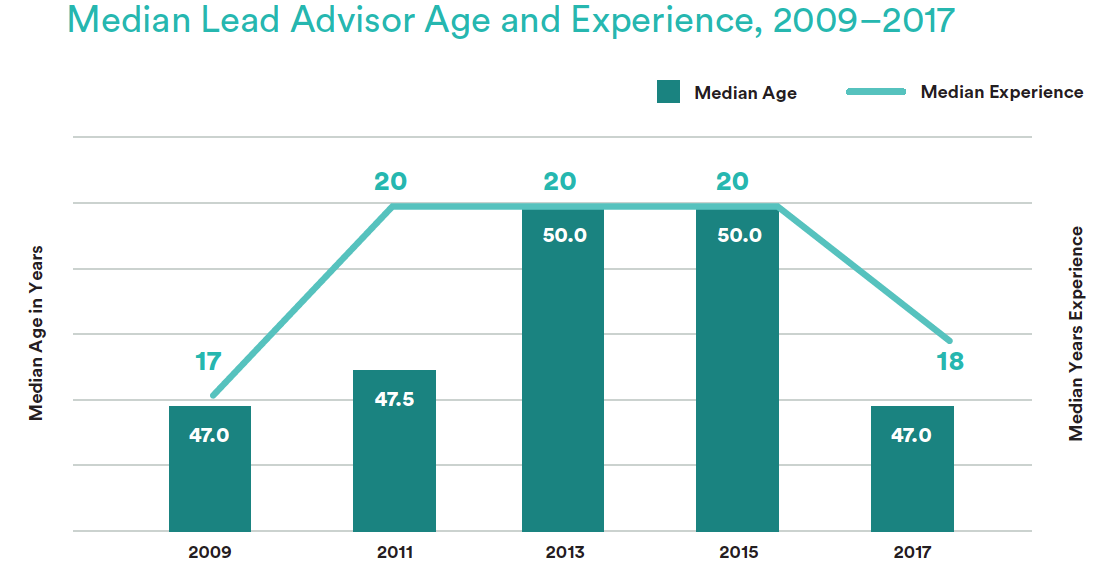

The median age of lead advisors declined from 50 in 2015 to 47 this year, according to the 2017 FA Insight Study of Advisory Firms: People & Pay, an industry benchmarking report from TD Ameritrade Institutional. The median years of experience of lead advisors is also trending downward, falling to 18 years from 20 years in 2015.

“Everyone recognizes the talent shortage, and it’s the right thing to do,” said Vanessa Oligino, director of business performance solutions at TD Ameritrade Institutional. “In order for the industry to continue to renew and have the great success that it has had over the long term, it needs to have fresh talent coming in each and every year.”

To conduct the study, TDAI sent an online survey to advisors with at least $150,000 in annual revenue and who have been in the business for at least 12 months; 388 advisor firms responded.

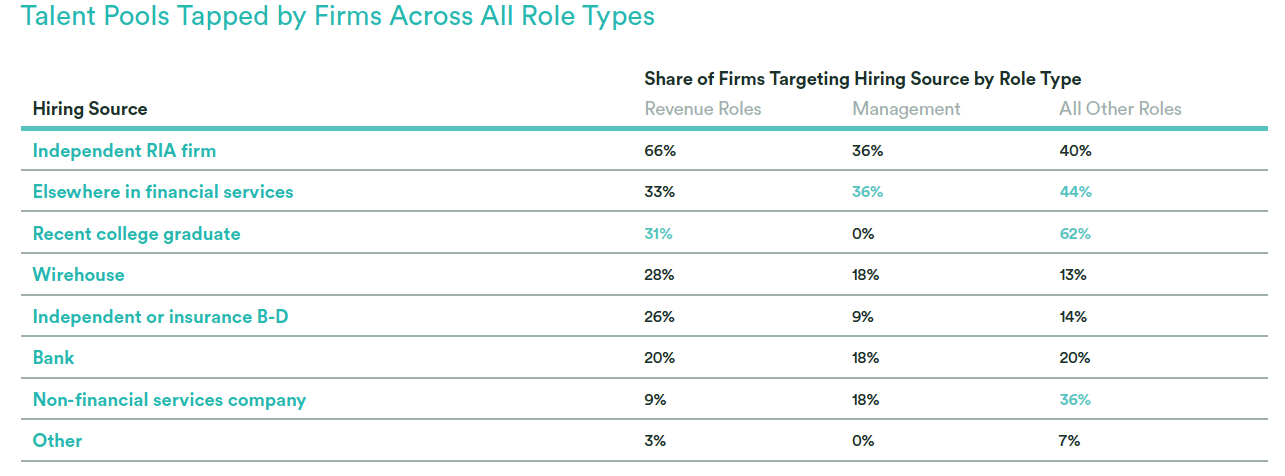

On average, firms expect to add one full-time employee, 40 percent of which will be in revenue-producing roles. And while the majority of firms (66 percent) are looking to other RIAs for hiring for revenue roles, 31 percent of firms are targeting recent college graduates.

“Advisors traditionally recruit from other advisory firms, and that’s a very limited pool of people to be going after,” Oligino said. “If you’re looking to recruit an advisor with decades of experience and an established client base, it can be very expensive. So I think advisors are starting to realize that the bigger opportunity for them is to really get these highly qualified, recent college graduates in on the ground floor and groom them to be future leaders of the firm.”

Standout firms—those in the top quartile—are more likely to target recent grads for revenue roles than other firms, “presumably because they have put in place the infrastructure required to develop talent and help them to progress along a career trajectory,” the report said.

Larger firms are more focused on developing career paths and helping people continue through them, Oligino said. Eighty-five percent of firms generating $8 million or more in annual revenue (what TDAI calls “Pacesetters”) encourage development-coaching conversations, versus 69 percent of firms in the lower-revenue category. Seventy-four percent of Pacesetters have senior team members mentor junior members, and 68 percent of these firms offer informal on-the-job professional-development opportunities. Nearly 60 percent of the largest firms provide formal training that facilitates career growth, and 56 percent of them have up-to-date career development plans.

RIAs are also evolving to meet work-life needs of employees, and such nontraditional benefits are attractive to younger workers. Sixty-four percent of RIAs, for example, have flextime work schedules. Forty-five percent offer subsidized training programs, 41 percent allow telecommuting, and 36 percent offer maternity/paternity leave.

“The workforce is changing, and companies need to continue to motivate people, not only to perform well but to stay with the firm,” Oligino said. “In order to do that, some of these nontraditional benefits need to come into play.”

But one of the downsides to recruiting younger advisors is lower revenue growth and productivity. While AUM and client growth rates were healthy, the study found that annual revenue growth fell from 8.3 percent in 2015 to 6.7 percent in 2016. Revenue per team member failed to increase for the first time since 2009, dropping 12 percent over the year.

“If they are, indeed, bringing in a younger, less experienced individual onto the team, there’s going to be more ramp-up time for them to be able to be contributing regularly to revenue growth,” said Oligino.