(Bloomberg) -- The nation’s biggest banks are close to agreeing upon a plan to deposit as much as $30 billion with First Republic Bank in an effort supported by the US government to stabilize the battered California lender, according to people with knowledge of the matter.

Banks including JPMorgan Chase & Co., Citigroup Inc., Bank of America Corp., Wells Fargo & Co., Morgan Stanley, U.S. Bancorp, Truist Financial Corp. and PNC Financial Services Group Inc. are part of the discussions, said the people, asking not to be identified because the talks are private.

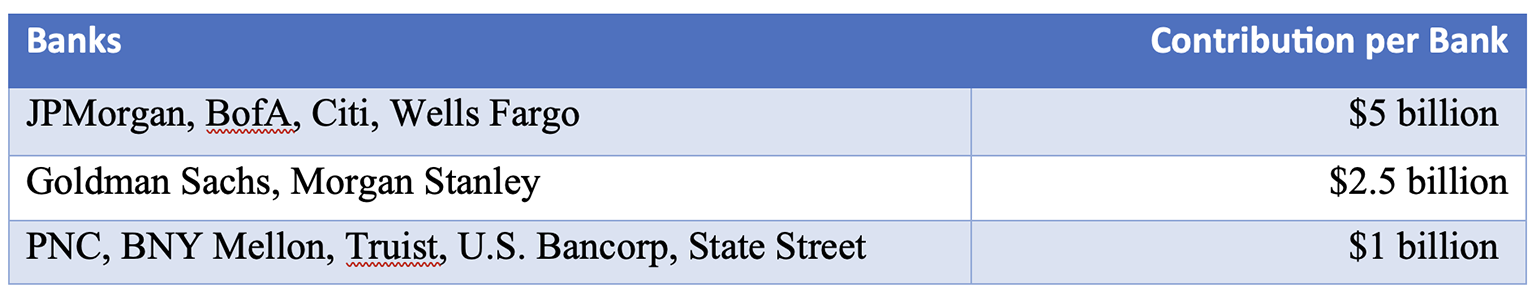

The biggest banks, including JPMorgan, Bank of America, Citigroup and Wells Fargo would contribute $5 billion of deposits each, with other lenders kicking in smaller amounts, the people said. Details of the rescue, which are still being worked out, may be announced as soon as Thursday afternoon, the people said. Drafts of an announcement are being shared at banks and across federal agencies, the people said.

Representatives of the banks, the Federal Reserve, the Federal Deposit Insurance Corp. and the Treasury Department either declined to comment or didn’t immediately respond to requests for comment. A spokesman for San Francisco-based First Republic declined to comment.

First Republic’s share price swung wildly Thursday, plunging as much as 36% early in the day, then surging as much as 28% midday. They were up 12% at 1:59 p.m. in New York following multiple trading pauses for volatility.

The bank is exploring strategic options including a possible sale, Bloomberg News reported late Wednesday. The lender’s shares have plummeted in the aftermath of regulators’ seizure of fellow regional lenders Silicon Valley Bank and Signature Bank over the past week.

Play Video

First Republic, which specializes in private banking and has built up a wealth-management franchise with some $271 billion in assets, has made an effort to differentiate itself from SVB Financial Group’s Silicon Valley Bank. Unlike SVB, which counted startups and venture firms among its biggest clients, First Republic said that no sector represents more than 9% of total business deposits.

Silicon Valley Bank collapsed into FDIC receivership Friday after its customer base of tech startups grew concerned and pulled deposits.

Read more: First Republic Goes From Wall Street Raider to Prey in Days

First Republic Bank has been working with JPMorgan as it tackles its challenges. On Sunday, the same day Signature Bank was taken over by regulators, First Republic said it “further enhanced and diversified its financial position” by securing additional liquidity from the Fed and JPMorgan.

(Updates with additional bank contributions in table.)

--With assistance from Katherine Doherty, Allyson Versprille, Jenny Surane and Max Reyes.