The Financial Industry Regulatory Authority published an inaugural report Thursday that showed what many knew already: The number of wealth managers and small firms is shrinking.

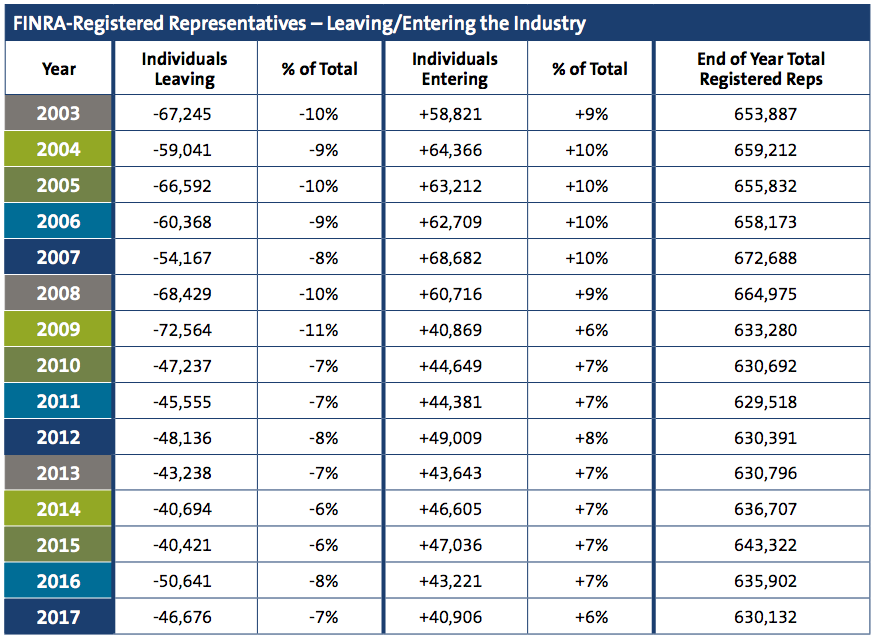

There were a total of 653,887 registered representatives in 2003, but that number whittled down to 630,132 at the end of 2017, according to FINRA. The financial crisis of 2008 is partly to blame. A total of 72,564 individuals left the industry in 2009, compared to the 40,869 that joined it, the largest difference between the numbers since 2003. The number of representatives was slashed from almost 665,000 to little more than 633,000—only about 3,000 more than the total at the end of last year.

Since then, the total number of representatives has oscillated around 635,000. The headcount has never fully recovered as the workforce ages and the industry undergoes consolidation.

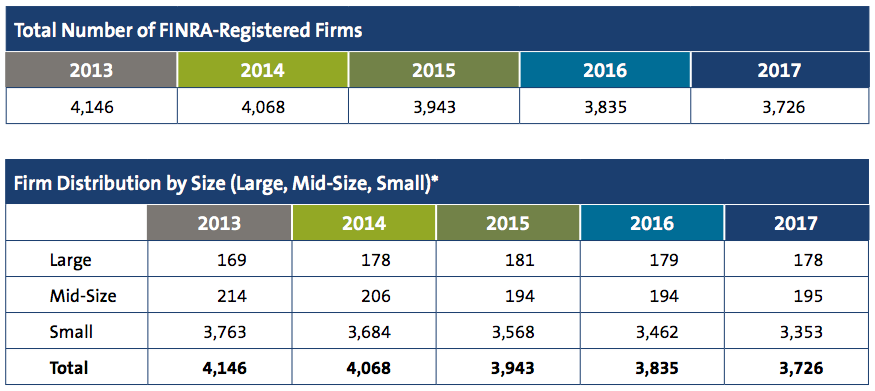

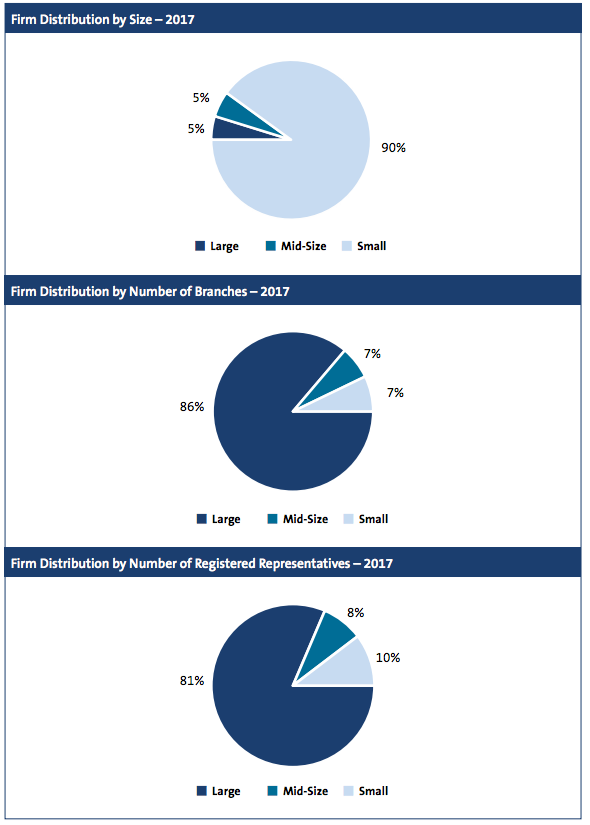

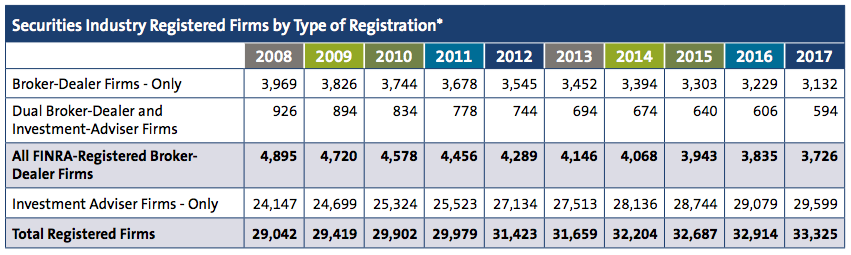

The total number of FINRA-registered firms fell from 4,146 to 3,726 between 2013 and 2017, and small firms accounted for 410 of the 420 fewer businesses. Broker/dealers and dually registered firms (b/d and investment advisory), both contributed to the lower total.

Small firms still accounted for 90 percent of all those registered in 2017, although 86 percent of branches and 81 percent of registered representatives were affiliated with large firms.

Meanwhile, the growing number of registered investment advisory firms continued to keep pace with recent years. In 2008, there were 24,147 RIA-only firms and the total has grown steadily to 29,599 at the end of 2017.

Also included in the report was some data about firm advertising.

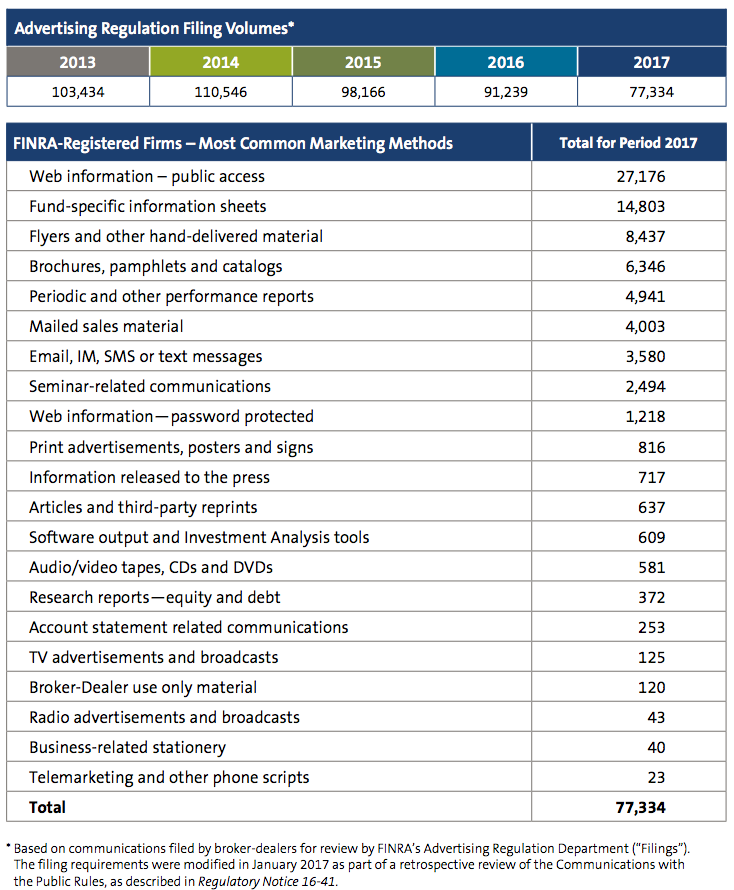

FINRA’s Advertising Regulation Department, which reviews firms’ advertisements and other communications with the public to ensure they’re not misleading and comply with the standards of the SEC, MSRB and SIPC advertising rules, saw a significant dip in the number of filings in 2017.

In 2017, there were 77,176 communication filings compared to more than 91,000 in 2016, and there were more in 2015 (98,166) and 2014 (110,546), too.

FINRA does not require all communications with the public to be filed, so the figures represent only a segment of such communications, but they’re interesting nonetheless. About a third of the filings in 2017 were related to publicly accessible on the internet, followed by fund-specific information sheets, flyers, brochures and other advertisements. There were only 4,941 periodic and other performance reports filed.