In recent years, as the registered investment advisory space has grown and matured, mergers and acquisitions among wealth management firms are becoming more common. RIAs are aggregating and consolidating in an attempt to scale, drive down costs, reinvest in the business and become more profitable.

But that trend isn't resulting in increased profitability, according to one recent report by strategy and consulting firm Accenture.

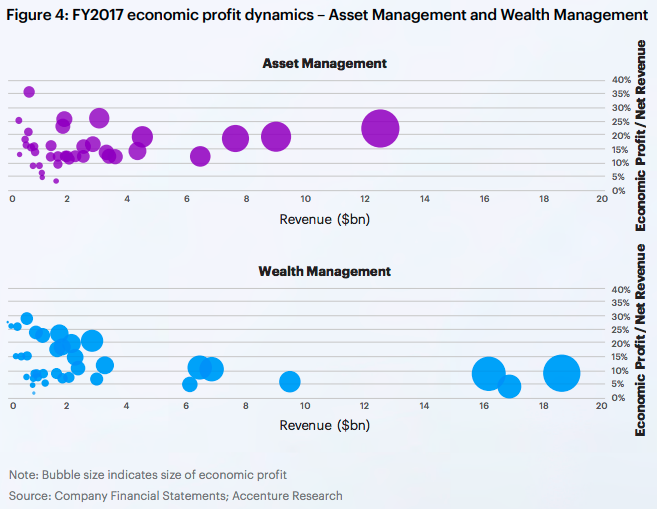

Although asset and wealth management are among the most profitable businesses in finance, they "seem to defy economic logic." Structurally, those businesses should be scaling, but the biggest money managers have the same economic profit margin–a metric that accounts for opportunity costs–as smaller ones.

"This is absolutely counterintuitive, but it is an economic fact," according to Accenture's Capital Markets Vision 2020 report.

"Operating models need to be redesigned for industry consolidators to truly realize the benefits of M&A. Strategies should be sector-specific, covering a variety of channel, niche and capability acquisitions where partnership models deliver insufficient synergy. However, it should be borne in mind that investment in digital technologies and organizational structures can help service more clients while keeping headcount and infrastructure under control," the report said.