Americans are relatively comfortable with automating financial advice but the majority still want a human to consult, according to Charles Schwab’s latest Consumer Digital Demands report.

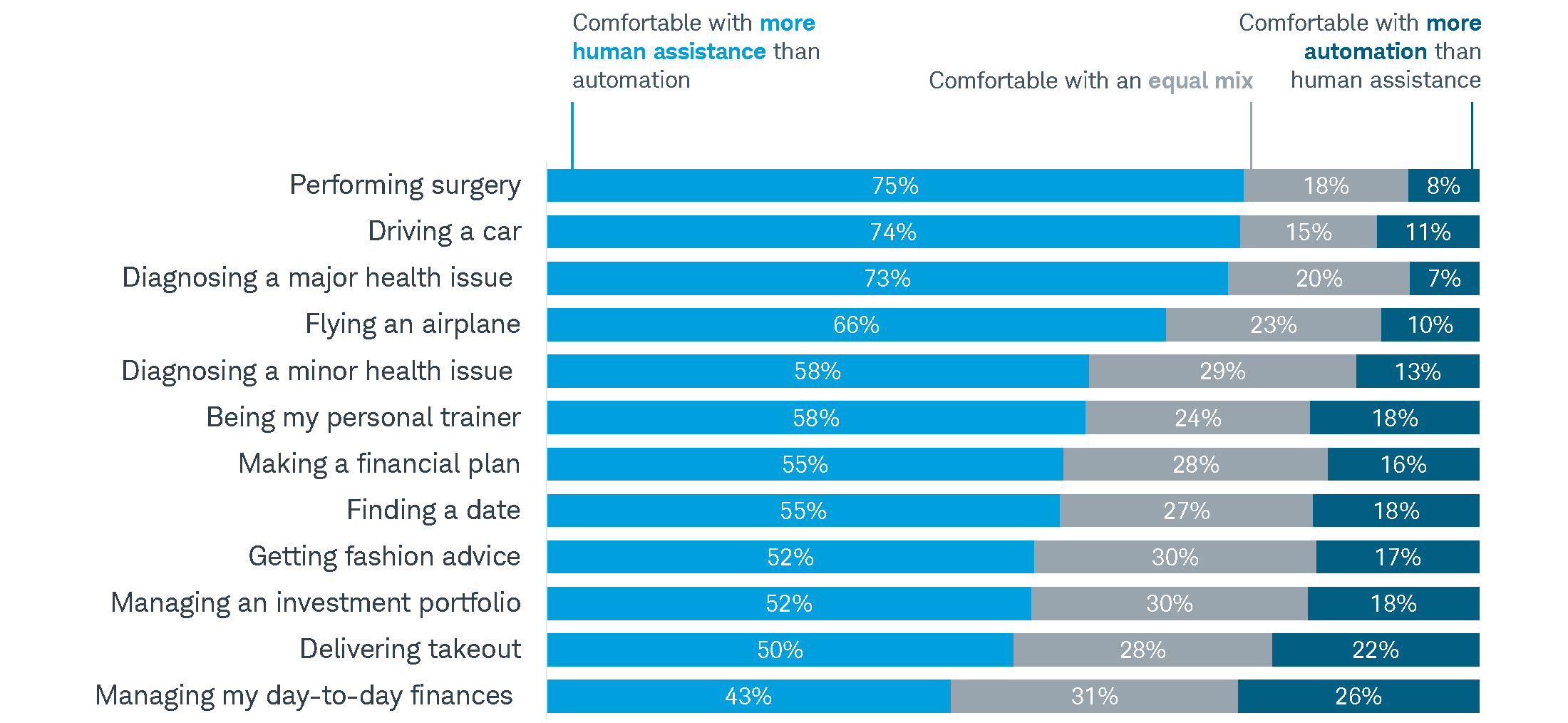

The report, which surveyed 1,000 U.S. adults this summer, including 391 current robo advisor users, showed Americans are more open to technology performing some tasks than others. For example, 75 percent of respondents said they’re comfortable with more human assistance than automation when it came to performing surgery. They also are overwhelmingly more comfortable with humans over technology when it comes to driving a car (74 percent), diagnosing a major health issue (73 percent) and flying an airplane (66 percent).

Relatively speaking, Americans were much more comfortable with automated technology, or a mix of human and automated solutions, managing day-to-day finances. But managing an investment portfolio or creating a financial plan are things respondents overwhelmingly wanted a human to have a part in.

Although 46 percent of respondents reported getting “anxious when they have to talk to someone they don’t know on the phone,” 86 percent also said they prefer brands that make it easy to get in touch with a real person. “Easy access to human customer service” was among the top drivers when it came to whether respondents trusted apps or digital experiences online.

The only driver that was more important to Americans was how easy an app or service was to use. The survey found that most Americans (55 percent) feel financial planning is “at least as hard as training for a marathon” but want it to be “as easy as booking a hotel.”

Robo advisors and traditional wealth managers have recently moved to offer the others’ services in an effort to cater to this consumer preference. Betterment, one of the first robo advisors that now has $13.5 billion in assets under management, began offering ways users can connect to financial advisors. Meanwhile, Morgan Stanley, which continues to invest heavily in its wealth management business and associates digital solutions, recently hired Betterment’s chief marketing officer.