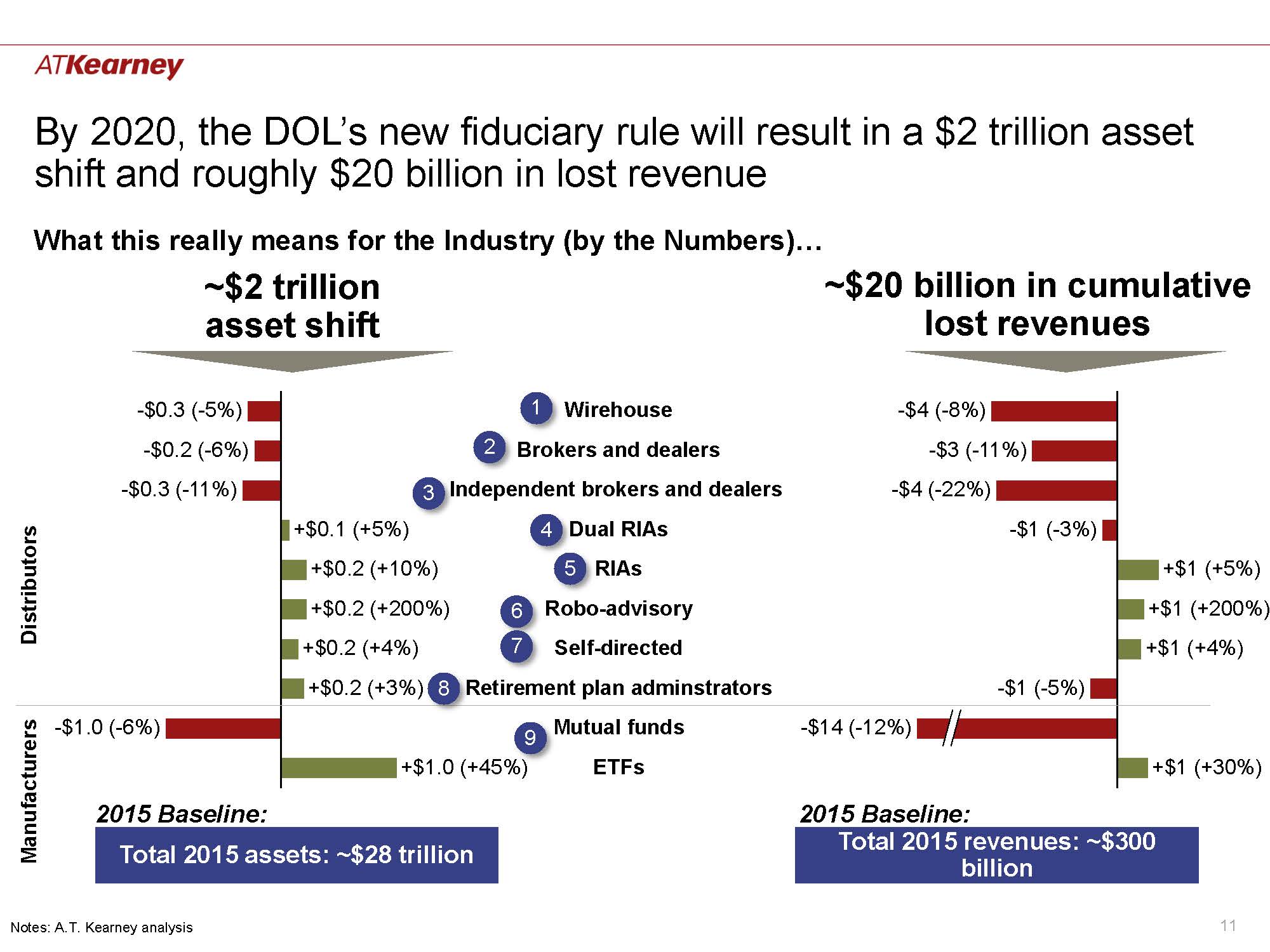

There's been a great deal of debate in the past several years as to how much, exactly, the Department of Labor's new fiduciary rules will cost advisors. In the past, SIFMA warned that it could cost upwards of $5 billion, but with only seven months to go before the rules go into effect in April 2017, new research posits an even more sobering figure: $20 billion by 2020.

A recent study by A.T. Kearney reached this number by defining eight “drivers” caused by increased regulations (for example, "decline in expense ratios") and estimating their total costs to advisors.

The weight of these costs won’t be borne equally throughout the industry, however, as according to the study, significant asset shifts as a result of the impending rule will impact industry professionals differently across all levels.

The research predicts that broker/dealers of all stripes will shoulder the largest burdens. Independent b/ds look to have it the worst, losing an estimated 11 percent of their assets and 22 percent in revenue, as their resources will be strained by increased compliance demands, which could drive consolidation and advisor outflow. B/ds won’t fare much better, as high commission products become tougher to move. They stand to lose 6 percent of assets and 11 percent of revenue.

The big guys are expected to feel the pain as well, as the research indicates that wirehouses, forced to transition even more rapidly into fee-based models, stand to lose 5 percent of assets and 8 percent of revenues.

Retirement plan administrators fall somewhere in the middle of the pack. With 12b-1 fees for product placements feeling pressure under the new rules, they will be forced to adjust their business models. Luckily, most already wear several hats in the value chain, so won’t feel the impact as harshly. Their assets are actually expected to increase by 3 percent, but revenues could fall by 5 percent.

That all being said, some groups do look to benefit from the changes according to the research. Self-directed investors will experience the most humble gains, as they reap the benefits of increased product streamlining. The study estimates that this group could gain 4 percent in assets and revenues. The rise of the robos is also expected to continue unchecked, as increased robo adoption siphons accounts away from b/ds. Our machine overlords could gain 15 percent in assets and revenues.

A.T. Kearney expects that manufacturers will be the big winners, though not without streamlining their product offerings and lowering fees. As such, mutual funds look to take a big hit, losing 6 percent of assets and 11 percent of revenues. However, mutual funds’ losses will be ETFs’ gains, as they’re estimated to increase a whopping 45 percent in assets and 30 percent in revenues.