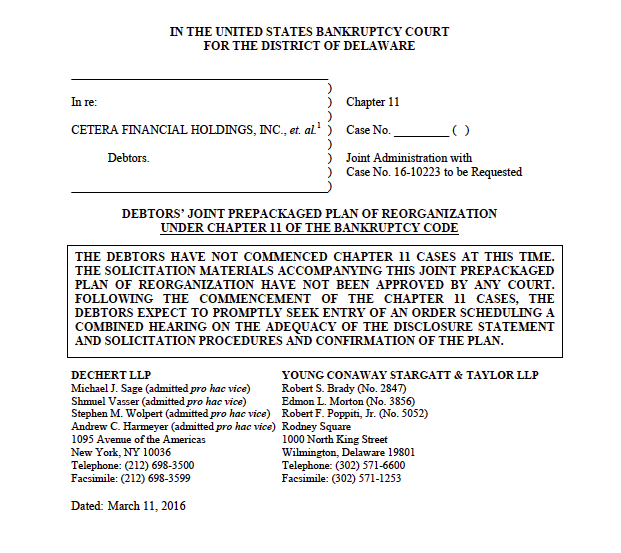

RCS Capital filed a pre-packaged Chapter 11 bankruptcy for the holding companies of some of its broker/dealers on Saturday. The move is meant to restructure the holding companies’ terms with RCAP creditors, which filed its own bankruptcy in January, and bring Cetera Financial, the firm’s brokerage arm, closer to becoming an independent entity out from under the thumb of its troubled parent company, RCAP.

Once the firm emerges from the restructuring, the broker/dealer network will have no relationship to Nicholas Schorsch, who founded RCAP, and the former chairman will have no equity stake in the new company.

“We are excited about this important step forward, which puts us in the home stretch to complete our transformation into a Cetera-only organization that is independent, well-capitalized and privately owned,” said Larry Roth, CEO of Cetera. “This will truly be a fresh start for Cetera that will include significant additional capital for us to continue investing in industry-leading tools and resources for the financial advisors and financial institutions we support.”

In late January, RCAP filed for pre-arranged Chapter 11 bankruptcy after reaching agreements with a majority of its creditors. The firm said its independent b/ds would not be involved in the bankruptcy.

But the holding companies of the b/ds are guarantors of RCAP’s debt, so the firm made arrangements to file Chapter 11 for those entities too, to restructure their terms with RCAP creditors without impacting the brokerage business.

Other creditors to the holding companies, such as vendors, will ride through the bankruptcy and emerge with existing claims intact.

Because these b/d holding companies are separate entities from Cetera’s broker/dealers themselves, the b/ds and corporate RIA firms will not be involved in the filing. The firm will not be notifying advisors’ clients of the bankruptcy.

RCAP’s first and second lien holders will become the majority owners of the company that emerges out of bankruptcy, which include Fortress Investment Group, Eaton Vance Management and Carlyle Investment Management.

“The first and second lien holders represent top-tier institutional investors who recognize the industry leadership of Cetera,” said Saul Burian, managing director at Houlihan Lokey, advisor to the first lien lenders. “They are excited by the incredible loyalty demonstrated by Cetera’s advisors and institutions since the start of this process, and are enthusiastic about partnering with Cetera’s talented management team to create a new chapter of success for the company.”

The firm has started offering retention packages to eligible advisors.

RCAP has been mired in turbulence since October 2014, when a formerly related company announced a $23 million accounting error. In November 2015, a unit of the company, Realty Capital Securities, was charged by Massachusetts’ top securities regulator with fraudulently casting shareholder proxy votes.

Bradley Scher, an independent director and chairman of the executive committee, took over as CEO from Larry Roth on Jan. 22. Scher, 55, is the managing member of Ocean Ridge Capital Advisors, an independent consulting company with experience helping companies through bankruptcy proceedings.

Roth, who still serves as head of Cetera, oversees the constellation of firms Nicholas Schorsch stitched together over the past few years. Cetera has some 9,100 brokers, making it the second largest independent brokerage group in the United States.