(Bloomberg) -- A smooth exit from a truck-stop empire is proving tricky for the Haslam family and their $17.8 billion fortune.

The Haslams, whose wealth is being valued for the first time by the Bloomberg Billionaires Index, are engaged in litigation with Warren Buffett’s Berkshire Hathaway Inc. over the sale of their remaining stake in Pilot Travel Centers, the gas-station network founded by the family’s patriarch, Jim Haslam.

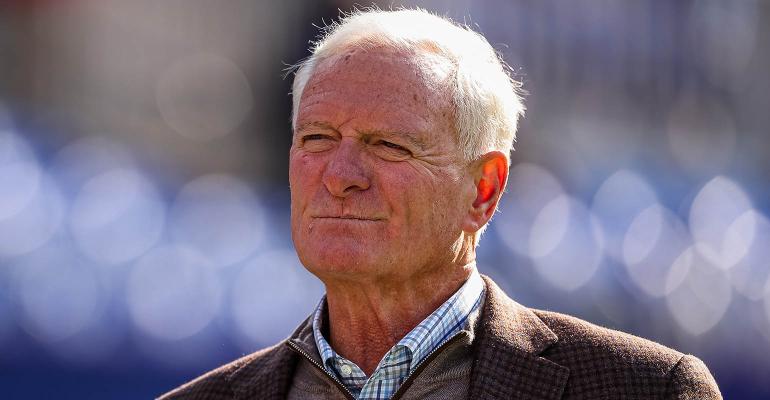

The case hinges on obscure accounting rules the family claims could cost them more than $1 billion. Berkshire has hit back with accusations of bribery leveled at former Chief Executive Officer Jimmy Haslam, 69, best-known as the owner of the Cleveland Browns football team along with his wife Dee.

At stake is the family’s effort to diversify, which began even before they first sold a chunk of Pilot to Berkshire in 2017. Jimmy and his brother Bill have both invested in sports teams, beginning with Jimmy’s purchase of the NFL’s Browns in 2012 for $1 billion. In 2018 he bought the Columbus Crew soccer team, then this year purchased 25% of the NBA’s Milwaukee Bucks.

Meanwhile, Bill, 65, who formerly served two terms as Tennessee’s governor, agreed last year to buy a majority stake in the Nashville Predators hockey team. Sports teams are now the largest asset class in the family’s fortune, according to the Bloomberg wealth index.

Put Option

A spokesperson for the Haslams declined to comment.

The family still has about $4 billion locked up in Pilot, according to the Bloomberg wealth index, though its value will change depending on the lawsuit’s outcome. After selling most of the Knoxville, Tennessee-based company to Berkshire in two tranches that paid them $2.8 billion in 2017 and another $8.2 billion in January, they own a put option to sell the remaining 20% to Berkshire at 10 times its trailing annual earnings, exercisable as soon as January 2024.

In a lawsuit filed in October, the Haslams argue those earnings have been artificially depressed because Berkshire started using pushdown accounting at Pilot when it took majority ownership. The change, which values the acquired company at the purchase price rather than its historical cost, increased depreciation and amortization expenses.

Read More: Berkshire Sued for Changing $10 Billion Deal’s Accounting Rules

In the first eight months of 2023, Pilot took $613 million in depreciation and amortization charges, Berkshire’s results show. Earnings before interest and taxes fell more than $200 million to $1 billion, even as Pilot’s net revenue grew. The Haslams claim they may lose as much as $1.2 billion because of the accounting change.

In an October phone call, the elder Jim Haslam, now 92, pressed Buffett, 93, on whether Berkshire would use the new accounting method in calculating the value of the exercise price, according to the lawsuit. Buffett “refused to provide a straight answer” and “instead repeated, ‘I said that Berkshire will comply with the terms of the contract. That’s exactly what will happen.’”

Boost Profit

Last week, Berkshire hit back with its own allegations that Jimmy Haslam promised secret bonuses worth millions to Pilot’s executives if they could boost short-term profit at the firm, increasing what he’d get when the put was exercised.

Read More: Berkshire Says Billionaire Haslam Promised Illicit Payments

At a March dinner with executives, Jimmy Haslam said he would “make good” on bonuses tied to the put option, even though they weren’t officially due anything from the firm, according to Berkshire’s counterclaim. Executives installed by Berkshire after its takeover weren’t promised the same incentives.

Berkshire said the arrangement may have “corruptly influenced” Pilot’s 2023 earnings, and is seeking to stop the Haslams from invoking their put option next year. The Haslams responded by calling the allegations a wild invention.

Jim Haslam, who bought his first gas station for $6,000 in 1958 in Virginia, opened his initial truck stop in 1981. Pilot grew to become the largest such chain in North America after merging with Flying J in 2010.