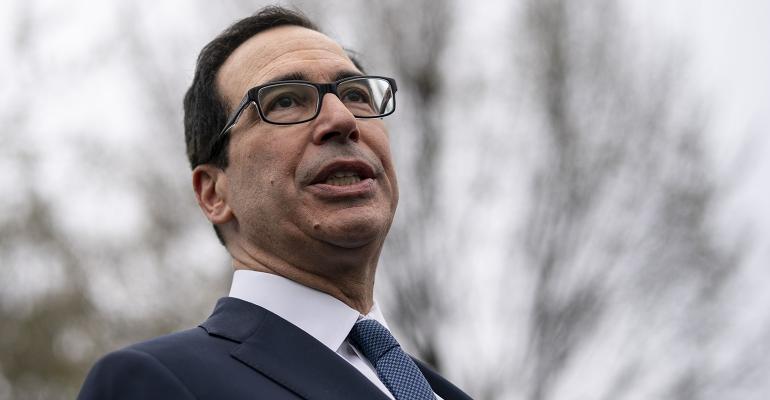

Treasury Secretary Steven Mnuchin announced Tuesday that taxpayers will get a three-month reprieve to pay their 2019 income tax returns as part of the federal government’s coronavirus response.

Filers will have 90 days to pay income taxes due on up to $1 million in tax owed, Mnuchin said. This reprieve amount would also likely apply to small businesses and pass-through entities. Corporate filers, on the other hand, would get the same length of time to pay amounts due on up to $10 million in taxes owed.

During that three-month deferral period, taxpayers won’t be subject to interest and penalties, Mnuchin said.

The tax deadline delay pushes the due date for payment for last year’s returns and taxes from April 15 to July 15; however.

“We encourage those Americans who can file their taxes to continue to file their taxes on April 15,” Mnuchin said. “Because for many Americans, you will get tax refunds.”

Regarding state taxes, only Maryland and California have announced any sort of reprieve, though given this move by the federal government, it’s likely more states will follow suit.

The IRS has also created a new website specifically regarding the coronavirus' effect on taxpayers. The site links to various online resources, and has information about the Free File program, refunds, payment plans and assistance for those who are low-income, elderly or disabled.

*This article has been updated to reflect that the delay is currently for tax payment only, not filing.