Investors have warmed to bonds and cooled on savings accounts this year even as asset price inflation rages, wage inflation is the highest in five years, consumer price inflation topped 2 percent year-over-year in five of the first nine months this year, and the Fed is starting to withdraw liquidity and talking about raising rates further. If the Fed is not as close to stopping rate hikes as the consensus believes, financial markets could be in for a jolt.

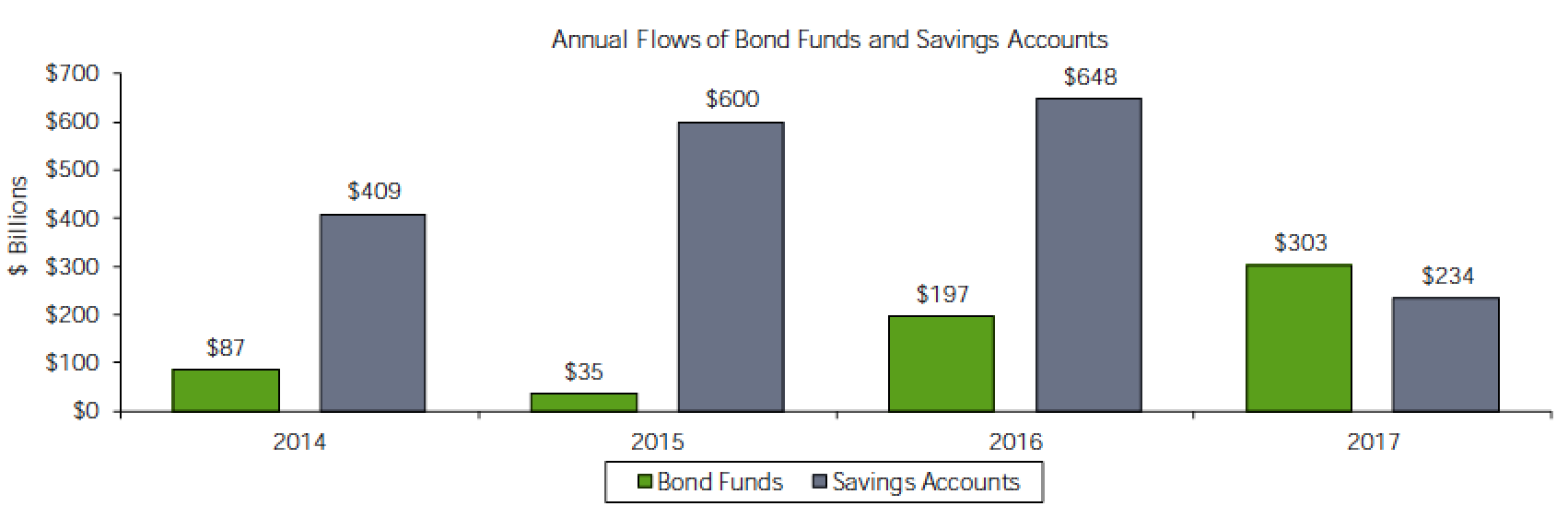

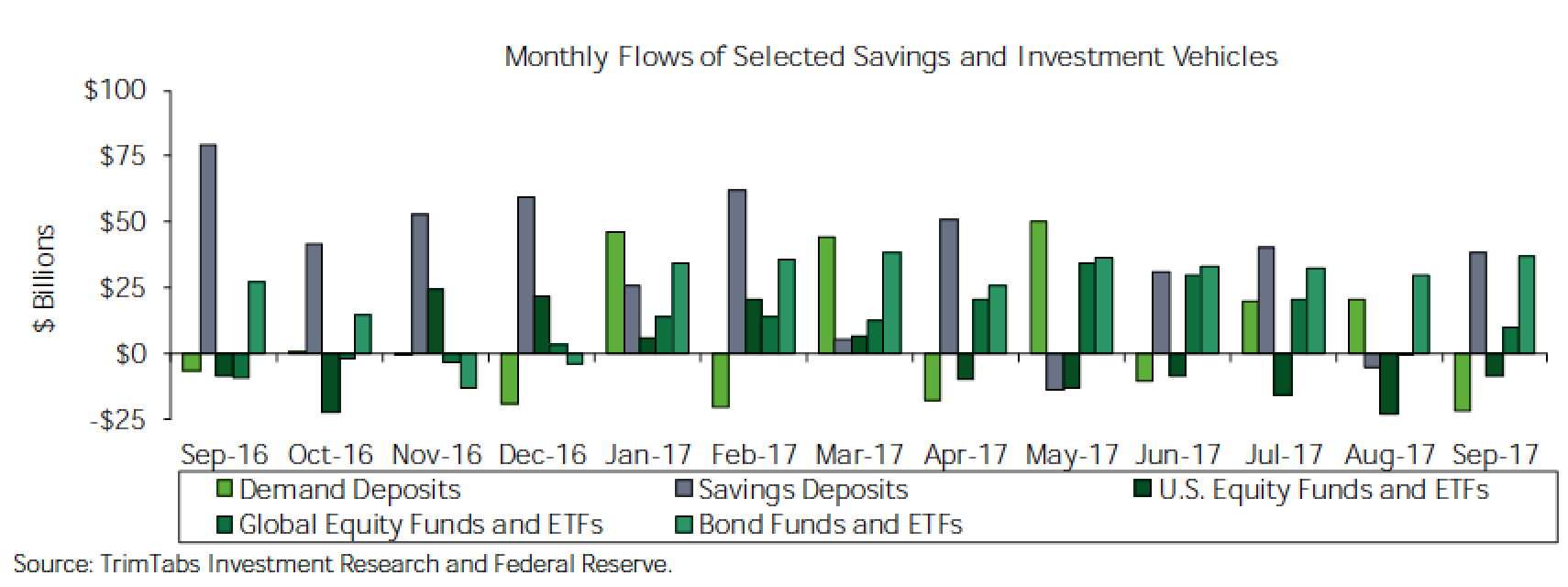

Inflows into savings deposits are running at the slowest pace since 2008. Savings accounts took in $38.3 billion in September following an outflow of $5.5 billion in August that was the second monthly outflow this year. Inflows have averaged $26.0 billion per month this year, down sharply from $37.4 billion per month in 2014, $50.0 billion per month in 2015, and $54.0 billion per month in 2016.

By contrast, inflows into bond funds are running near the record pace of 2009, when these funds raked in $419 billion. Bond MFs and ETFs took in a six-month high of $36.7 billion in September, and the inflow of $302.9 billion in the first nine months of this year was the biggest nine-month inflow since September 2009 to May 2010. Inflows have averaged $33.7 billion per month this year, up from $7.2 billion per month in 2014, $2.9 billion per month in 2015, and $16.4 billion per month in 2016.

Bucking the trend of lower inflows into bank products are small-denomination certificates of deposit, which have been drawing more money as yields have increased. The inflows of $7.9 billion in August and $11.0 billion in September were the biggest since late 2008. Inflows have occurred for eight consecutive months for the first time since July 2007 to February 2008.

David Santschi is the CEO of TrimTabs, a division if Informa Business Intelligence.