Now that we are in the aftermath of the Silicon Valley Bank and Signature Bank failures and have had a couple of days to catch our breath, it’s time to express our thoughts and answer some concerns.

Time to wrap your cash in tinfoil and place it in the freezer?

To answer this question and ease concerns about the entire banking industry we need to do a quick recap of what caused the failure of SVB. The unique structure of SVB will go a long way in determining if this is an isolated event or are we on the verge of a widespread financial crisis.

I’d be remiss to say I am very knowledgeable about SVB’s business model and inner workings. However, the name and some basic public details of the bank can lead us to some conclusions as to why the bank failed.

First, the majority of SVB’s depositors/customers had similar backgrounds and professions. SVB catered to startup businesses, specifically tech startups that were backed by venture capital firms. Additionally, the bank had a very high percentage of deposits that were above $250,000 (FDIC insurance breakpoint), resulting in an increased risk of a bank run.

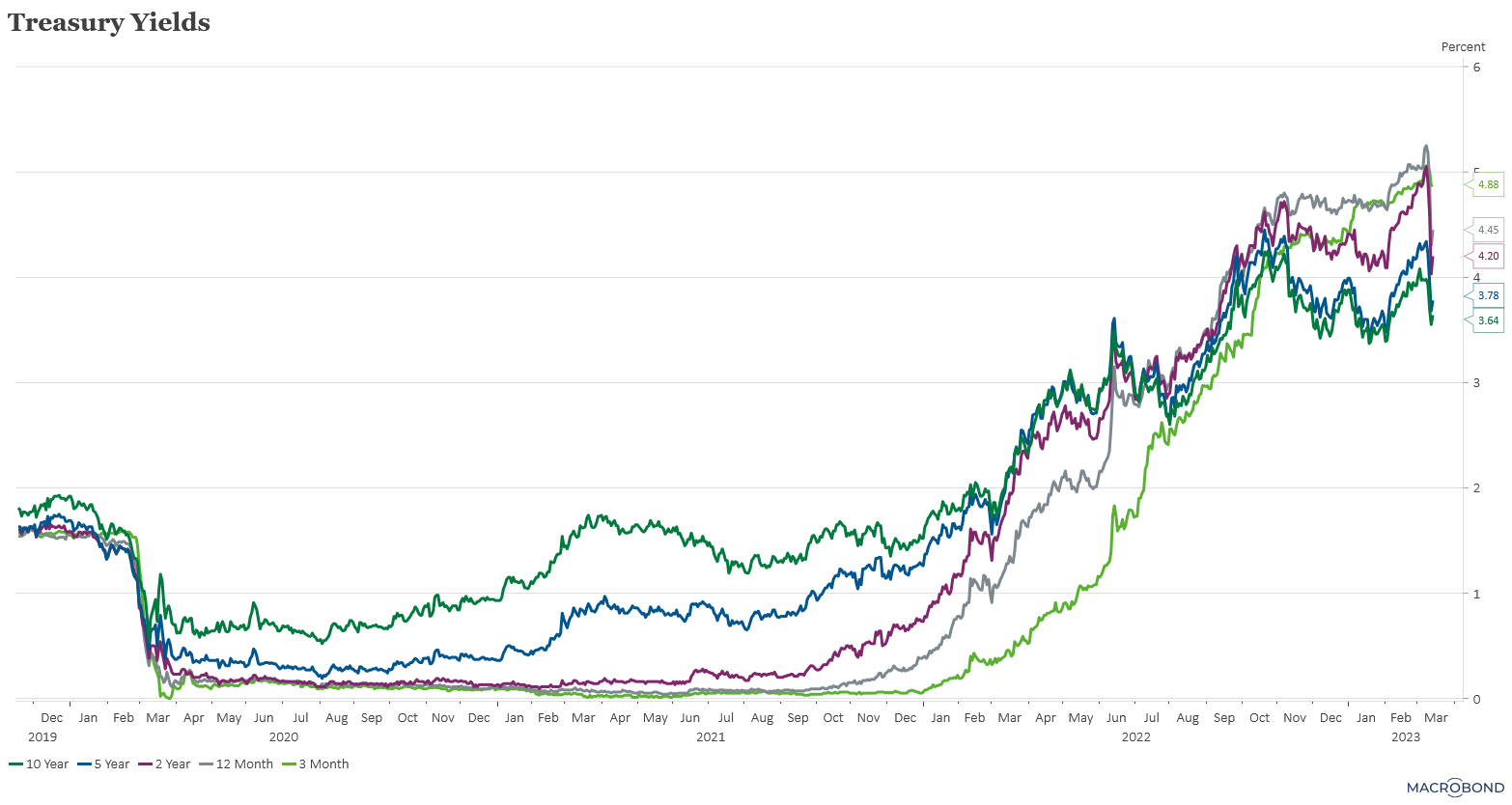

One can also safely assume that these venture-backed tech startups didn’t need bank loans, so SVB had a lot of excess cash (deposits – loans) to invest. The bank executives decided to invest that excess cash in higher-yielding, long duration Treasurys, while expecting interest rates to remain low. By now you can start to see the risks here: First there is a high concentration in a similar type of customer who answers to similar venture capital firms, and second the mismanaged investments had too much exposure to interest rate risk.

As word spread that SVB needed a capital infusion and subsequently sold its bond holdings, which were sold at a big loss due to the steep spike in interest rates, the large number of depositors who had well over $250,000 in deposits started a run on the bank.

Because of the niche business and customers SVB catered too, and the risk management error within its investment portfolio, this is an isolated event rather than a systemic issue. Banks are very well capitalized and are more conservative than ever since the aftermath of the Global Financial Crisis due to stricter regulations (stress tests). So no, I do not believe it’s time to bury your cash in the backyard or store it in the freezer. But rather it is time for those of you who may have more than $250,000 in deposits at a single bank to consider more prudent cash management.

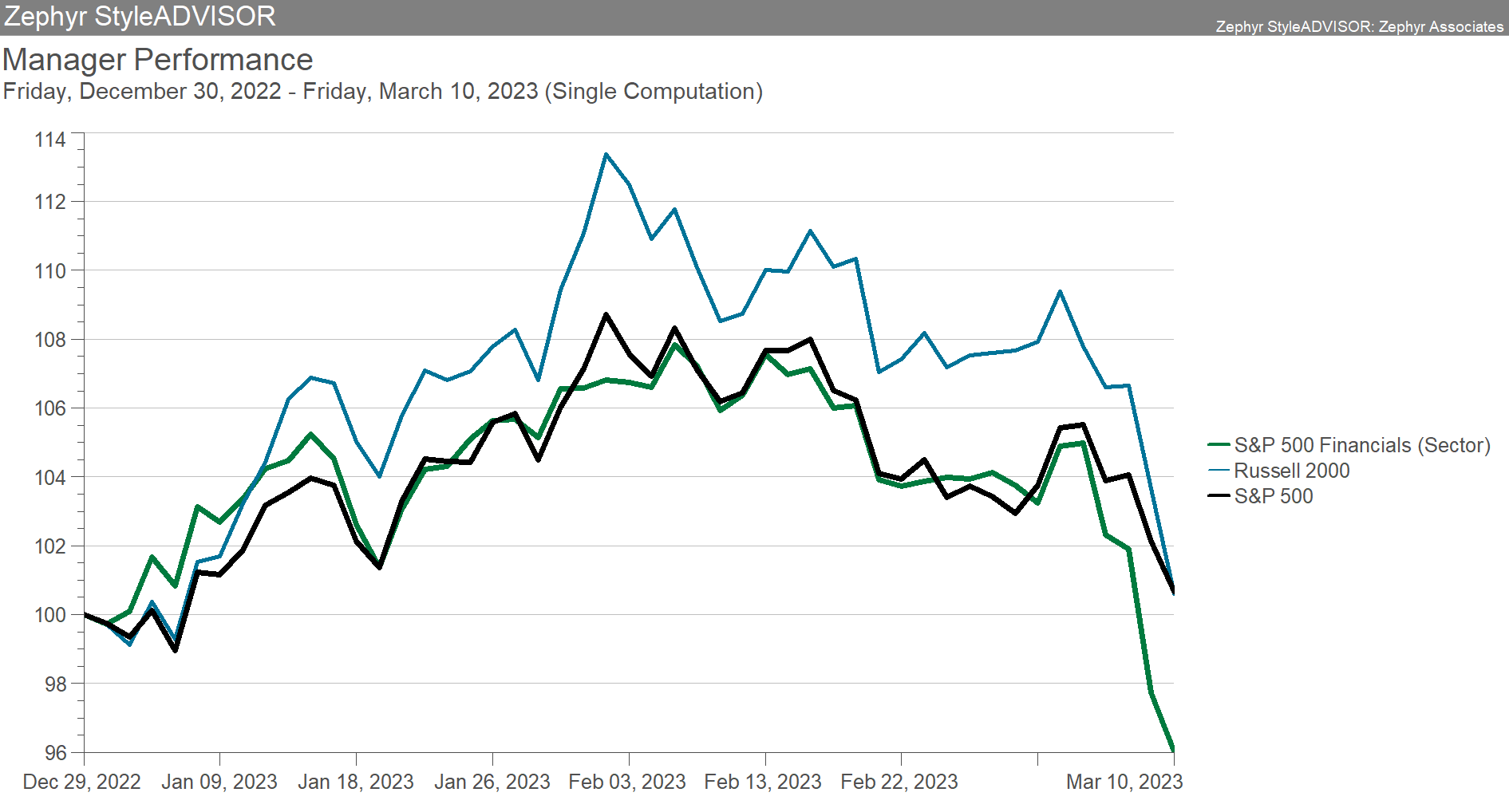

Lastly, you are likely to see a lot of customers transfer from regional banks to the very large national banks like JPMorgan Chase, Bank of America, and Citigroup as concerns mount over the health of these smaller banks.

Fed has blood on its hands

Let’s be clear, despite the very hawkish actions of the Fed, the central bank was not the sole reason SVB failed. As we discussed above, SVB was unique in its customer base and mismanagement of its bond holdings, but the Fed shouldn’t get a free pass.

You can say the Fed’s breakneck pace of interest rate hikes broke the housing market. Now you can add SVB to the list of entities the Fed had a hand in breaking. The Fed essentially compounded its policy mistake of keeping rates too low for too long following the COVID pandemic by raising rates at a breakneck pace in an attempt to correct the previous mistake.

It is known that interest rate hikes/cuts have a lagging impact on the economy, which we are experiencing now. It takes time before changes in rate policy trickle through to the economy. It still remains to be seen exactly what impact the steep interest rate hikes will have on the economy and if other businesses or industries will break as a result.

The Fed will most likely have to decide what is most important: taming inflation (rate hikes) or stabilizing the financial sector (rate cuts). While keeping prices stable is one of the Fed’s two mandates, stabilizing the health of the financial sector is arguably more important in the grand scheme of things. The Fed is in a tough position as it needs to be cautious not to overtighten financial conditions causing additional stress on the financial sector while also continuing to bring inflation to its 2% target.

While I think it’s time for the Fed to pause its rate hikes in March, it doesn’t mean the central bank cannot resume rate hikes in future months. The recent developments and tight financial conditions that are impacting banks should give the Fed enough reason to pause; however, look for the Fed to move forward with a 25 basis point hike next week. The Fed will continue the hiking cycle on the belief that the bank risks have been solved after the Fed, Treasury Department and FDIC jointly said all SVB customers will have access to their money and created a program that gives banks access to additional liquidity.

What Are Falling Yields Signaling?

As a result of the swift and sudden bank closures, the yield on 2-year Treasurys plummeted to as low as 3.72% on March 15 after reaching as high as 5.08% as recently as March 8. Not only did 2-year yields plummet, yields across the entire curve fell as well.

The falling yields could be signaling that markets are expecting the Fed to either stop its current hiking cycle or potentially cut rates by the end of 2023 if there is more financial distress.

Furthermore, the falling yields could be signaling a “flight to safety” trade is happening, as investors are concerned that the bank issues are more widespread in the financial sector and will negatively impact the broad economy. While this is the worse-case scenario, bond investors may welcome the price appreciation after the pain they endured last year.

Impact on markets

Instability and a loss of trust in the financial sector is deflationary, or causes asset prices to decline, and it also negatively impacts investor sentiment. In a vacuum, additional stress and weakness in the financial sector are bad for equities. However, there are other dynamics in play that will impact equities, and it all starts and ends with the Fed.

As we know, the Fed reigns supreme and is currently the primary driver of market performance. Investors are hoping and praying the Fed will pause its rate hikes or even better yet start cutting rates by the end of the year, resulting in the “bad news is good news” dynamic. With this in mind, additional stress on the financial industry may result in the Fed ending its rate hiking cycle and pivoting to a rate cutting cycle, which investors would applaud. On the periphery, an unstable financial industry is bad for equities; however, markets are different this time around, and if the instability results in interest rate cuts, then the instability will be bullish for equities.

Despite the steep fall in yields over the past week, yields remain relatively attractive, especially compared with recent years. However, uncertainty about the health of the broad financial sector and the potential impact it can have on the U.S. economy may cause yields to fall further. For investors looking for some stability and income, now is a good time to gain or increase their exposure to bonds while the yields still remain attractive. Additionally, bonds are also offering some total return potential.

I feel as if I have been saying this for decades, but it is important for investors to not make big wagers and to focus on their investment objectives and financial plans during this time of heightened uncertainty. Stay committed to sound asset allocation strategies that offer increased diversification to help get through times of volatility. Moreover, the volatility will provide opportunities for equity investors who have long time horizons and can stomach the volatility.

Ryan Nauman is the market strategist at Zephyr, an Informa company.