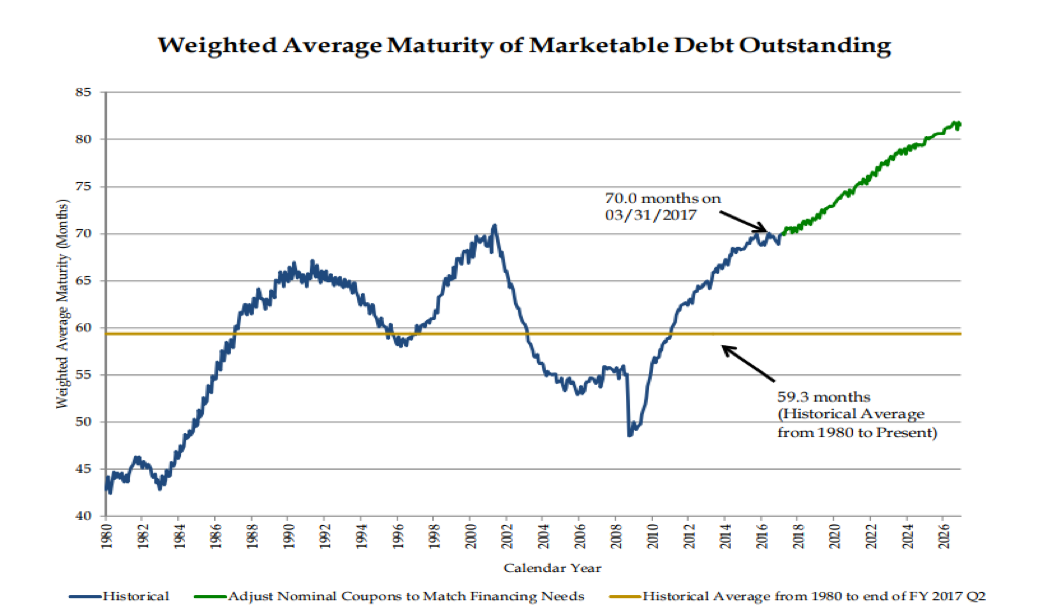

The Treasury’s new initiative is to increase short-term debt and that could ease any upward pressure on longer-term rates.

This challenges the notion that investors who would have to chase duration as indexes with an increasing weighting of Treasurys would also find an increasing average maturity structure.

As the Wall Street Journal recently reported, “the department would increase the share of shorter-term debt issuance and reduce the share of longer debt issuance, ending a year long trend that favored long-term debt issuance.”

The increase in short-term issuance relative to long-term, though both categories are bound to increase, could combine with other factors to offset, to a degree, upward stress in yields as: (1) the Fed unwinds its balance sheet, and there’s (2) diminished enthusiasm for issuance of really long-term paper, (3) further Fed hikes, and (4) maybe ongoing subdued inflation. In other words, it contributes to a flatter curve.

I don’t expect this interest in shorter-term issuance will last. Ultimately, we’ll get the average maturity of Treasury debt rising again. Why? Well, to the extent all of the above means a flatter yield curve when rates remain quite low, the incentive surely would be to issue longer-term. Also, while the initial interest in 40- and 50-year paper wasn’t great, we are one of the few major countries that don’t.

Between the level of rates, the chance for the curve to flatten and the sharp increase in the budget deficit that will come no matter what the tax plan does, seems it’s only a matter of time before we see longer-term debt issuance add to the average maturity of outstanding Treasury debt. For the moment, I concede we have a lull in that story.

This chart was part of the Treasury’s presentation to TBAC in July (see page 23 https://goo.gl/Sqo9LV); I think we’ll revisit this soon enough.

I also came across a few disinflationary sounding ideas. One came from Greg Ip in the WSJ who noted that the Consumer Price Index “tweak” in the GOP tax plan might mean higher taxes—both the House and Senate plans would use chained inflation vs. the CPI to adjust income thresholds. CPI is more generous in terms of inflation, so to the extent the income thresholds are raised based on a lower inflation rate, the more “real” income you’ll lose to taxes because you’ll be pushed into a higher tax bracket.

In the article, Ip says switching to a chained measure would extract $130 billion from incomes, or raise revenues if you want to be optimistic about it, over the next 10 years. Ip writes, “for some income groups, this would eventually wipe out the entire initial tax cut.”

I then read that Amazon and Whole Foods lowered prices for holiday foods for Prime members and they promise more such deals. That dovetailed with a Financial Times editorial, “Pharmacies are set for a big dose of Amazon.” The upshot of this is that Amazon is starting to look into entering the business, and even with the caveat of “only just starting,” the FT can say, “This alone has been enough to set the industry on edge,” concluding, “If Amazon shook up this cozy industry, competing profits away while improving service ... consumers would have reason to be thankful.”

David Ader is Chief Macro Strategist for Informa Financial Intelligence.