Let’s start with the premise that business cycles remain intact. That is, after 10 years of a recovery, long by any stretch, the U.S. economy is closer to a recession as each day passes. With global economic weakness, certain aspects of our domestic economy and the strong indicator represented by the flat yield curve, it’s reasonable to think a recession can occur within 12 to 24 months.

Forecasting such is not the point of this article, however. The objective is to outline how the Fed’s response will be different from what it has been heretofore and note the related market implications, because monetary policy is in new and uncharted territory. “New” and “uncharted” were exciting for Lewis and Clark but rather more problematic for holders of risk assets.

Monetary policy has been important to valuations in risk assets here and abroad, of course. I worry, though, that it has been grossly too important. In the past few weeks, subsequent to last year’s Q4 equity rout, I came across more than one comment that said, in effect, thank goodness for the weak economic data here and overseas because that data helped goose equity markets.

Cognitive dissonance much?

Weak data is just that, weak. It underscores risks to economic growth, which isn’t a good thing for risk assets. But now it seems that the hopes of market bulls come from that data because it could mean the Fed, and other central banks, will stop their tightening efforts and, fingers crossed, ease up at some point. That markets would focus on such a hope is misplaced. If equity markets need easy money policy to sustain gains, something is amiss.

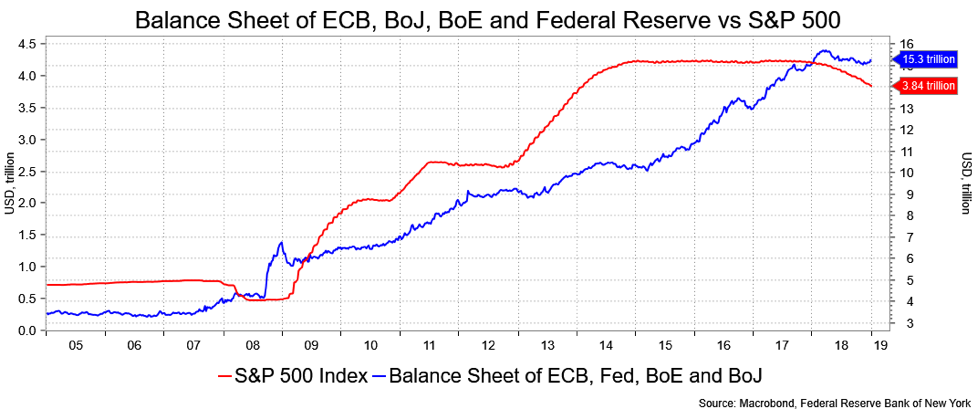

Tradition is, of course, that the Fed loosens by cutting short-term rates. That’s been monkeyed around with in this cycle in that the monkey is more like a gorilla via the expansion of the Fed’s balance sheet and its specific effort to increase holdings of long-term Treasurys, and mortgage-backed securities, to keep such rates at economically expansionary levels. Such balance sheet expansion is not limited to the U.S. but has been a source of support for risk assets in Europe and Japan as well. In Europe, the European Central Bank has been the largest buyer of corporate bonds since the financial crisis.

At the very least, when the economy starts to slow, we can expect the traditional form of easing at the front end of the yield curve. With Europe and Japan’s short-end rates still well below 0 percent, it’s hard to see easing doing much more.

This leaves it up to the balance sheet to do more of the work. The Fed hasn’t tapered very much, all things considered. The balance sheet was roughly $4.5 trillion through 2017 and now is just a hair over $4 trillion, and they could end tapering in a matter of days.

A good argument can be made for their needing to boost to allow for better dollar liquidity; the more they refrain from buying, the more the float is in the market soaking up dollars when there are already funding concerns, especially from emerging markets. Now add to that the rapidly rising budget deficit and all the new Treasury issuance that will further sponge up dollar liquidity and you have a potential problem.

I don’t doubt the Fed can, and will, lower the funds rate with such action’s traditional influence on the short end of the curve, i.e., steepening it. However, the real element that we’ve not seen is the use of the balance sheet. Yes, of course it rose dramatically post financial crisis, before the Fed opted to bring it back to an unspecified "normal" level.

But in the next recession, it is likely to come into play again but with unknowable consequences. The Fed seems somewhat reluctant to discuss specifics of what it could or would do, because it doesn't know. It has said it wants the balance sheet to consist of Treasurys, implying that it will not be buying MBS next time—with implications for that market. That means it will buy only Treasurys. The Fed will have to buy a lot to have an impact.

Consider that federal debt held by the public was $4.9 trillion in 2007 when the Fed’s balance sheet was $878 billion. Today, that debt is $16.1 trillion, or $22 trillion when you include all federal government debt (not held by the public) and the balance is that $4 trillion. The Fed owns about 11 percent of outstanding Treasurys, down from 13.5 percent at the peak. Odds are that with rates in general low, the balance sheet will have to come into play in a much bigger way given the rise in the deficit. And here’s the thing; if that assessment is correct, the Fed will probably be slow in figuring it out because it’s a new approach. In that event, risk assets may struggle to take the solace they seem to need in the next cycle.

David Ader is the former chief macro strategist at Informa Financial Intelligence, and previously held senior roles at CRT LLC and RBS/Greenwich Capital. He was the No. 1-ranked U.S. government bond strategist by Institutional Investor magazine for 11 years and was No. 1 in technical analysis for five years.