Despite the oddity of the reaction to the Federal Open Market Committee Minutes, the market continues to consolidate with what technicians should recognize as bullish divergences on the charts. As you’ll see below that means momentum measures are both high (oversold) and turning over while yields continued to rise—it’s a signal for a bullish reversal.

One overlooked aspect of this sentiment, and a reason I’m not getting very bullish, is lack of participation. Using EPFR flows as an example, there simply hasn’t been a swoosh of excitement in government bond funds (or corporate bond funds for that matter). Still, the auctions went OK and, allowing for the softer seven-year as a function of the “rally” that day, I’d say supply was well received at these sorts of yield levels.

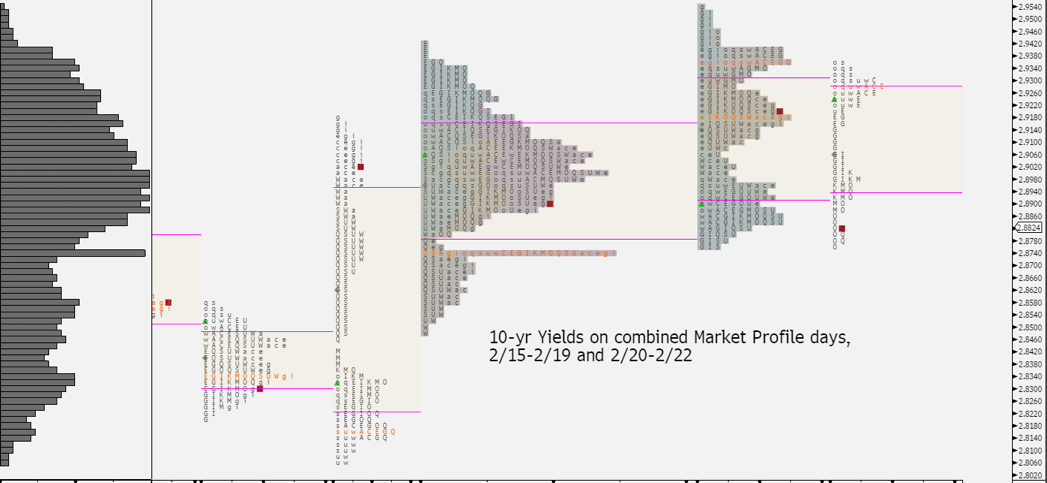

One way of seeing that is via Market Profile, which essentially shows you activity at a given yield level, sort of like volume traded. The one below combines Feb. 15 to 19 and Feb. 20 to 22. You see a volume buildup around 2.90 to 2 percent and effort to build above that and with some of Friday’s activity a move under all that volume—something like a “rejection” of the higher yields, for now. I’m keeping ambition limited to, perhaps, the 21-day MA at 2.81 percent to the breakdown level of 2.83 percent from Consumer Price Index day. That’s all close to the lows of that day as well. Momentum suggests 10s could slip further, which would bring 2.75+ percent into play—possible on a benign personal consumption expeditures report.

I take some further bullish leanings from the belly’s outperformance, which tends to work with a firmer tone. The Commitment of Traders data shows speculators still very short TY, FV and E$ and much less long U.S. The latter reveals the behavior at the long end was about positions more than data, so I’ll suggest the shorts in the belly now have room to cover, while shorts at the front end hold into the FOMC meeting. Overall, the NET spec short base is massive—most ever.

David Ader is Chief Macro Strategist for Informa Financial Intelligence.