Let me skip over the most obvious event of this past week — the dovish Fed rate hike. I say dovish not because it’s news, but because the analytical emphasis is on the subdued nature of the statement and various forms of projections (which were little changed). The latter includes the annoying dot plot, which has proven to be pretty useless as a forecasting tool beyond simply listening to Fedspeak, which should have the more immediate influence. I don’t know why people focus on the dots when they go out to 2019 and the longer-run forecasting so far in the future is largely guesswork.

The most recent hawkish rhetoric did a very good job of preparing the market for a hike and teased it into pricing in a modicum of hawkish anticipation. In other words, the hike was fully priced in, and then some, so the resulting rally on dovish aspects largely reflect a relief trade that dovetails with technical formations that I’ll get to in just a moment. I am not the only person who notes the last hike came with a 1 percent handle on GDP in Q4 and this one with the Atlanta Fed GDPNow forecasts at 0.9 percent for Q1. (That’s at the low end of the forecast range, but most retain a 1-handle.) After some recent hard data, others have downgraded forecasts too, but the consensus is somewhat higher. Still, Fed hikes with subpar GDP gains like that are notable. My takeaway is we won’t need another three this year to keep animal spirits under control.

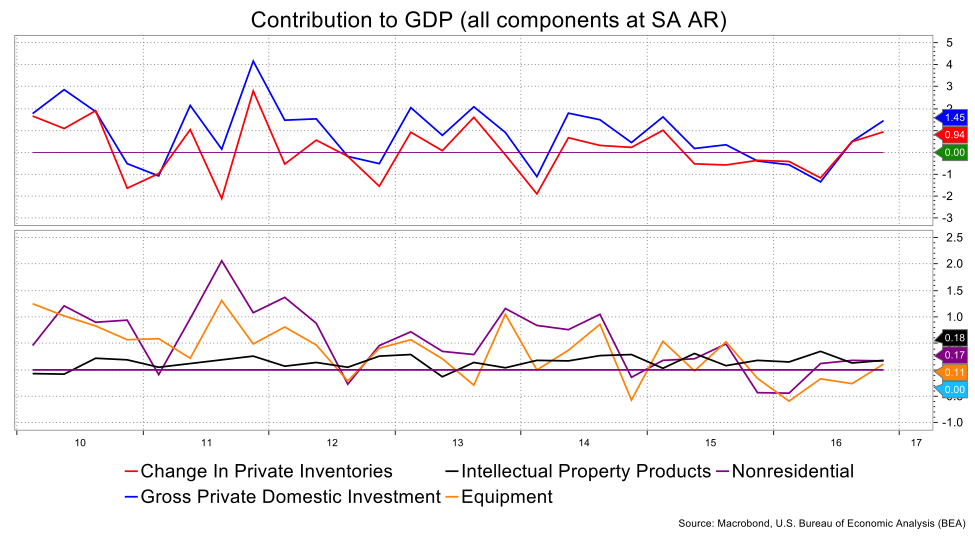

Within the statement a few things stand out: one is that it referenced investment as having picked up somewhat. It has, but from really lousy levels and it’s speculative where it came from. Gross Private Domestic Investment was up 1.45 percent in Q4, but of that, inventories contributed the bulk at 0.94 percent. Time was when higher inventory builds extracted from growth in the subsequent quarter if demand wasn’t gaining commensurately. Non-residential fixed investment was up a paltry 0.17 percent. The FOMC’s ‘firmed somewhat’ was rightly subdued. This remains a very important aspect to the recovery of the last few years; corporate America simply is not investing for future productivity gains.

The statement also brought up core inflation running below target for the first time, which is interesting, and in January was at 1.7 percent based on the core PCE price measure. The statement said inflation was running closer to the 2 percent target and fair enough, but there is some wiggle room. It was interesting to see the language change that they expected inflation to stabilize around 2 percent, which seems to hint that it can get over that level without provoking alarm. They did shift from seeing only gradual increases in Fed funds to gradual. Unlike me, the Fed chooses its words carefully. So, that simple change implies they feel freer to proceed with hikes though in reality it’s so subtle and nuanced as to give little reason than to add, say, 5 bp to latter 2017 Fed Fund futures.

The Wall Street Journal carried an interesting piece on Thursday, especially as it dovetails with something I’ve been commenting on. The headline was “Economic Growth Lags Behind Rising Confidence Data.” This came out before the Philadelphia Fed report which, though weaker at the headline level, nonetheless showed strength in all its sub categories from prices paid and received to new orders and employment.

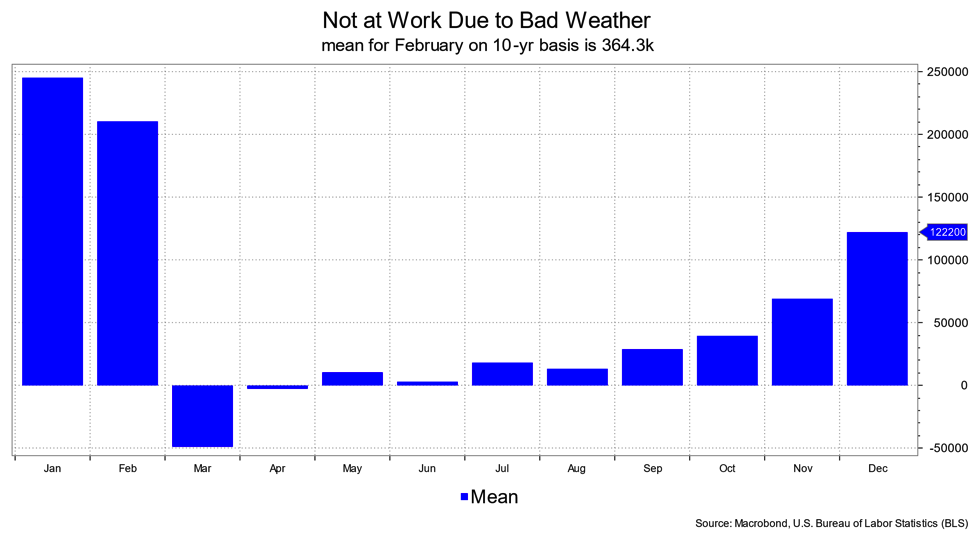

The upshot of the WSJ piece is that while confidence and stocks are robust, the underlying data has yet to conform. To quote, “Yet the U.S. economy shows few signs of breaking out of its long stretch of subpar growth.” They cite the recent retail sales report, trade data and drop in home sales, and pay heed to the unseasonably warm weather up until now. For example, the February NFP report showed a whopping gain of 235,000 with at least decent components. However, the curious category of "those out of work due to bad weather" came to 157,000 against a 10-year average of 364,300. Those seasonal adjustment factors anticipated vastly more people not showing up so the strength in NFP is a bit misleading if you consider the weather component.

I won’t go into dreadful details comparing some data with the various measures confidence or the stock market other than to say that to the extent those are up on the hopes and promises of the Trump administration's policies, well, like expectations for the FOMC, we’ve discounted a lot and have yet to see what it all looks like. I’ve read a lot about GOP infighting on the changes to the Affordable Care Act, for example, and protracted budget battles to ensue.

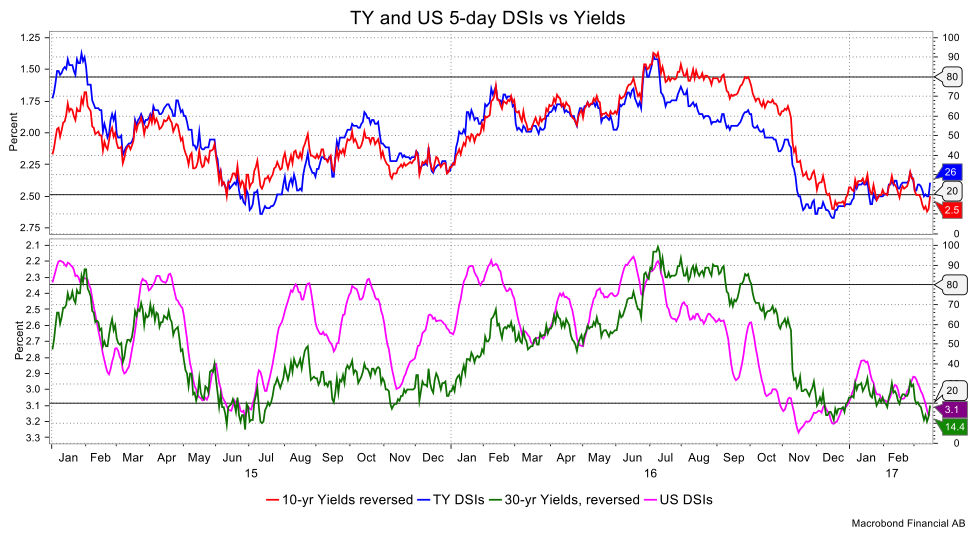

In any event the bond market did post improvement last week, sharply so relative to the recent range but not exactly strategic in its magnitude. There is a technical case to be made for that price action beyond the sense of FOMC relief or, hmmm, a bit of buying versus some stumbling out of Washington. For a while I’ve pointed out that sentiment in bonds is sharply oversold as well manifested by the Daily Sentiment Indexes which appear to be reversing from extremes.

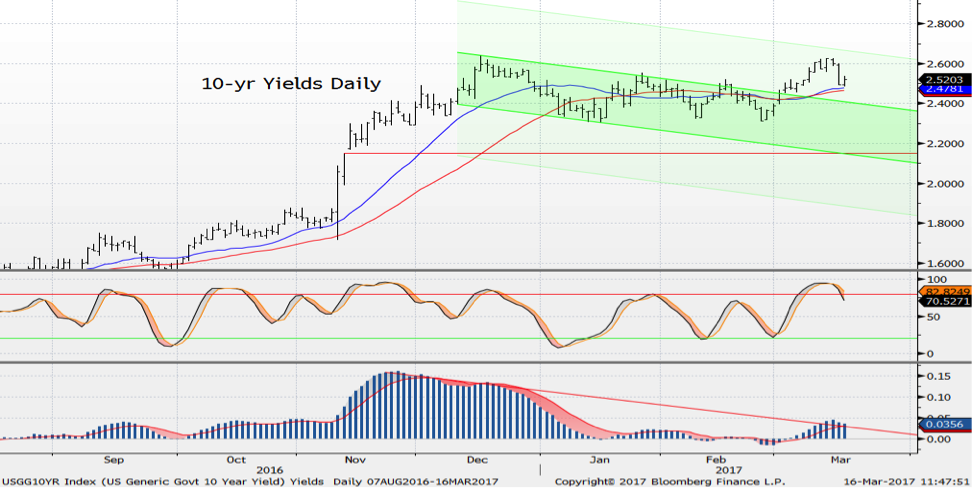

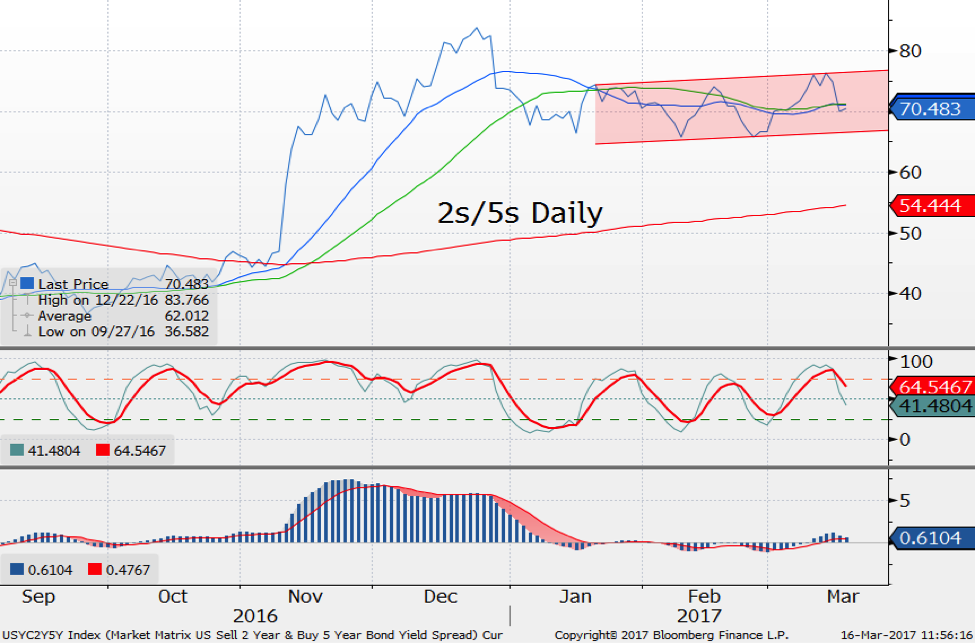

You can see this too on the technical charts. 10-year Treasuries pulled back from an approach to a bit of support near a channel projections with stochastics oversold. I slated the 21- and 40-day moving averages at about 2.47 percent as a first target and given the price action pushed the potential to 2.4 percent near term and an outside show to the low 2.3s (trendline). I’m not really bullish. Rather I’m playing ranges. I also like 5s/30s edging to the 200-day MA at 117 and am pretty indifferent to 2s/10s and 2s/5s doing much. I was surprised that my charts favor a bit of flattening though admittedly they are not too compelling.

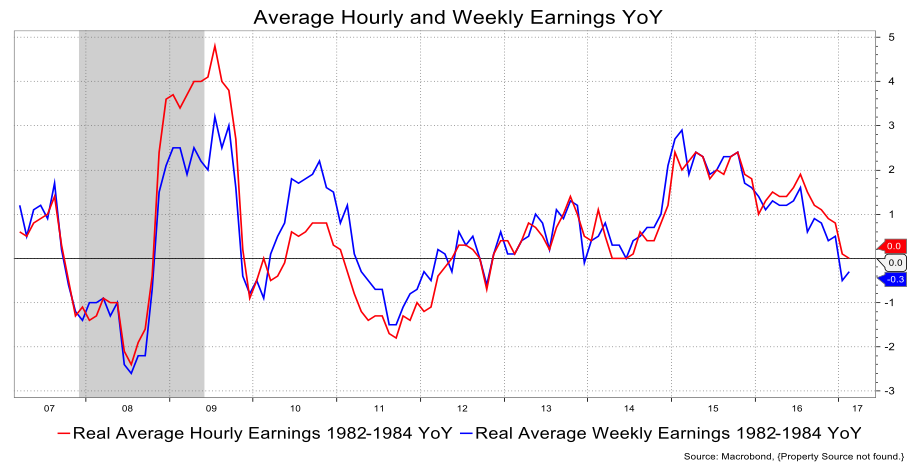

Speaking of inflation (was I?) we did get CPI on Wednesday which came in pretty much as expected. I bring it up because the 2.7 percent YoY gain is well above the Fed’s target but did little to the market presumably because it was on consensus and we were waiting for the FOMC. The angle I’ll offer up is that such a gain puts REAL year-over-year hourly earnings down to 0 percent and REAL average weekly earnings to -0.3 percent. In short, higher inflation isn’t translating to real wage gains. Until it does, I think REAL people will not accelerate their spending habits tremendously.

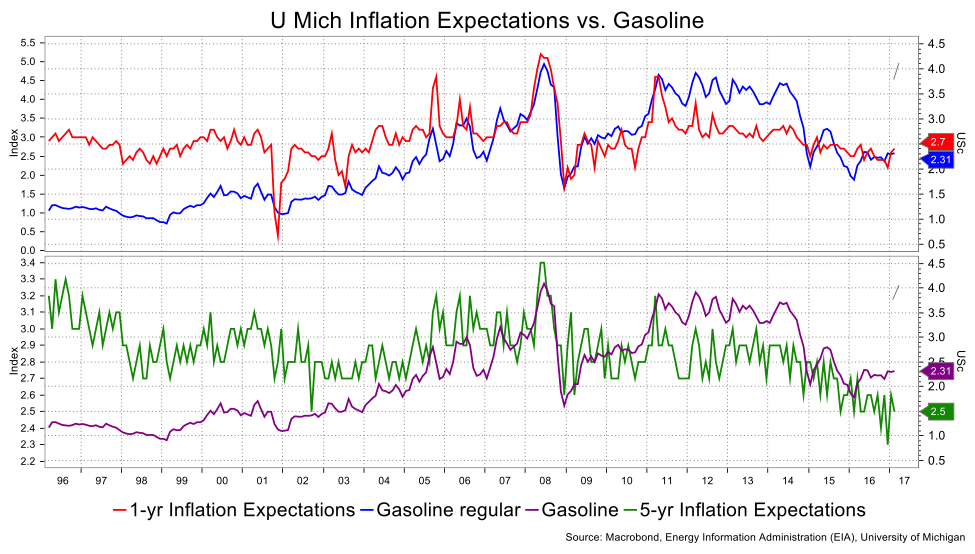

It’s interesting to see the behavior in TIPS against some soft reads on the inflation front. NFIB lists inflation as the single least important problem amongst their members. Interest rates and Financial are the next Least Important Problem and just over that is Cost of Labor. No signs of inflation here. FYI their biggest problems are 1) Taxes, 2) Quality of Labor and 3) Government Regs. If we go back a bit to the University of Michigan Survey, we’ll find five-year inflation expectations at 2.5 percent versus a cycle low of 2.3 percent. One-year expectations are slightly higher but correlate extremely well with simple gas prices. Perhaps the FOMC was smart to change the language to read that it expected inflation to stabilize around 2 percent.

P.S. did you see auto-buying intentions in the recent Consumer Confidence Poll? Plunged. I’ve been reading that there are a lot of cars in inventory, too. Ward’s report the Days Supply of light vehicles is up, too. Keep an eye on this.

David Ader is Chief Macro Strategist for Informa Financial Intelligence. For further information, please see: https://financialintelligence.informa.com/