(Bloomberg) -- European banks are snapping up large pieces of their own collateralized loan obligations, keeping the market for CLOs afloat in the absence of the US and Japanese banks that traditionally make up the bulk of the buyer base.

French bank Societe Generale SA arranged its first CLOs since the Global Financial Crisis in November, and then following an example by Deutsche Bank AG earlier in the year, it also played a key role in getting the deals out the door by purchasing a chunk of the AAA -- or safest -- bonds. In doing so, these banks are hoping they can keep the wheels turning until more takers materialize.

Europe’s CLO markets screeched to a halt earlier this year after global sentiment soured in the wake of the US Federal Reserve’s first 75 basis point hike. Concerns about downgrades and defaults are growing as the loans that act as collateral for CLO bonds are issued by heavily indebted companies that are especially exposed to higher costs and interest-rate rises. There have been other shocks as well, such as the fire sale by UK pension funds during the recent gilt crisis.

Major global banks have historically been the biggest customers for CLOs, but the ones that put the deals together didn’t use to be significant investors in their own vehicles. However, with US banks’ appetite for CLOs either sated by 2021’s record issuance, curbed by regulatory pressure or tempted by better relative value elsewhere, the traditional buyer base for these products has shrunk. That’s led the Europeans to step in.

“The rise of the European banks, particularly in taking down substantial amounts of the triple-As, has been very important this year during the challenging macro and geopolitical turmoil,” said James Smallwood, senior associate at Allen & Overy LLP. “Arrangers will step in to top up the triple-As if needed. On a deal-by-deal basis it can go from a minority to substantial majority.”

As a product by banks largely for other banks, under normal circumstances the treasury department at an arranging institution may also choose to take a small position in a CLO. Demand for triple-As would also have been robust enough that this sort of topping up, when needed, would more likely have been for lower-rated bonds. This year, arranging banks have effectively become anchoring investors in many of their own deals as demand softened.

Finding investors willing to buy AAA-rated securities issued by CLOs has grown harder this year, according to Octagon Credit Investors’s Lauren Law.

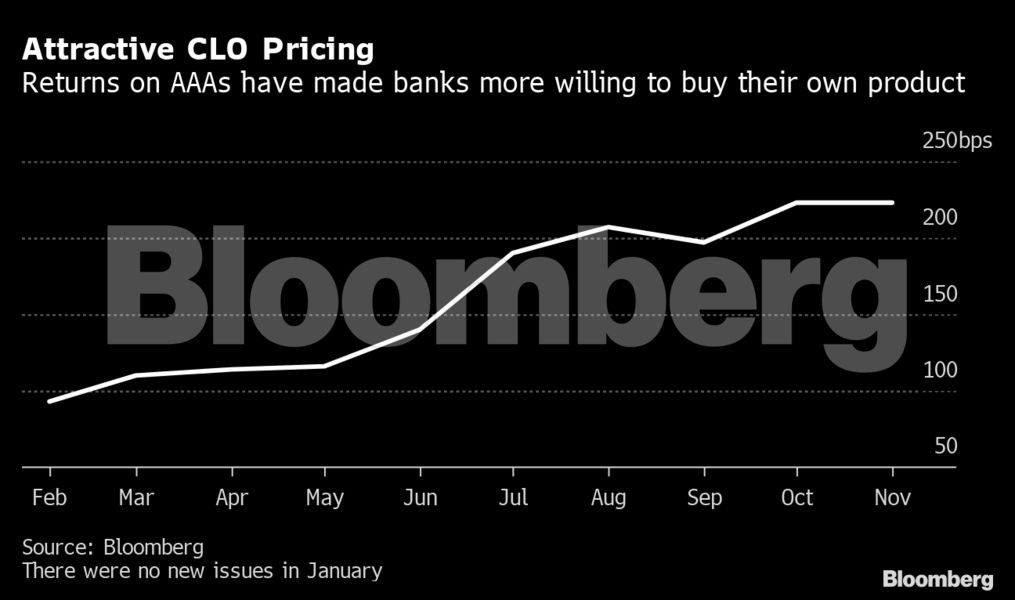

For arranging banks, the fact that AAA yields are near record highs makes buying up those portions of CLOs palatable. Yields at 4% to 5% make them “compelling,” according to Vasundhara Goel, head of European ABS and CLO strategy at Morgan Stanley.

“There is a connection between price and why an arranger would do that,” she said.

European Markets

SocGen, which is already active in CLOs in the US, entered the European market through a partnership with Barclays PLC after CVC Credit Partners lost a key backer on a deal. The French bank’s ability to fulfill that dual role of arranger and investor provided it with a way into a market that’s typically difficult to break into. BNP Paribas SA is another European institution that has performed that dual role of arranging bank and key investor on a number of deals this year.

“The vast majority of issuers in the ABS and CLO market know they may struggle with the triple-As so they appreciate when the bank can support with that,” said Laurent Mitaty, SocGen’s head of asset-backed products for Europe and APAC.

Representatives for Deutsche Bank and BNP Paribas declined to comment.

Read more: CVC Credit’s CLO Loses Key Investor Norinchukin Bank Mid-Deal

However, in the same way some US banks filled their coffers to the limit with CLO bonds last year, the new crop of investor-arrangers could also find themselves hitting capacity limits. It’s in the nature of the market that different investor groups come to the fore at different points in time, according to Allen & Overy’s Smallwood. The danger would be if the disruption persists and a new batch of backers doesn’t appear. Some see the pace of issuance slowing next year.

“It’s been a big trend this year but there have to be limitations,” said Morgan Stanley’s Goel. “Every investor has their limits on how much they can buy regardless of how much sense it might make to buy. At some point, they might run into some capacity constraints.”

Elsewhere in credit markets:

EMEA

Europe’s primary market is set to be quieter this week as the seasonal slowdown sets in even amid ongoing benign credit conditions.

- French telecommunications company Iliad was the only borrower to tap the European market by 11 a.m. in London Monday, with a €500 million note to refinance existing debt and for general corporate purposes

- Forty percent of respondents to Bloomberg News’ most recent survey don’t expect sales this week to exceed €15 billion, compared to only 10% with such a low target last week; none expect sales to exceed €25 billion

- Prices of a junior bond sold by UBS Group AG jumped after the lender decided to use its first opportunity to redeem the debt, amid fears that some of Europe’s riskiest bank bonds will be left outstanding

- Credit Suisse Group AG junior bonds with redemption dates next year were indicated higher after the UBS move

Asia

Yield premiums on Asian investment-grade dollar bonds tightened further on Monday, extending a recent rally, as risk-asset sentiment got a boost after Chinese authorities eased Covid testing requirements across major cities.

- Spreads of the notes narrowed at least 1bp, according to traders, putting them on track to decline for a seventh-straight session and the longest such streak since June

- China property firms’ dollar bonds rose at least 3 cents earlier Monday, according to credit traders, on reopening prospects for the economy

- No issuers in the region were offering new dollar debt

Americas

Projections for the week are for $10 billion to $15 billion in high-grade corporate bond issuance, with the first full week of the month expected to be the most active period in December.

- Full month estimates are for around $20 billion

- Supply is anticipated to slow to a trickle in the last three weeks of the year as the consumer-price index report on Dec. 13 and the Federal Reserve meeting the next day dampen activity

- It’s anticipated monthly volume will be the lowest December amount in three years

--With assistance from Harry Suhartono and Josyana Joshua.

© 2022 Bloomberg L.P.