Back in February, indexing powerhouse Vanguard Group plunged headlong into actively managed exchange traded funds with the floatation of a six-fund fleet focused on factors. We took the measure of the flagship Vanguard U.S. Multifactor ETF (BATS: VFMF) after its first month and found it outperforming both its Russell 3000 benchmark and its ETF peers.

So here we are at midyear—a good time for a course check on the Vanguard armada. Are the factor ETFs leaving the market behind? Which has fared best? And which ones have caught investors’ interest?

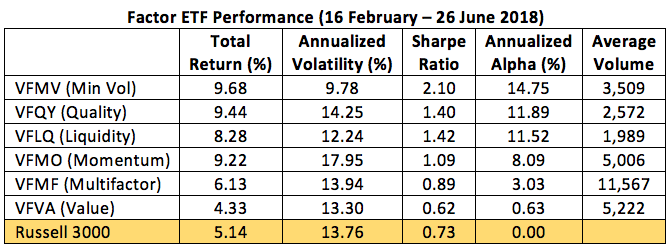

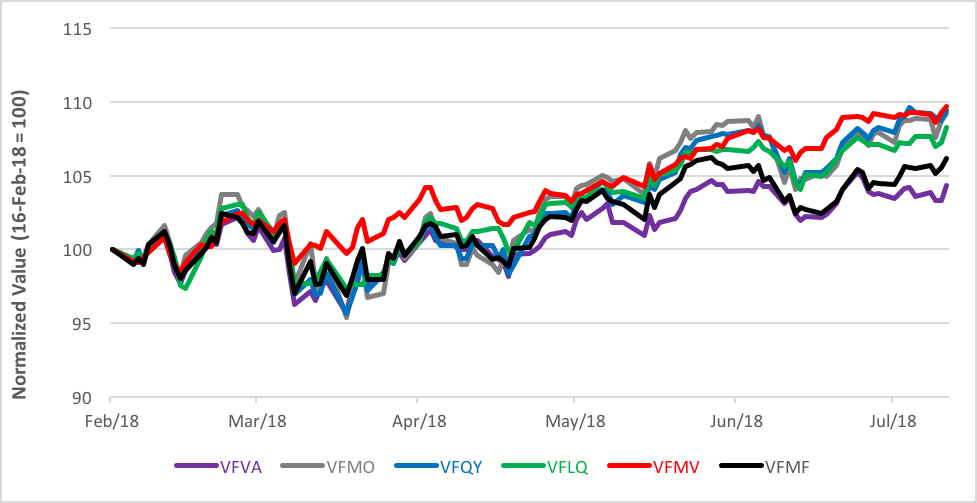

Performance-wise, the Vanguard U.S. Minimum Volatility Factor ETF (BATS: VFMV) is the top factor fund on an absolute return and a risk-adjusted return basis. The manager’s proprietary risk modeling yields a substantial reduction in portfolio standard deviation versus the market, making it easier for the fund to retain and build on its gains. VFMV isn’t the most popular Vanguard factor ETF, though. Far from it. Average daily turnover has been a relatively paltry 3,500 shares.

The Vanguard U.S. Quality Factor ETF (BATS: VFQY) portfolio—filled with stocks exhibiting strong fundamentals—snagged a market-beating return but its high volatility cost it a few alpha points compared to the Vanguard U.S. Liquidity Factor ETF (BATS: VFLQ). VFLQ’s value proposition is the capture of the low liquidity premium which slows portfolio turnover somewhat. VFLQ ranks lowest in average daily volume, reflecting investor—and advisor—unfamiliarity or distrust of the factor tilt.

Price velocity is bagged in the Vanguard U.S. Momentum Factor ETF (BATS: VFMO) which earned the third highest period gain in the table. The fund’s high volatility was costly, though, to its alpha production.

Value brings up the rear as the table laggard. The Vanguard U.S. Value Factor ETF (BAT: VFVA) trailed the market by 30 basis points (0.30 percent) for the period, though it still managed to eke out a positive alpha coefficient by a dint of its modest volatility. VFVA enjoys the greatest popularity among the Vanguard single-factor ETFs, signaling investors’ fluency with the deeply researched and advertised value concept.

The Vanguard U.S. Multifactor ETF (BATS: VFMF) is by far the most actively traded ETF in the table and provides exposure to four factors: value, quality, momentum and low volatility. The high volume and relatively high asset base indicate investors’ and advisors’ comfort with a multifactor approach. Four-factor exposure doesn’t require the timing decisions required of single-factor investing.

Overall, the Vanguard suite of factor ETFs are impressive in that they’re all alpha producers. It’s positive alpha they crank out—the holy grail of actively managed funds. The unimpressive volume and asset base is, in large part, an educational issue. Vanguard’s reputation is built on its index fund offerings—it’s just not seen as an active ETF manager. Yet.

Also working against the funds’ asset collection efforts is the inherent reticence of investors and advisors to reallocate away from market-tracking investments during a bull market. After all, why take on active risk when beta provides attractive returns? If the February market downdraft and volatility spike turns out to be a top, the funds’ fortunes could turn.

Vanguard’s factor ETFs are young and lack the visibility of older, established products. If they can survive the 3-year probationary period before their stats become Morningstar fodder, they could be valuable portfolio allocations.

Brad Zigler is WealthManagement’s Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange’s (now NYSE Arca) option market and the iShares complex of exchange traded funds.