The pace of active ETF launches is accelerating, and with the recent flurry of launches by large asset managers like American Century, Fidelity and BlackRock of new, non- or semi-transparent ETFs, momentum is accelerating.

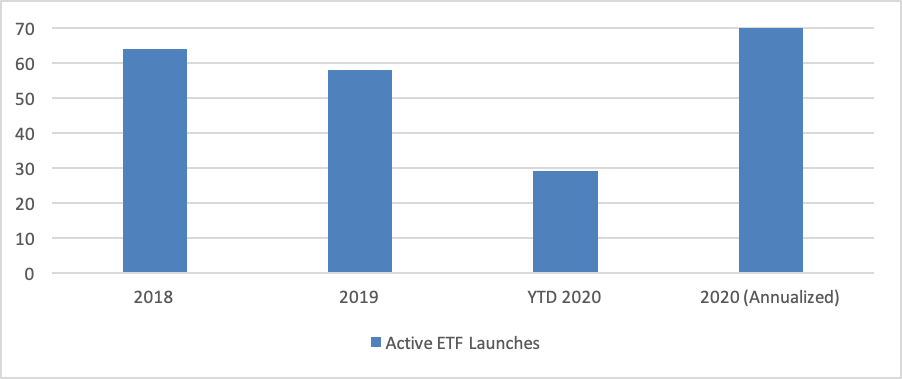

While many investors focus on how well an ETF tracks its underlying index, a growing number of products have come to market in the past three calendar years that have no underlying index to passively replicate. Rather, they are actively managed by portfolio managers selecting securities based on the market environment and proprietary analytics, with no set schedule for portfolio changes. Since the beginning of 2018, 151 actively managed ETFs launched, though a few have already closed. In the first five months of 2020, the 29 new active funds have put the industry on pace for 70 such funds, which would exceed 2018 (64) and 2019 (59) levels, according to First Bridge Data, a CFRA company.

Chart 1: Active ETF launches between 2018-2020

More recently, large active management firms can offer ETFs without full holdings transparency. In May 2019, Precidian Investments received regulatory approval for its ActiveShares intellectual property and later in the year four other firms, including Fidelity and T. Rowe Price, got the green light to move forward with their own structures. CFRA thinks regulators allowing U.S. equity ETFs to limit the daily disclosure of holdings—in line with the advantages enjoyed by active mutual fund managers—to protect management’s best ideas from the public, will drive many more active ETFs into the market this year. These are likely to appeal to cost-conscious fans of active management.

The first funds using the ActiveShares structure were launched by American Century at the end of March, and another one from Legg Mason began trading at the end of May. American Century’s FDG has a 0.45% expense ratio and $19 million in assets. In its first two months of trading, FDG was up 31%, outperforming the 22% gain for the iShares Russell 1000 Growth Index ETF (IWF). At the end of April (latest available), FDG had relatively large stakes in Boston Beer and Tesla.

Today, Fidelity is launching similar semi-transparent ETFs using its proprietary, semi-transparent structure. Meanwhile, BlackRock, Gabelli, Goldman Sachs, T. Rowe Price, and other established active managers have announced plans to come for semi-transparent active equity ETFs in the coming months. Despite the limited disclosure, investors in these funds would still receive the tax benefits and intra-day liquidity that have made fully transparent active ETFs popular.

Fidelity brings a strong record and brand name to the active equity universe. American Century and Legg Mason are the 40th- and 53rd-largest ETF sponsors based on assets under management, with a combined $1.8 billion in assets, according to First Bridge Data. In contrast, Fidelity has generated a stronger ETF presence, as its $17 billion in assets garners it 13th place in the league table.

We think Fidelity is also likely to have collective success with its three new semi-transparent ETFs due to the company’s strong active management presence and large brokerage business. For example, Fidelity Blue Chip Growth ETF (FBCG) is likely to look similar to $32 billion Fidelity Blue Chip Growth Fund (FBGRX) but incur a lower expense ratio. Like the new ETF, FBGRX seeks to own well-known established holdings with above-average growth potential. Eight of the mutual fund’s recent top-10 holdings were CFRA Buy or Strong Buys, including Amazon.com and Nvidia. The mutual fund has also generated an above-average risk-adjusted Sharpe ratio relative to mutual fund peers. FBCG will charge a 0.59% expense ratio, below the 0.8% for FBGRX, which could encourage investors to shift to the cheaper alternative if they are willing to incur the one-time tax impact.

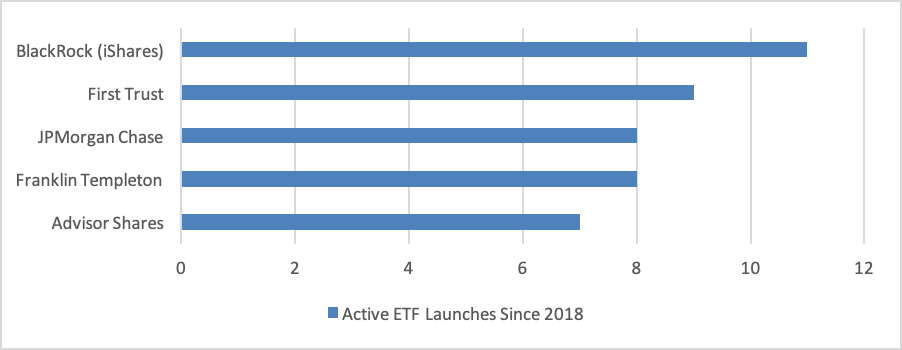

The ETF industry leader is seeking to win with active thematic funds too. iShares has a 38% share of the $4.3 trillion ETF market and offers more than 350 equity and fixed income ETFs rated by CFRA. iShares Core S&P 500 (IVV) is the largest iShares offering with approximately $190 billion in assets, but the firm has launched 11 actively managed ETFs since the beginning of 2018, the most of any asset manager.

Chart 2: What firms have launched active ETFs since 2018

iShares funds under three years old but already rated by CFRA based on holdings, costs and performance record include iShares Evolved U.S. Discretionary Spending ETF (IEDI) and BlackRock U.S. Equity Factor Rotation (DYNF).

Yesterday, BlackRock filed to launch four actively managed ETFs focused on long-term themes—Fintech, Health Sciences, Technology and General Innovation. While three of these will be fully transparent, BlackRock Future FinTech ETF will license Precidian’s ActiveShares semi-transparent structure to invest in companies involved in the research, development, production and/or distribution of technologies used and applied in financial services,

BlackRock is seeking to tap into growing demand for actively managed thematic ETFs. For example, ARK Innovation (ARKK) is a nearly $4 billion fully transparent active ETF focused on next-generation companies positioned to benefit from industrial innovation, genomics, shared technologies and fintech trends. The firm also offers ETFs focused on the single long-term themes and has $6.5 billion in assets, making it the 19th-largest fund sponsor. ARKK and its siblings charge premium expense ratios of 0.75%, but we would expect BlackRock to use its scale to charge a much lower fee. For example, DYNF and IEDI have expense ratios of 0.30% and 0.18%. We think asset managers need to price active ETFs not only cheaper than mutual fund alternatives but also closer to the fees of smart-beta index ETFs to excite investors.

BlackRock is not alone in attempting to tap into demand for active thematic ETF strategies. For example, in February, Franklin Templeton launched three such funds, including Franklin Genomic Advancements ETF (HELX). HELX charges a 0.50% expense ratio but has so far failed to gain traction with just $3 million in assets.

Conclusion

The actively managed ETF universe has expanded in the past three years, with established firms American Century, Fidelity, Franklin Templeton and Legg Mason rolling out new equity strategies. Meanwhile, the ETF industry leader plans to expand its long-term thematic presence. We think investors will focus less on the frequency of portfolio transparency and more on the quality of the securities management favors, fund fees and performance. We expect asset managers to leverage their scale to offer attractively priced products, which could spur demand.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.