More employees than ever are working at home, and may continue to do so even after the COVID-19 threat subsides. More than half the companies that responded to a recent PricewaterhouseCoopers survey regarding the coronavirus were planning to make a remote work option permanent and three-quarters of Fortune 500 CEOs were accelerating the technological transformation of their companies. These work-from-home trends are helping drive the information technology sector’s rise in 2020 and even more narrowly focused theme-based ETFs are rewarding a growing investor base.

For example, the WisdomTree Cloud Computing Fund (WCLD), which launched in September 2019, was up 53% year-to-date through Aug. 10, more than double the 24% gain achieved by Vanguard Information Technology ETF (VGT). Another strong performer was Global X Cybersecurity ETF (BUG), which launched in October 2019, and rose 31% so far in 2020.

Strong performance has driven robust inflows.The solid performance by cybersecurity and cloud computing ETFs, coupled with the near-term investment case for these themes in the current and near-term work-from-home environment, has driven strong ETF flows. CFRA Equity Analyst Keith Snyder thinks companies discovered that legacy network security solutions were ill-equipped to handle the mass migration of workers to a home-based existence. The work-from-home shift has made it difficult, if not impossible, for IT staff to remotely enforce corporate-defined security policies due to a lack of logical and physical control of managed and unmanaged devices and their access networks (i.e. home Wi-Fi).

In addition, the absence of a virtual presence on end users' devices and their access networks is making it challenging for security teams to identify shadow IT and anomalous activity by end users and attackers due to a lack of telemetry. Snyder expects a spike in demand for virtual private network (VPN) services and software-defined access services in response to the rapid growth in the number of remote workers attempting to access resources that are sequestered behind corporate firewalls.

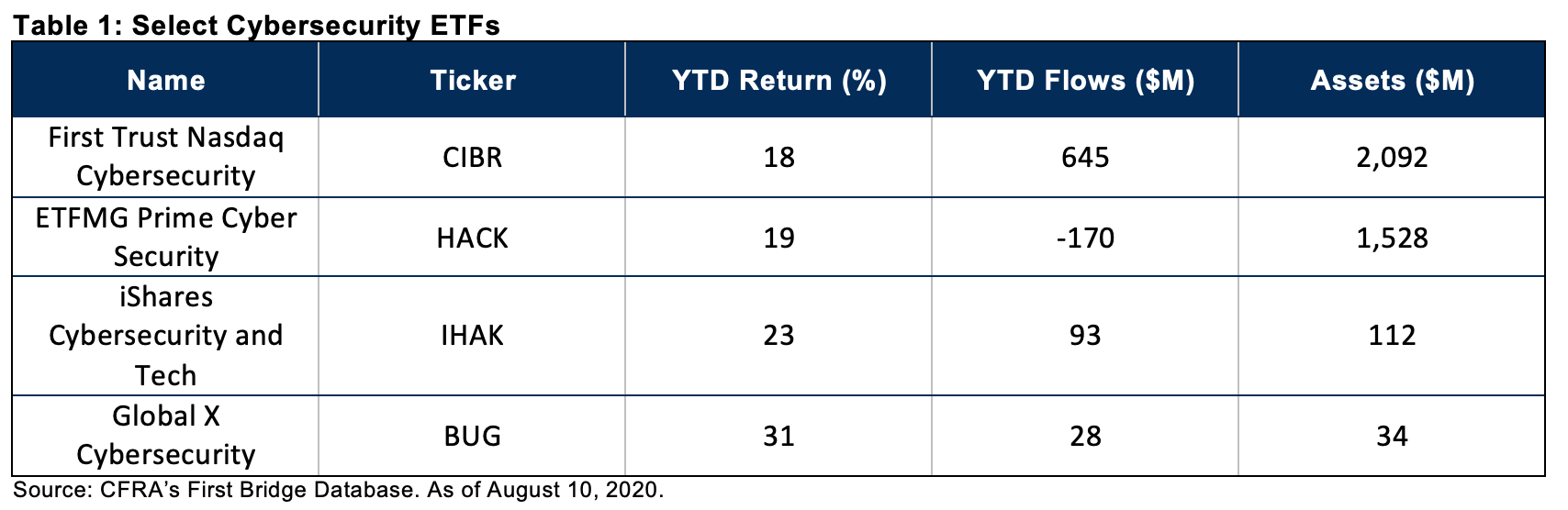

First Trust Nasdaq Cybersecurity ETF (CIBR) has been the biggest beneficiary of cyber ETF demand, yet has underperformed its peers. CIBR gathered $645 million of net inflows in 2020 to push its asset base over $2 billion, making it one of the largest thematic funds regardless of investment approach. The fund’s 18% gain in 2020 lags smaller peers BUG (31%), iShares CyberSecurity and Tech ETF (IHAK) (up 23%), and ETFMG Prime Cyber Security ETF (HACK) (up 19%).

HACK previously was the largest cyber ETF but has incurred $170 million of net outflows in 2020. We think some investors have cooled on the fund as HACK had been involved in multi-year legal battle that is likely to result in HACK being reorganized as a new fund run by Exchange Traded Concepts, not current provider ETFMG, and tracking a different benchmark, pending shareholder approval.

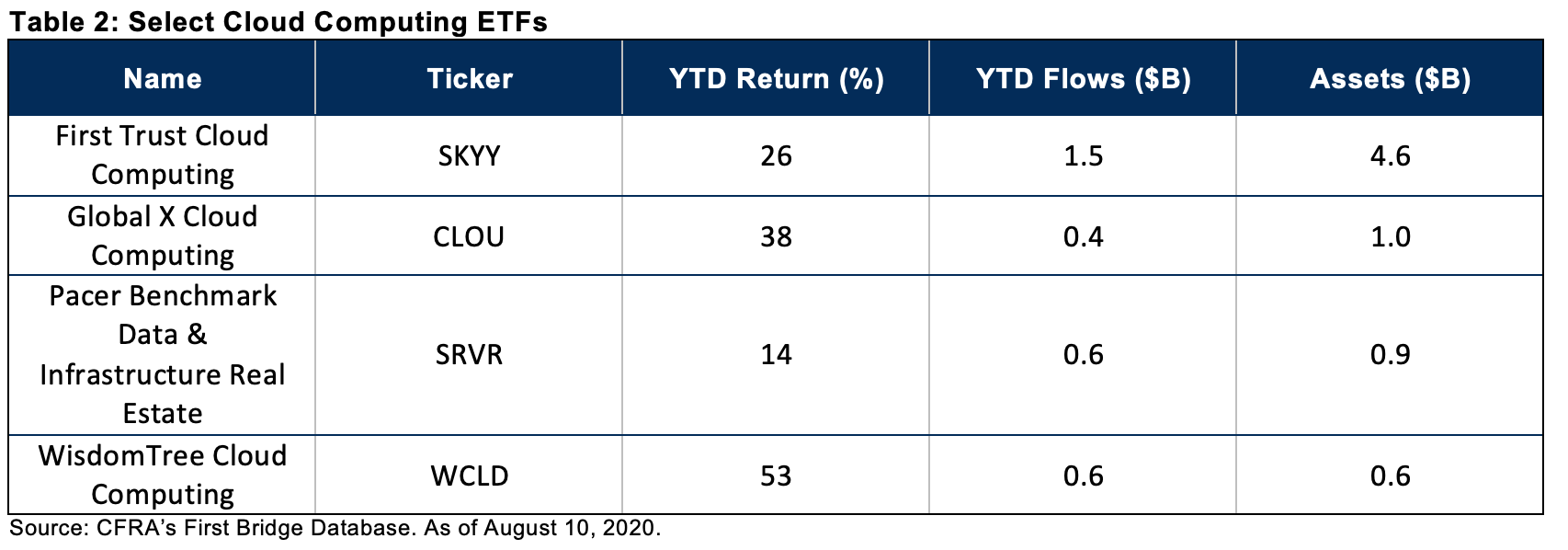

Meanwhile, more than $3 billion of new money flowed into cloud computing ETFs thus far in 2020—likely in response to the need for data to be securely stored and shared remotely. The largest cloud-focused offering is the $4.6 billion First Trust Cloud Computing ETF (SKYY), which launched in 2011. SKYY captured $1.5 billion of net inflows thus far, leading the pack, but newer entrants are also experiencing demand. WCLD and Pacer Benchmark Data & Infrastructure Real Estate (SRVR) each pulled in approximately $590 million of net inflows, while Global X Cloud Computing ETF (CLOU) raked in nearly $400 million. While each of these funds has found a large investor base, the funds are constructed differently, which has driven their distinct performance records.

For example, WCLD recently had 98% of its assets in Information Technology stocks, such as DocuSign and Zscalers. SRVR owns a mixture of specialty REITs that operate data centers, such as Equinix, or that own wireless towers companies such as American Tower. As such, the performance gap between WCLD’s 53% gain and SRVR’s 14% is wide.

And now there’s a new entrant in the mix. A thematic index-based ETF combining cybersecurity and cloud computing with other technology themes launched in late June and already gathered $85 million in assets. Direxion Work from Home ETF (WFH) includes remote communications and online project and document management companies that can benefit as companies seek to connect workers and use collaborative tools. WFH’s holdings include emerging companies, such as Box and Twilio as well as well-established Amazon.com and Microsoft. While WFH considers TWLO a beneficiary of remote communications, it can also be found in cloud computing focused WCLD.

Conclusion

Investors are increasingly focusing on thematic ETFs that can benefit from the new environment, including working from home and social distancing. However, as the supply of these funds grows, it remains important to look inside since the companies positioned to benefit from the theme are open to interpretation by the index provider and asset manager.

CFRA will be hosting a webinar on these work-from-home themes on Aug. 19. The webinar will also feature a discussion of CFRA’s proprietary ETF ranking methodology, which analyzes what’s inside to forecast future performance rather than rely simply on past performance. CFRA’s ETF ratings are based on a combination of forward-looking holdings analysis and fund attributes including the performance record and relevant cost factors. To register for the event or for additional information, please visit https://go.cfraresearch.com/wfh-theme.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.