Lots of folks responded to our last column “Oil’s Slump: Boon Or Bust For Refiners?” with questions. While many opinions were jockeyed on the fate of refiners’ stocks, some readers wondered why so much oil was being stockpiled in the first place.

Well, first and foremost, because it’s a money maker. And not just for refiners. For arbitrageurs, too. A “cash-and-carry” trade in oil can, sometimes, provide a return better than high yield bonds and lottery tickets.

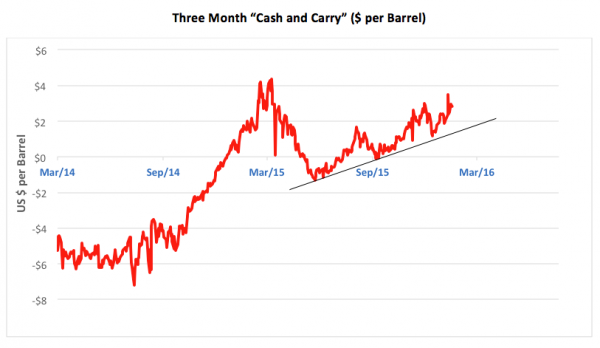

The trade relies on the contango – the positive curve -- in oil futures pricing. When spot oil trades at $32 a barrel while oil for delivery in three months costs $36, there’s said to be a $4 contango. The spread accounts for storage and financing costs to “carry” the oil ‘til the delivery date. Mostly. Sometimes, there’s a little “extra” in the spread. That’s the “convenience yield” which is extracted in the arbitrage. The convenience yield, put simply, is the benefit of temporary ownership.

Here’s how it works:

First, you borrow the money to purchase a cargo of crude. Let’s say you contract for 1,000 barrels of West Texas Intermediate (WTI) to be delivered to the oil terminus at Cushing, Oklahoma. At the same time, you sell a NYMEX futures contract maturing in three months. By locking in a sale through the futures market, you’re now hedged against any decline in WTI’s price.

In three months, you’ll fulfill the delivery requirement, turning over your oil and receive the contract price. You’ll also settle up on the principal and interest on your loan, plus the storage costs. The difference in your ending cash flows is your profit.

It’s that profit potential that’s been growing while oil’s price slid. Last June, when spot WTI was $60, the storage yield was negative. A three-month arb would have cost you more than a dollar a barrel. Now, with oil at the $30 level, you can make nearly $3 a barrel. That’s a 9 percent return for three months ownership. Roll that kind of a return over a year’s time and you earn 35 percent. You can see the appeal, can’t you?

Until the convenience yield seriously shrinks toward zero, there’ll be an irresistible incentive to store oil. Keep an eye on it.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.