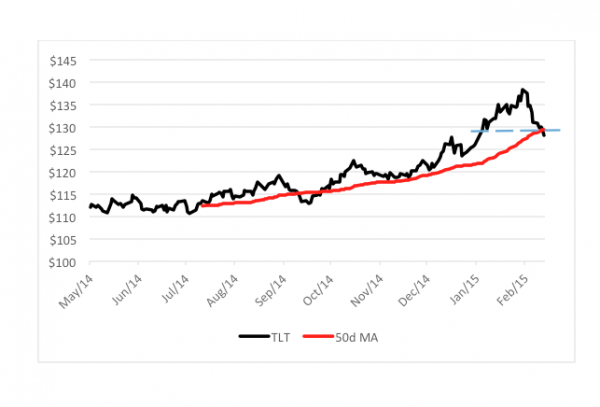

Bondholders have been really shaken up lately. Or, rather, they’ve been shaken down by a dramatic spike in interest rates. Yields on the 30-year Treasury bond have jumped nearly 40 basis points over the past two weeks, knocking the stuffing out of the iShares 20+ Year Treasury Bond ETF (NYSE Arca: TLT). The interest rate spike translated into a $10, or seven percent, loss in the fund’s share price. That move took out support established in early January and put TLT’s price below its 50-day moving average for the first time since last fall.

More notably, at least for technically minded traders, is the deep depression in the fund’s MACD indicator. MACD is the acronym for the Moving Average Convergence/Divergence Oscillator, a statistic that relies on two moving averages—one short, one long—to gauge a market’s momentum. The MACD for the iShares product is the lowest on record since January 2009. Then the fund was a third of the way into a 27 percent price slide.

TLT’s market has been liquidating since the beginning of February. But in the past couple of trading sessions, a new feature has emerged—short selling, something we haven’t seen, at least consistently, since November.

So, does all this indicate further selling ahead? Likely so. But there’s bound to be some reactive bounces to the upside in the near term. Indicators such as the Relative Strength Index and the Money Flow Index, in fact, point to a bobble. Some TLT holders will use these rebounds as selling opportunities. More aggressive investors may optfor the ProShares UltraShort 20+ Year Treasury ETF (NYSE Arca: TBT) as a proxy for a TLT short sale. TBT affords double inverse (-2x) exposure to long-dated Treasury paper, mimicking a margined trade.

So, what are short sellers looking for? Keeping TLT’s recent price parabola in mind, most likely a dip below $120 from its present $128 level.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.