No doubt about it. Last week was a good week for gold. Well, gold stocks really. The VanEck Vectors Junior Gold Miners ETF (NYSE Arca: GDXJ) was up 10.28%; its sibling, the VanEck Vectors Gold Miners ETF (NYSE Arca: GDX) climbed 6.75%. And gold itself? Meh. SPDR Gold Shares (NYSE Arca: GLD), a grantor trust backed by gold bullion, barely moved, up just 0.70%.

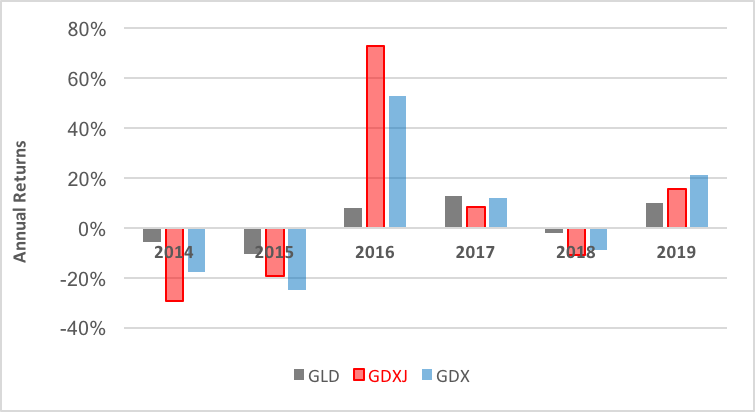

This differential performance of bullion and mining stocks is longstanding. Gold miners are just more volatile. About three times as volatile, in fact. You can see volatility reflected in the annual returns notched by mining stocks: Miners have outdone bullion on both the upside and the downside for a long, long time. Chart 1 below, portraying five years of recent returns, gives you a snapshot view.

Chart 1 – Annual Returns (June 2014-June 2019)

Plainly, volatility can be a good thing when it works for you but can be ruinous when you’re on the wrong side of it. Still, because miners and gold are poorly correlated to the broad stock market, that volatility could be useful as a portfolio diversifier.

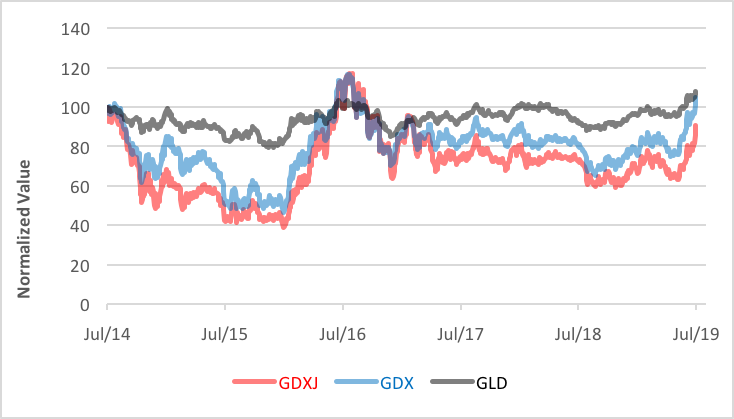

There’s an interesting interplay between correlation and volatility in gold-related investments. Gold itself is negatively correlated with stocks, but bullion’s price is relatively stable compared with mining stocks. Miners are positively–barely–correlated to the broad equity market and are anything but stable in price. Chart 2 gives you a picture of the gold ETFs’ day-to-day price changes over the past five years.

Chart 2 – Daily Normalized Values (July 2014-July 2019)

As of last week’s close, GLD’s five-year cumulative return of 6.4% has edged out the 4.1% gain earned by GDX. After five years, GDXJ is still underwater by 10.5%.

But that’s the past. What of the future? The way things look now, gold has the technical grit to eventually reach the $1,760 level. Not a guarantee, mind you, just an assessment of the metal’s potential. That gives GLD permission to ascend another 23% from Friday’s close. Chartwise, GDXJ could outdo the bullion-based trust with a 27% gain. The best technical picture, however, belongs to GDX with the capacity to make a 32% jump in the months ahead.

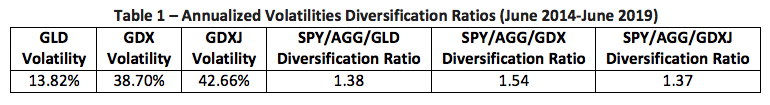

So, what’s the best way to get gold’s diversification benefit? Is it to hold a bullion surrogate like GLD or is a gold miner ETF better? Past performance can help us quantify each of the funds’ probable effects. Synergy created by adding an asset to a portfolio is reflected in the diversification ratio, produced by putting the summed weighted component risks in the numerator and the actual portfolio risk in the denominator. A ratio greater than one (1.00) denotes a diversification benefit.

For example, a classic balanced portfolio can be constructed by allocating 60% of one’s capital to the SPDR S&P 500 ETF (NYSE Arca: SPY) and 40% to the iShares Core U.S. Aggregate Bond ETF (NYSE Arca: AGG). Over the past five years, the annualized standard deviation (risk) of SPY’s returns has been 11.90%; AGG’s has been 3.05%. The weighted sum of the two components’ volatilities is 8.36%, but the asset mix’s actual historical risk has been clocked at 7.18% since 2014. A diversification ratio of 1.16 results.

If we start with a balanced (60/40) portfolio and carve out room for a 10% gold (or gold miner) allocation from the equity side, we can compare the diversification benefit attached to each, as in Table 1.

As Howard (Walter Huston) said in The Treasure of the Sierra Madre, “Gold’s a devilish sort of thing.”

That may be, but going forward, the GDX gold miner ETF seems to offer the least bedevilment: a brighter technical picture as well as greater risk diversification.

Brad Zigler is WealthManagement's alternative investments editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.