Investors building ESG-based ETF portfolios have a growing number of fixed income choices. While just 17 of the 128 ETFs that CFRA classifies as ESG (and offers a star rating on) are fixed income, with nearly half of them (eight) launched within the last three years. There are still some holes in an asset allocation strategy that can be filled in, but investors have additional options to consider when managing ESG-focused portfolios. Indeed, CFRA launched a Global ESG ETF Asset Allocation portfolio at the end of March as part of an expansion of the model portfolios we offer on MarketScope Advisor.

Despite the growing popularity of ESG, or because of it, skepticism remains high. In the past year, index-based iShares ESG Aware MSCI USA ETF (ESGU) gathered more than $6 billion of new money and has $17 billion in assets. However, some people question whether investors understand the differences between ESG ETFs and a traditional market-cap weighted ETF such as iShares Core S&P 500 ETF (IVV). ESGU has approximately 350 positions and its top holdings include Apple, Microsoft and Amazon—just like IVV despite ESGU’s use of an ESG lens. Yet, ESGU outperformed IVV in the three-year period ended April 28, rising 19.7% compared to 18.4%, even though ESGU charges a higher expense ratio. Altria and Boeing are couple of examples of large-cap stocks not part of ESGU.

PIMCO Enhanced Short Maturity Active ESG ETF (EMNT) is an ESG alternative to the popular actively managed ultra-short-term PIMCO Enhanced Short Maturity Active ETF (MINT). EMNT launched in December 2019 with the same top-down focus as $15 billion MINT and has a nearly identical average duration of 0.7 years. However, EMNT has just 152 holdings, a fraction of MINT’s 770 due to the exclusion of certain sectors, like alcohol and tobacco, and the use of a proprietary ESG framework focused on reducing carbon intensity as well as other social and sustainable priorities. At the end of March, EMNT owned bonds from just 62 corporate issuers, 40% of the number of MINT’s total positions. The same team runs both PIMCO ETFs but uses different criteria for security selection.

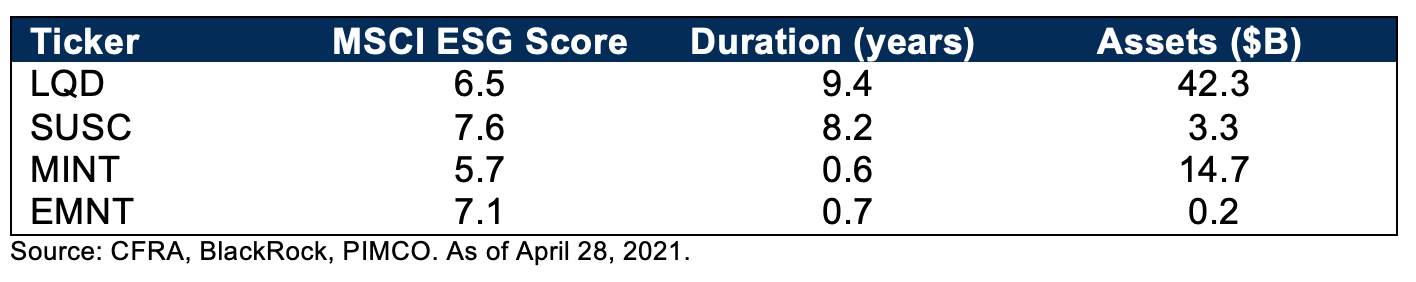

Figure 1: Key Metrics for Fixed Income ETFs

The corporate bonds inside EMNT garnered an average ESG score of 7.1 (out of 10) from independent research provider MSCI, favorably higher than MINT’s 5.7; MSCI rates companies based on their exposure to industry specific risks and their ability to manage those risks relative to peers.

For example, EMNT owns bonds from utilities that support renewable energy and tends to avoid sectors with structural challenges from an ESG perspective, such as the oil and automotive industries. Beyond investment-grade corporates, EMNT’s portfolio managers have emphasized bonds from agencies that support homeownership and increased access for underserved communities, while promoting responsible lending and limiting investment in predatory lending practices. In addition, the fund invests in what management believes are attractively priced sovereign and corporate green bonds that address climate change and support leading environmental practices.

Despite a narrower investment universe, EMNT has essentially matched MINT in 2020, rising 0.06% compared to a 0.02% decline for MINT that is partially the result of EMNT’s lower expense ratio (0.27% vs. 0.37%).

iShares ESG Aware USD Corporate Bond ETF (SUSC) could be a replacement for the widely-known investment-grade corporate bond ETF iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD). We think the $42 billion index-based LQD has many favorable attributes, but for some investors the fund’s average MSCI ESG Score of 6.5 and modest ownership of bonds issued by makers of controversial products like nuclear weapons and tobacco is a concern. ESG-oriented investors might find SUSC, which does not own such companies and receives an MSCI ESG Score of 7.6, more appealing. SUSC owns bonds from issuers that have relatively strong ESG attributes, including AT&T, Citigroup, and Microsoft. SUSC recently had a 6.8% weighting in energy bonds, below LQD’s 8.6% stake. Meanwhile, with an average duration of 8.2 years, SUSC incurs less interest rate risk than LQD with an average of 9.4 years. SUSC and LQD track benchmarks from different index providers but have just over half of its assets in BBB-rated bonds.

Year-to-date through April 28, SUSC’s 3.9% decline was less than LQD’s 4.8%, even though SUSC charges a slightly higher 0.18% expense ratio.

Conclusion

As more investors seek to align their societal goals with their financial objectives, we think it is important to understand what is and is not inside ESG ETFs. EMNT and SUSC are delivering solid performance in 2021 despite restrictions on what it owns, which should appease some concerns that investors are giving up a lot of the reward potential in exchange by attempting to do good.

Todd Rosenbluth is the director of ETF and mutual fund research at CFRA. Learn more about CFRA's ETF research here.